GE 2006 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2006 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

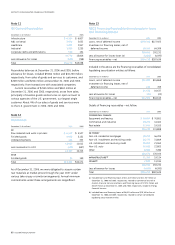

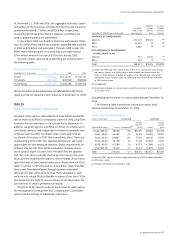

GECS financing receivables include both loans and fi nancing

leases. Loans represent transactions in a variety of forms, includ-

ing revolving charge and credit, mortgages, installment loans,

intermediate-term loans and revolving loans secured by business

assets. The portfolio includes loans carried at the principal amount

on which finance charges are billed periodically, and loans carried

at gross book value, which includes fi nance charges.

Investment in financing leases consists of direct fi nancing and

leveraged leases of aircraft, railroad rolling stock, autos, other

transportation equipment, data processing equipment, medical

equipment, commercial real estate and other manufacturing,

power generation, and commercial equipment and facilities.

As the sole owner of assets under direct financing leases and

as the equity participant in leveraged leases, GECS is taxed on

total lease payments received and is entitled to tax deductions

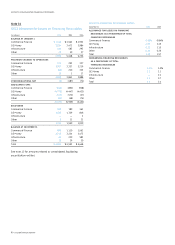

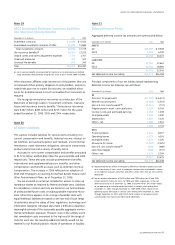

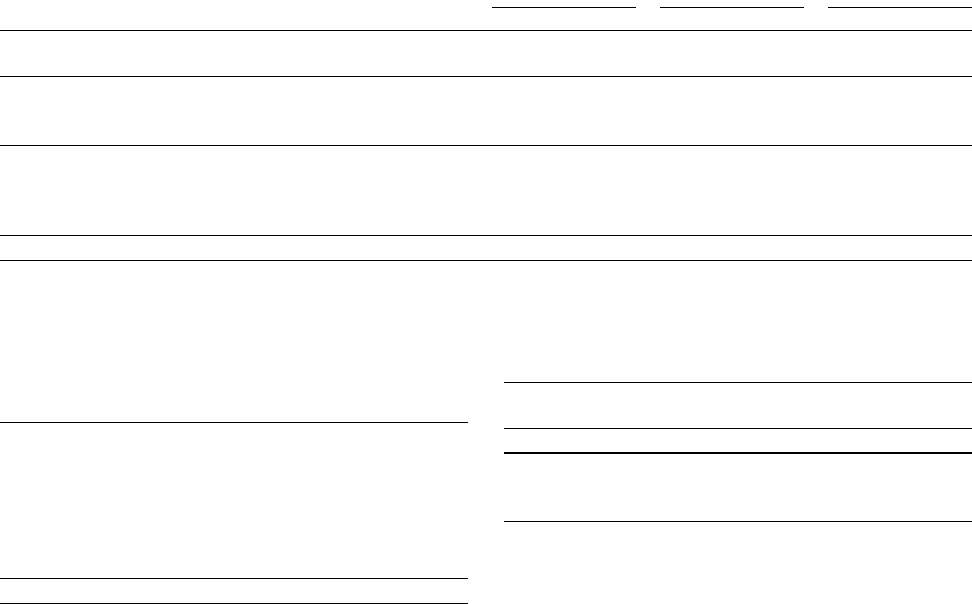

NET INVESTMENT IN FINANCING LEASES

December 31 (In millions)

based on the cost of leased assets and tax deductions for interest

paid to third-party participants. GECS is generally entitled to any

residual value of leased assets.

Investment in direct financing and leveraged leases repre-

sents net unpaid rentals and estimated unguaranteed residual

values of leased equipment, less related deferred income. GECS

has no general obligation for principal and interest on notes and

other instruments representing third-party participation related

to leveraged leases; such notes and other instruments have not

been included in liabilities but have been offset against the

related rentals receivable. The GECS share of rentals receivable

on leveraged leases is subordinate to the share of other partici-

pants who also have security interests in the leased equipment.

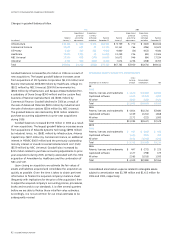

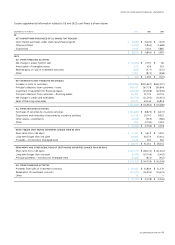

Total financing leases Direct financing leases(a) Leveraged leases

(b)

2006 2005 2006 2005 2006 2005

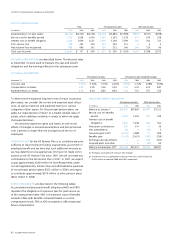

Total minimum lease payments receivable $88,598 $86,436 $64,637 $60,594 $23,961 $25,842

Less principal and interest on third-party nonrecourse debt (17,309) (19,061) — — (17,309) (19,061)

Net rentals receivable 71,289 67,375 64,637 60,594 6,652 6,781

Estimated unguaranteed residual value of leased assets 10,062 9,379 7,068 6,260 2,994 3,119

Less deferred income (12,782) (12,445) (9,634) (9,305) (3,148) (3,140)

Investment in financing leases, net of deferred income 68,569 64,309 62,071 57,549 6,498 6,760

Less amounts to arrive at net investment

Allowance for losses (392) (525) (370) (380) (22) (145)

Deferred taxes (8,314) (8,037) (3,410) (3,495) (4,904) (4,542)

Net investment in financing leases $59,863 $55,747 $58,291 $53,674 $ 1,572 $ 2,073

(a) Included $654 million and $475 million of initial direct costs on direct financing leases at December 31, 2006 and 2005, respectively.

(b) Included pre-tax income of $306 million and $248 million and income tax of $115 million and $96 million during 2006 and 2005, respectively. Net investment credits recognized

during 2006 and 2005 were inconsequential.

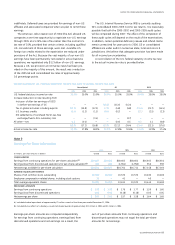

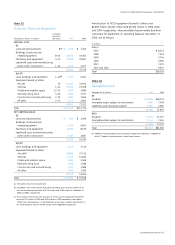

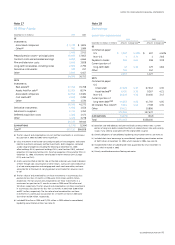

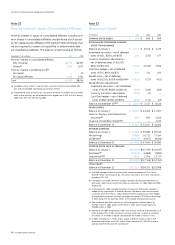

CONTRACTUAL MATURITIES

Net rentals

(In millions) Total loans receivable

Due in

2007 $ 89,651 $18,422

2008 33,413 15,094

2009 25,731 11,637

2010 14,759 7,860

2011 17,893 5,244

2012 and later 88,896 13,032

Total $270,343 $71,289

We expect actual maturities to differ from contractual maturities.

Individually “impaired” loans are defined by GAAP as larger

balance or restructured loans for which it is probable that the

lender will be unable to collect all amounts due according to

original contractual terms of the loan agreement. An analysis of

impaired loans follows.

December 31 (In millions) 2006 2005

Loans requiring allowance for losses $1,346 $1,479

Loans expected to be fully recoverable 497 451

$1,843 $1,930

Allowance for losses $ 446 $ 627

Average investment during year 1,860 2,118

Interest income earned while impaired

(a) 34 46

(a) Recognized principally on cash basis.

ge 2006 annual report 89