GE 2006 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2006 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

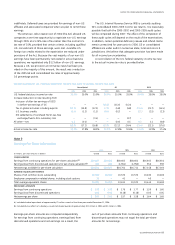

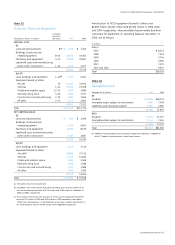

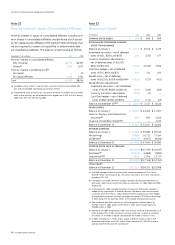

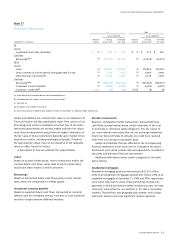

Note 19

GECS Investment Contracts, Insurance Liabilities

and Insurance Annuity Benefits

December 31 (In millions) 2006 2005

Investment contracts $ 5,089 $ 6,034

Guaranteed investment contracts of SPEs 11,870 11,685

Total investment contracts

Life insurance benefi ts

(a)

16,959

14,054

17,719

13,220

Unpaid claims and claims adjustment expenses

Unearned premiums

Universal life benefits

2,714

740

340

1,707

401

340

Total $34,807 $33,387

(a) Life insurance benefits are accounted for mainly by a net-level-premium method

using estimated yields generally ranging from 3.0% to 8.5% in both 2006 and 2005.

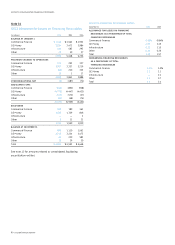

When insurance affiliates cede insurance to third parties, they are

not relieved of their primary obligation to policyholders. Losses on

ceded risks give rise to claims for recovery; we establish allow-

ances for probable losses on such receivables from reinsurers as

required.

We recognize reinsurance recoveries as a reduction of the

Statement of Earnings caption “Investment contracts, insurance

losses and insurance annuity benefits.” Reinsurance recoveries

were $162 million, $183 million and $223 million for the years

ended December 31, 2006, 2005 and 2004, respectively.

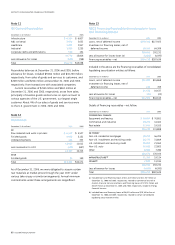

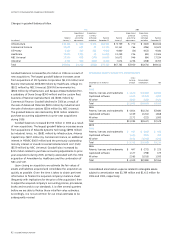

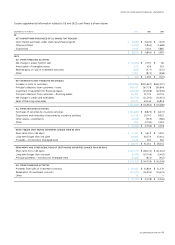

Note 20

All Other Liabilities

This caption includes liabilities for various items including non-

current compensation and benefits, deferred income, interest on

tax liabilities, accrued participation and residuals, environmental

remediation, asset retirement obligations, derivative instruments,

product warranties and a variety of sundry items.

Accruals for non-current compensation and benefi ts amounted

to $17,214 million and $13,856 million for year-end 2006 and 2005,

respectively. These amounts include postretirement benefi ts,

international and supplemental pension benefits, and other

compensation and benefit accruals such as deferred incentive

compensation. The increase in 2006 reflected our adoption of

SFAS 158, Employers’ Accounting for Defi ned Benefi t Pension and

Other Postretirement Plans, as of December 31, 2006.

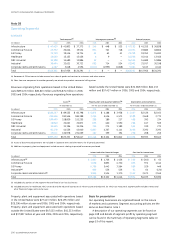

We are involved in numerous remediation actions to clean up

hazardous wastes as required by federal and state laws. Liabilities

for remediation costs at each site are based on our best estimate

of undiscounted future costs, excluding possible insurance recov-

eries. When there appears to be a range of possible costs with

equal likelihood, liabilities are based on the low end of such range.

Uncertainties about the status of laws, regulations, technology and

information related to individual sites make it difficult to develop a

meaningful estimate of the reasonably possible aggregate environ-

mental remediation exposure. However, even in the unlikely event

that remediation costs amounted to the high end of the range of

costs for each site, the resulting additional liability would not be

material to our financial position, results of operations or liquidity.

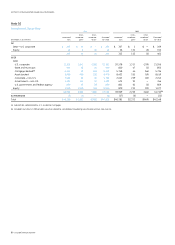

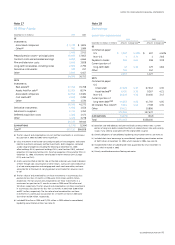

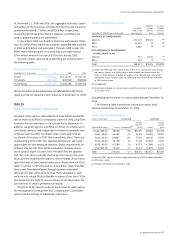

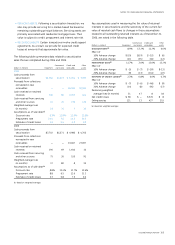

Note 21

Deferred Income Taxes

Aggregate deferred income tax amounts are summarized below.

December 31 (In millions) 2006 2005

ASSETS

GE $11,990 $ 9,928

GECS 8,563 6,209

20,553 16,137

LIABILITIES

GE 13,944 13,661

GECS 20,780 18,684

34,724 32,345

Net deferred income tax liability $14,171 $16,208

Principal components of our net liability (asset) representing

deferred income tax balances are as follows:

December 31 (In millions) 2006 2005

GE

Provision for expenses

(a)

Retiree insurance plans

Non-U.S. loss carryforwards

(b)

Prepaid pension asset — principal plans

Contract costs and estimated earnings

Intangible assets

Depreciation

Other — net

$ (7,218)

(2,654)

(1,214)

5,257

2,053

1,934

1,830

1,966

$ (6,521)

(1,503)

(731)

6,249

1,078

1,490

2,130

1,541

1,954 3,733

GECS

Financing leases

Operating leases

Intangible assets

Allowance for losses

Non-U.S. loss carryforwards

(b)

Cash fl ow hedges

Other — net

8,314

4,327

1,278

(1,763)

(835)

(226)

1,122

8,037

4,024

1,195

(2,025)

(688)

(372)

2,304

12,217 12,475

Net deferred income tax liability $14,171 $16,208

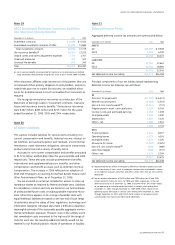

(a) Represented the tax effects of temporary differences related to expense accruals

for a wide variety of items, such as employee compensation and benefi ts, interest

on tax liabilities, product warranties and other sundry items that are not currently

deductible.

(b) Net of valuation allowances of $679 million and $890 million for GE and $203

million and $132 million for GECS, for 2006 and 2005, respectively. Of the net

deferred tax asset as of December 31, 2006, of $2,049 million, $41 million relates

to net operating loss carryforwards that expire in various years ending from

December 31, 2007, through December 31, 2009, $698 million relates to net

operating losses that expire in various years ending from December 31, 2010,

through December 31, 2021, and $1,310 million relates to net operating loss

carryforwards that may be carried forward indefi nitely.

ge 2006 annual report 95