GE 2006 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2006 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.To Our Investors:

I assumed the CEO job on September 7, 2001,

a fact most of you know. The week after

September 11, GE’s stock was in a “free fall.”

On September 21, GE opened at $29 and

then stabilized. As the stock hit $34 during

the fall, I bought 15,000 shares thinking,

“I love the Company and when will it ever

be this cheap again?” The answer turned

out to be — in 2006.

You can only believe one thing if you run GE or own GE stock:

Consistent earnings and cash flow growth, with expanding returns,

increase shareowner value. This is a long-term investment. There

are no short-term tricks.

We lead the Company to grow earnings and cash fl ow with

high returns. We invest and deliver consistently. If you take out

the effect of non-cash pension, over the last fi ve years we have

nearly doubled GE’s profits from $11 billion in 2001 to $21 billion.

Cash flow from operations has made similar progress, growing

to $24.6 billion. Our return, at 18.4%, has increased 220 basis

points in the last two years and is near our target.

We strive to be a reliable growth company. Our earnings

growth has been 11% over one year, 10% over fi ve years, 11%

over 10 years, 12% over 15 years and 11% over 20 years. Over

the past 20 years, the S&P 500’s earnings growth has averaged 8%.

The question is: Has reliable growth gone out of style?

Alternative investments such as hedge funds are very popular

today. GE’s PE ratio is only a modest premium to that of the

S&P 500, despite our strong performance.

We don’t believe reliable growth has gone out of style. We

know that reliable growth is always in style for long-term investors.

They look at the Company over an extended horizon, like I do.

They benefit from a company that anticipates change in the envi-

ronment and executes aggressively. This is your GE.

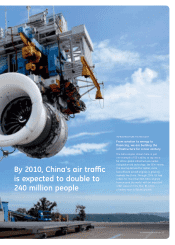

A reliable growth company must have the

courage to invest and the discipline to deliver.

It took courage to invest over $1 billion in a

new jet engine, such as the GE90, with minimal

returns for more than 10 years. Today, because

of these investments, GE enjoys exceptional

success in commercial aviation. The GE90

engine should generate $40 billion of revenues

over the next 30 years.

It took courage to invest $11 billion to acquire Amersham in

2004. This was our biggest industrial acquisition, and it gave us

capability in molecular diagnostics. Today, we have a transformed

Healthcare business that is a leader in the early detection

of disease.

At the same time, we will always be disciplined in our actions.

It takes discipline to be one of only six U.S. industrial companies

with a “Triple-A” balance sheet. It is tempting, particularly today,

to add more leverage. However, we like the fi nancial fl exibility of

a strong balance sheet.

ge 2006 annual report 3