INTL FCStone 2012 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2012 INTL FCStone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.CHIEF EXECUTIVE’S REPORT

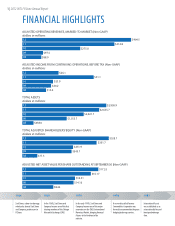

In scal year 2012, INTL FCStone experienced

a second consecutive year of record adjusted

operating revenues, more than 12 percent higher

than last year’s mark. Adjusted shareholder

equity and adjusted net value per share

outstanding also increased over the previous

scal year. The continued growth in operating

revenues and shareholder value is a convincing

indication that the company’s business model is

a strong and eective one.

The company’s business strategy was tested

as never before by an unprecedented series

of events beginning in October, 2011 with the

collapse of Futures Commission Merchant (FCM)

MF Global. As one of the most high-prole

organizations in the FCM space, MF Global’s

improper use of customer margin funds, and

the subsequent losses suered by many of its

customers, gave the entire listed futures industry

– which had long emphasized the inviolability

of margin accounts – a credibility issue with its

customers. Less than ten months later, another

well-known FCM, Peregrine Financial Group, shut

its doors suddenly amid allegations of nancial

fraud, with a signicant shortfall in customer

funds.

While the demise of MF Global in particular

removed a substantial competitor of ours from

the playing eld, it also contributed to a loss

of condence in the markets that was among

several factors resulting in lower trading volumes

overall for FCMs and exchanges.

At the same time, the nancial industry faced a

number of wrenching regulatory adjustments.

Chief among these was the implementation

of the Dodd-Frank Wall Street Reform and

Consumer Protection Act, which required

expensive, complex and far-reaching changes

in many areas of the industry, particularly in the

marketing of Over-the-Counter (OTC) derivatives.

The ongoing global nancial weakness, the

slowdown in the growth of commodity prices

and commodity volatility, and the long-term

drought in the Midwestern United States also

contributed to the turmoil and uncertainty facing

the commodities industry worldwide.

However, the board and executive management

remain convinced that we have a strategy and

a business model that remains relevant in the

current dicult environment – providing a high-

touch value-added service to mid-sized, mainly

commercial organizations looking to hedge

their nancial risks and gain ecient access to

nancial markets. As a relationship business,

we focus our expertise, capital and systems on

providing thoughtful and strategic nancial

solutions to these organizations with the intent

of creating long-term relationships with them –

and, at the same time, annuities for our business.

In many ways, this is an old-fashioned approach

that has become increasingly uncommon in an

industry focused on high-frequency trading,

automation and a preoccupation with scale

rather than service. Nonetheless, we believe our

strategy works. Thanks to our unique customer-

centric approach, and to our diversication

across a broad range of niche nancial services,

we remain protable and continue to exhibit

strong growth as customers increasingly

recognize us as a credible solution provider.

Our growth has also been aided by the

consolidation of the industry and the resulting

reallocation of capital, as business models reliant

on high degrees of leverage, outright speculative

or proprietary trading or the interposing of a

brokerage function between a customer and

an exchange without adding value have been

eectively eliminated. Our business model,

which has never been reliant on any of these

“The continued growth in operating

revenues and shareholder value

is a convincing indication that the

company’s business model is a strong

and eective one.”

7 | 2012 INTL FCStone Annual Report