Intel 1999 Annual Report Download - page 37

Download and view the complete annual report

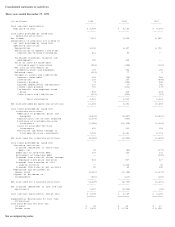

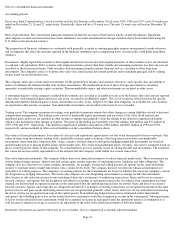

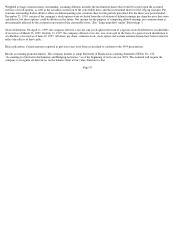

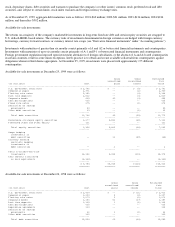

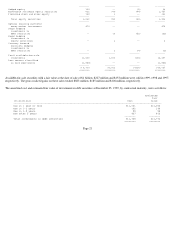

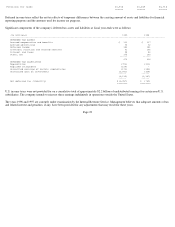

Please find page 37 of the 1999 Intel annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.are not hedges must be adjusted to fair value through income. If the derivative is a hedge, depending on the nature of the hedge, changes in the

fair value of derivatives will either be offset against the change in fair value of the hedged assets, liabilities or firm commitments through

earnings, or recognized in other comprehensive income until the hedged item is recognized in earnings. The change in a derivative's fair value

related to the ineffective portion of a hedge, if any, will be immediately recognized in earnings. The effect of adopting the standard is currently

being evaluated but is not expected to have a material effect on the company's financial position or overall trends in results of operations.

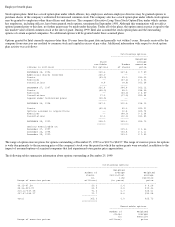

Common stock

Stock repurchase program. The company has an ongoing authorization, as amended, from the Board of Directors to repurchase up to 760

million shares of Intel's common stock in open market or negotiated transactions. During 1999, the company repurchased 71.3 million shares of

common stock at a cost of $4.6 billion. As of December 25, 1999, the company had repurchased and retired approximately 659.9 million shares

at a cost of $18.2 billion since the program began in 1990. As of December 25, 1999, after allowing for 2 million shares to cover outstanding

put warrants, 98.1 million shares remained available under the repurchase authorization.

1998 step-up warrants. In 1993, the company issued 160 million 1998 step-up warrants to purchase 160 million shares of common stock. The

warrants became exercisable in May 1993. Between December 27, 1997 and March 14, 1998, approximately 155 million warrants were

exercised and shares of common stock were issued for proceeds of $1.6 billion. The expiration date of these warrants was March 14, 1998.

Put warrants

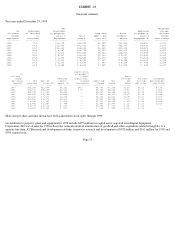

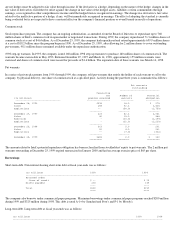

In a series of private placements from 1991 through 1999, the company sold put warrants that entitle the holder of each warrant to sell to the

company, by physical delivery, one share of common stock at a specified price. Activity during the past three years is summarized as follows:

The amount related to Intel's potential repurchase obligation has been reclassified from stockholders' equity to put warrants. The 2 million put

warrants outstanding at December 25, 1999 expired unexercised in January 2000 and had an average exercise price of $65 per share.

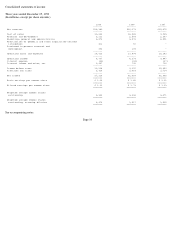

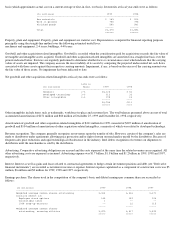

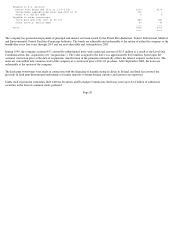

Borrowings

Short-term debt. Non-interest-bearing short-term debt at fiscal year-ends was as follows:

The company also borrows under commercial paper programs. Maximum borrowings under commercial paper programs reached $200 million

during 1999 and $325 million during 1998. This debt is rated A-1+ by Standard and Poor's and P-1 by Moody's.

Long-term debt. Long-term debt at fiscal year-ends was as follows:

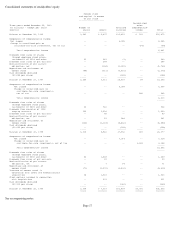

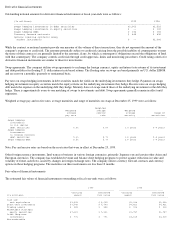

Put warrants

outstanding

-----------------------------

Cumulative

net Number of Potential

(In millions) premium received warrants obligation

--------------------------------- ----------------- --------- ----------

December 28, 1996 $335 18.0 $ 275

Sales 288 92.6 3,525

Expirations -- (58.0) (1,759)

--------- -------- --------

December 27, 1997 623 52.6 2,041

Sales 40 15.0 588

Exercises - (30.0) (1,199)

Expirations - (32.6) (1,229)

--------- -------- --------

December 26, 1998 663 5.0 201

Sales 20 4.0 261

Expirations -- (7.0) (332)

--------- -------- ---------

December 25, 1999 $683 2.0 $ 130

========= ======== =========

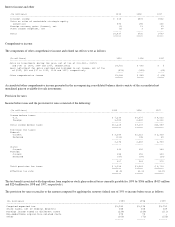

(In millions) 1999 1998

-----------------------------------------------------------------------------------------

Borrowed under

lines of credit $ -- $ 10

Drafts payable 230 149

---- ----

Total $230 $159

==== ====

(In millions) 1999 1998

-------------------------------------------------------------------------------------------------------------