Google 2014 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2014 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

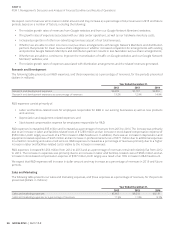

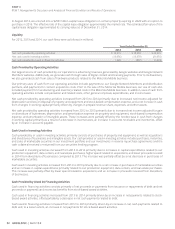

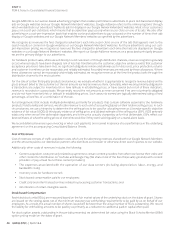

We considered the historical trends in currency exchange rates and determined that it was reasonably possible that changes in

exchange rates of 20% could be experienced in the near term. If the U.S. dollar weakened by 20% at December 31, 2013 and

$4 million and $686 million lower at December 31, 2013 and December 31, 2014, and the total amount of expense recorded as

interest and other income, net, would have been approximately $123 million and $90 million higher in the years ended December

31, 2013 and December 31, 2014. If the U.S. dollar strengthened by 20% at December 31, 20013 and December 31, 2014, the

$1.7 billion and $2.5 billion higher at December 31, 2013 and December 31, 2014, and the total amount of expense recorded

as interest and other income, net, would have been approximately $120 million and $164 million higher in the years ended

December

in currencies other than the local currency of the subsidiary. These forward contracts reduce, but do not entirely eliminate the

impact of currency exchange rate movements on our assets and liabilities. The foreign currency gains and losses on the assets

and liabilities are recorded in “Interest and other income, net,”

We considered the historical trends in currency exchange rates and determined that it was reasonably possible that adverse

changes in exchange rates of 20% for all currencies could be experienced in the near term. These changes would have resulted

in an adverse impact on income before income taxes of approximately $52 million and $93 million at December 31, 2013 and

31, 2013 and December 31, 2014. These reasonably possible adverse changes in exchange rates of 20% were applied to total

monetary assets and liabilities denominated in currencies other than the local currencies at the balance sheet dates to compute

the adverse impact these changes would have had on our income before income taxes in the near term.

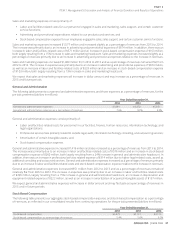

Interest Rate Risk

Our investment strategy is to achieve a return that will allow us to preserve capital and maintain liquidity requirements. We invest

mortgage-backed

securities, money market and other funds, asset backed securities, municipal securities, time deposits and debt instruments issued

interest rates fall. As of December 31, 2013 and December 31, 2014, unrealized losses on our marketable debt securities were

recorded in AOCI until the securities are sold. We use interest rate derivative contracts to hedge realized gains and losses on

our securities. These derivative contracts are accounted for as hedges at fair value with changes in fair value recorded in Interest

and other income, net.

We considered the historical volatility of short-term interest rates and determined that it was reasonably possible that an adverse

change of 100 basis points could be experienced in the near term. A hypothetical 1.00% (100 basis points) increase in interest

rates would have resulted in a decrease in the fair values of our marketable securities of approximately $1.0 billion and $1.2 billion

contracts outstanding as of December 31, 2013 and December 31, 2014.

36

GOOGLE INC.

PART II