Intel 1999 Annual Report Download - page 36

Download and view the complete annual report

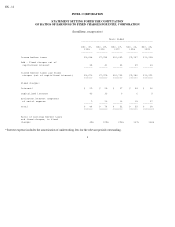

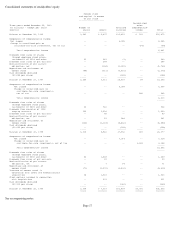

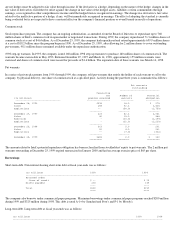

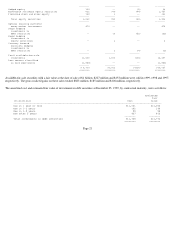

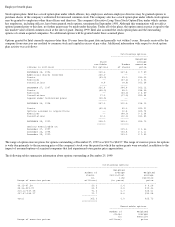

Please find page 36 of the 1999 Intel annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Weighted average common shares outstanding, assuming dilution, includes the incremental shares that would be issued upon the assumed

exercise of stock options, as well as the assumed conversion of the convertible notes and the incremental shares for the step-up warrants. Put

warrants outstanding had no dilutive effect on diluted earnings per common share for the periods presented. For the three year period ended

December 25, 1999, certain of the company's stock options were excluded from the calculation of diluted earnings per share because they were

antidilutive, but these options could be dilutive in the future. Net income for the purpose of computing diluted earnings per common share is

not materially affected by the assumed conversion of the convertible notes. (See "Long-term debt" under "Borrowings.")

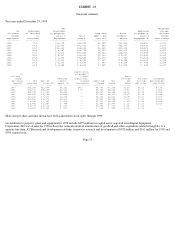

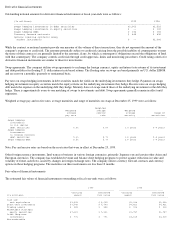

Stock distribution. On April 11, 1999, the company effected a two-for-one stock split in the form of a special stock distribution to stockholders

of record as of March 23, 1999. On July 13, 1997, the company effected a two-for- one stock split in the form of a special stock distribution to

stockholders of record as of June 10, 1997. All share, per share, common stock, stock option and warrant amounts herein have been restated to

reflect the effects of these splits.

Reclassifications. Certain amounts reported in previous years have been reclassified to conform to the 1999 presentation.

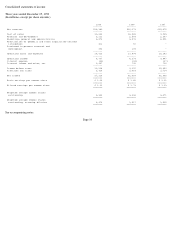

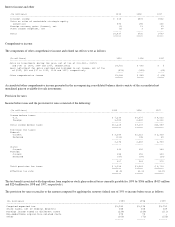

Recent accounting pronouncements. The company intends to adopt Statement of Financial Accounting Standards (SFAS) No. 133,

"Accounting for Derivative Instruments and Hedging Activities," as of the beginning of its fiscal year 2001. The standard will require the

company to recognize all derivatives on the balance sheet at fair value. Derivatives that

Page 19