INTL FCStone 2012 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2012 INTL FCStone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.CHAIRMAN’S LETTER TO SHAREHOLDERS

Ten years ago almost to the day, I invested in and became a director of this company.

With the benet of hindsight, the investment was an excellent one, but at the time, the company’s

future was far from assured. Its stock was trading at around 60 cents per share, and it had a book value

of approximately $1.40 and a pre-investment-market capitalization of less than $2 million.

I don’t think any of us could have imagined at the time how far we would come from these humble

beginnings. Today, INTL FCStone has become a prominent franchise in the commodities sector, with a

particular emphasis on grains and metals. Our stock price is 30 times higher than it was then, and our

book value is more than 12 times higher, at $17.32. Our market capitalization is approximately $350

million, more than 175 times greater than it was when I began my tenure as a director. Other than two

small rounds that raised approximately $40 million in capital, these results have been accomplished

through accretive acquisitions and organic growth.

This growth has not been without its diculties, however. The recent series of global economic

disruptions has negatively aected virtually every nancial services organization worldwide. More

specically, the FCM (Futures Commission Merchant) component of INTL FCStone’s business has, like

all FCMs, been aected by low interest rates, declining commodity trading volumes, the increasing

use of technology to connect customers directly to exchanges, the highly publicized recent collapses

of two prominent FCMs and, perhaps of greatest signicance, the most comprehensive change to

regulatory oversight we have witnessed in our lifetimes.

As a result of all these factors, our stock price has dropped from its peak, reached shortly before the

global nancial crisis, of more than $35 per share. This low current valuation of our company, despite

our long-term achievements, is of concern to both your management and your board of directors.

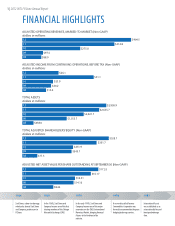

Nonetheless, our nancial results for the fourth quarter of 2012 are an encouraging indication that the

best is yet to come for INTL FCStone. We produced record adjusted operating revenues of $125 million

for the quarter, as well as a return on equity (ROE) of nearly 16%, directly in line with management’s

targets. In addition, our adjusted revenues were up 21%, and our adjusted earnings rose by a full 166%

compared to the same quarter a year ago.

As I look back at the past 10 years, I am highly encouraged by our performance. We have demonstrated

our ability to grow our larger market segments, and to deal with a geographically and product-diverse

business while at the same time maintaining tight risk control and rst-class operations and support

systems. In addition, we have maintained the capital resources and, more importantly, the liquidity

to deal with these markets. Nothing illustrates our ability to achieve these objectives better than

our performance during the crisis year of 2008, when we not only remained protable but achieved

double digit returns on equity and an increase in book value.

As to the future, we cannot do much about the credit crises, the scal “clis” and other macro factors.

What we can do, however, is strive to continue your company’s performance on an absolute and

comparative basis. The key to our continued success lies in an ongoing and intensive focus on risk

controls, robust systems and the ability to manage and motivate people, plus the strategic vision

necessary to grow the business.

5 | 2012 INTL FCStone Annual Report