GE 2006 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2006 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

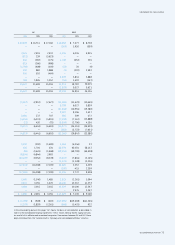

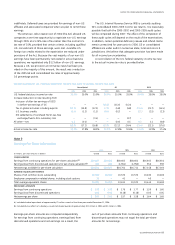

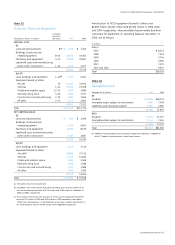

ABO balances for our pension plans follow.

ACCUMULATED BENEFIT OBLIGATION

December 31 (In millions)

GE Pension Plan

GE Supplementary Pension Plan

Other pension plans

2006

$38,137

2,314

8,053

2005

$38,044

2,178

7,194

Following is information about our pension plans in which the accu-

mulated benefit obligation exceeds the fair value of plan assets.

PLANS WITH ASSETS LESS THAN ABO

December 31 (In millions) 2006 2005

Funded plans with assets less than ABO

Plan assets $4,833 $4,737

Accumulated benefi t obligations 5,828 6,096

Projected benefi t obligations 6,667 6,967

Unfunded plans(a)

Accrued pension liability 4,310 3,323

Accumulated benefi t obligations 3,052 2,859

Projected benefi t obligations 4,310 4,235

(a) Primarily related to the GE Supplementary Pension Plan.

Pension plan assets are described below.

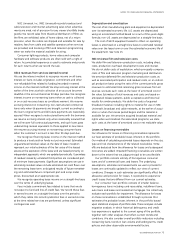

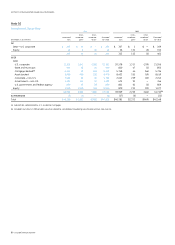

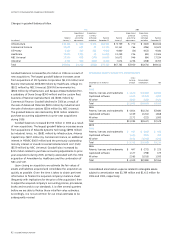

FAIR VALUE OF PLAN ASSETS

Principal pension plans Other pension plans

(In millions) 2006 2005 2006 2005

Balance at January 1 $49,096 $46,665 $5,213 $4,602

Actual gain on plan assets 7,851 4,558 679 670

Employer contributions 121 106 451 365

Participant contributions 162 174 37 36

Benefi ts paid (2,472) (2,407) (287) (256)

Exchange rate adjustments — — 340 (233)

Acquired plans and other — — 2 29

Balance at December 31 $54,758 $49,096 $6,435 $5,213

Our pension plan assets are held in trust, as follows:

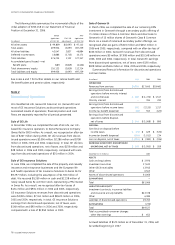

PLAN ASSET ALLOCATION

Principal pension plans

2006 2005

Target Actual Actual

December 31 allocation allocation allocation

U.S. equity securities 30–45% 41% 42%

Non-U.S. equity securities 15–25 22 21

Debt securities 15–30 17 18

Real estate 4–10 6 6

Private equities 5–11 7 7

Other 1–12 7 6

Total 100% 100%

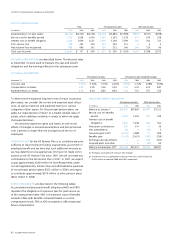

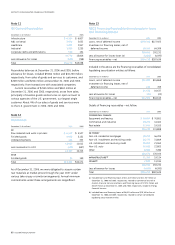

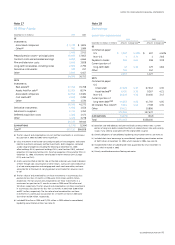

Plan fiduciaries of the GE Pension Plan set investment policies and

strategies for the GE Pension Trust. Long-term strategic invest-

ment objectives include preserving the funded status of the plan

and balancing risk and return. These plan fi duciaries oversee the

investment allocation process, which includes selecting investment

managers, commissioning periodic asset-liability studies, setting

long-term strategic targets and monitoring asset allocations.

Target allocation ranges are guidelines, not limitations, and occa-

sionally plan fiduciaries will approve allocations above or below a

target range.

GE Pension Trust assets are invested subject to the following

additional guidelines:

• Short-term securities must be rated A1/P1 or better, other

than 15% of short-term holdings which may be rated A2/P2,

• Real estate may not exceed 25% of total assets (6% of trust

assets at December 31, 2006),

• Investments in securities not freely tradable may not exceed

20% of total assets (13% of trust assets at December 31,

2006), and

• GE stock is limited by statute when it reaches 10% of total

trust assets (6.1% and 6.4% at the end of 2006 and 2005,

respectively).

Other pension plans (weighted average)

2006 2005

Target Actual Actual

December 31 allocation allocation allocation

Equity securities 66% 67% 65%

Debt securities 28 26 28

Real estate 3 3 3

Other 3 4 4

Total 100% 100%

ge 2006 annual report 83