INTL FCStone 2012 Annual Report Download - page 2

Download and view the complete annual report

Please find page 2 of the 2012 INTL FCStone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144

|

|

1924 1930 1978 1981

Saul Stone, a door-to-door egg

wholesaler, formed Saul Stone

and Company, predecessor to

FCStone.

In the 1930’s, Saul Stone and

Company became one of the rst

clearing members of the Chicago

Mercantile Exchange (CME).

A new entity called Farmers

Commodities Corporation was

formed to accommodate the grain

hedging brokerage services.

International Assets

was established as an

internationally focused

boutique brokerage

rm.

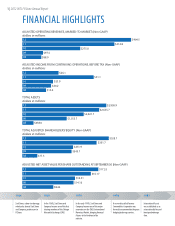

FINANCIAL HIGHLIGHTS

1970

In the early 1970’s, Saul Stone and

Company became one of the major

innovators on the CME’s International

Monetary Market, bringing nancial

futures to the forefront of the

industry.

TOTAL ADJUSTED SHAREHOLDERS’ EQUITY (Non-GAAP)

dollars in millions

10 $251.9

09 $245.7

08 $77.3

11 $301.7

12 $328.7

ADJUSTED NET ASSET VALUE PER SHARE OUTSTANDING AT SEPTEMBER 30 (Non-GAAP)

10 $14.31

09 $14.16

08 $8.66

11 $16.17

12 $17.32

TOTAL ASSETS

dollars in millions

10 $2,021.7

09 $1,555.7

08 $438.0

11 $2,635.7

12 $2,958.9

ADJUSTED INCOME FROM CONTINUING OPERATIONS, BEFORE TAX (Non-GAAP)

dollars in millions

10 $23.9

09 $20.2

08 $15.4

11 $51.1

12 $26.1

ADJUSTED OPERATING REVENUES, MARKED-TO-MARKET (Non-GAAP)

dollars in millions

10 $275.0

09 $97.5

08 $88.0

11 $414.8

12 $464.5

1 | 2012 INTL FCStone Annual Report