Intel 1999 Annual Report Download - page 38

Download and view the complete annual report

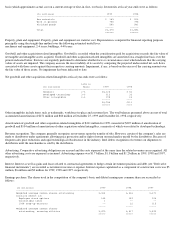

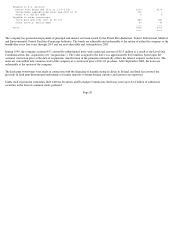

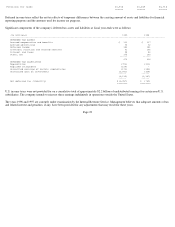

Please find page 38 of the 1999 Intel annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The company has guaranteed repayment of principal and interest on bonds issued by the Puerto Rico Industrial, Tourist, Educational, Medical

and Environmental Control Facilities Financing Authority. The bonds are adjustable and redeemable at the option of either the company or the

bondholder every five years through 2013 and are next adjustable and redeemable in 2003.

During 1999, the company assumed 4% convertible subordinated notes with a principal amount of $115 million as a result of the Level One

Communications, Inc. acquisition (see "Acquisitions"). The value assigned to the notes was approximately $212 million, based upon the

assumed conversion price at the date of acquisition. Amortization of the premium substantially offsets the interest expense on the notes. The

notes are convertible into common stock of the company at a conversion price of $31.01 per share. After September 2000, the notes are

redeemable at the option of the company.

The Irish punt borrowings were made in connection with the financing of manufacturing facilities in Ireland, and Intel has invested the

proceeds in Irish punt denominated instruments of similar maturity to hedge foreign currency and interest rate exposures.

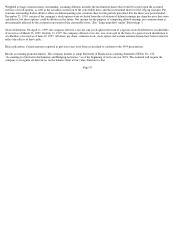

Under shelf registration statements filed with the Securities and Exchange Commission, Intel may issue up to $1.4 billion of additional

securities in the form of common stock, preferred

Page 20

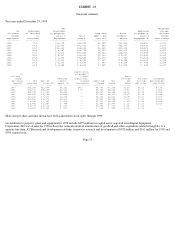

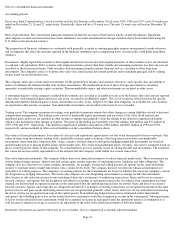

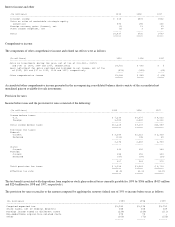

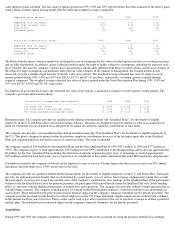

Payable in U.S. dollars:

Puerto Rico bonds due 2013 at 3.9%-4.25% $110 $110

Convertible subordinated notes due 2004 at 4% 210 -

Other U.S. dollar debt 6 5

Payable in other currencies:

Irish punt due 2001-2027 at 4%-13% 583 541

Other non-U.S. dollar debt 46 46

---- ----

Total $955 $702

==== ====