Google 2014 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2014 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

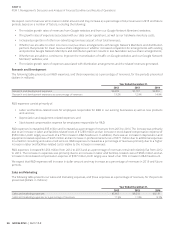

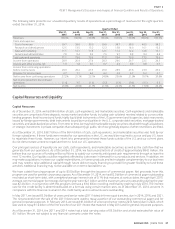

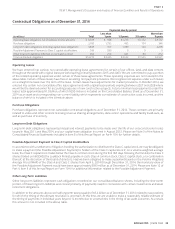

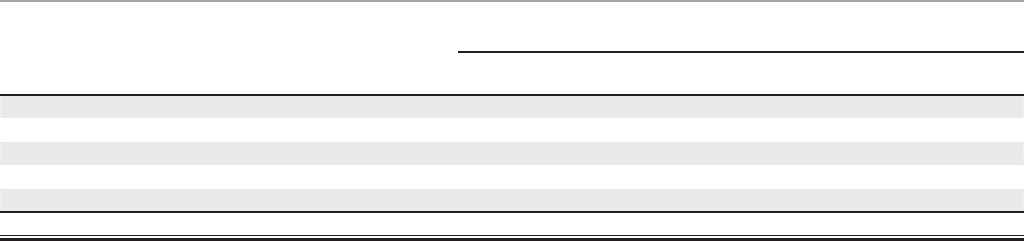

Contractual Obligations as of December 31, 2014

(in millions)

Payments due by period

Total

Less than

1year 1-3 years 3-5 years

More than

5years

Operating lease obligations, net of sublease income amounts $ 6,183 $ 598 $1,256 $1,172 $3,157

Purchase obligations 2,700 1,735 465 154 346

Long-term debt obligations, including capital lease obligations 3,843 107 1,390 140 2,206

Possible Adjustment Payment to Class C capital stockholders 593 593 0 0 0

954 212 441 89 212

Total contractual obligations $14,273 $3,245 $3,552 $1,555 $5,921

Operating Leases

throughout the world with original lease periods expiring primarily between 2015 and 2063. We are committed to pay a portion

of the related operating expenses under certain of these lease agreements. These operating expenses are not included in the

above table. Certain of these leases have free or escalating rent payment provisions. We recognize rent expense under such leases

on a straight-line basis over the term of the lease. Certain leases have adjustments for market provisions. In October 2014, we

we will be the deemed owner for accounting purposes of new construction projects. Future minimum lease payments under the

leases total approximately $1.0 billion, of which $250 million is included on the Consolidated Balance Sheet as of December 31,

2014 as an asset and corresponding non-current liability, which represents our estimate of construction costs incurred, and the

balance of which is included in the schedule above.

Purchase Obligations

Purchase obligations represent non-cancelable contractual obligations as of December 31, 2014. These contracts are primarily

related to video and other content licensing revenue sharing arrangements, data center operations and facility build-outs, as

well as purchase of inventory.

Long-term Debt Obligations

Long-term debt obligations represent principal and interest payments to be made over the life of our unsecured senior notes

issued in May 2011 and May 2014, and our capital lease obligation incurred in August 2013. Please see Note 3 of the Notes to

Consolidated Financial Statements included in Item 8 of this Annual Report on Form 10-K for further details.

Possible Adjustment Payment to Class C Capital Stockholders

In accordance with a settlement of litigation involving the authorization to distribute the Class C capital stock, we may be obligated

to make a payment (the Possible Adjustment Payment) to holders of the Class C capital stock if, on a volume-weighted average

Class C

shares traded on NASDAQ (the Lookback Period), payable in cash, Class A common stock, Class C capital stock, or a combination

thereof, at the discretion of the board of directors. Had we been obligated to make a payment based on the Volume Weighted

Average Price (VWAP) of the Class A and Class C shares from April 3, 2014 through December 31, 2014, the monetary value of

the Possible Adjustment Payment would have been approximately $593 million as of December 31, 2014. Please see Note 12 of

Part II, Item 8 of this Annual Report on Form 10-K for additional information related to the Possible Adjustment Payment.

Other Long-Term Liabilities

Other long-term liabilities represent cash obligations recorded on our consolidated balance sheets, including the short-term

portion of these long-term liabilities and consist primarily of payments owed in connection with certain investments and asset

retirement obligations.

In addition to the amounts above, we had long-term taxes payable of $3.4 billion as of December 31, 2014 related to tax positions

for which the timing of the ultimate resolution is uncertain. At this time, we are unable to make a reasonably reliable estimate of

the timing of payments in individual years beyond 12 months due to uncertainties in the timing of tax audit outcomes. As a result,

this amount is not included in the above table.

33GOOGLE INC.