GE 2006 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2006 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

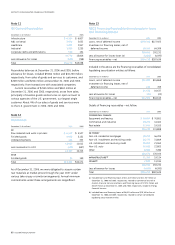

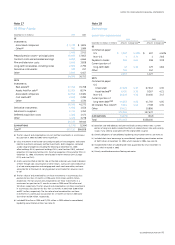

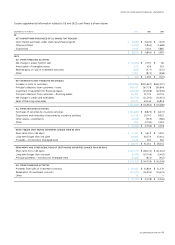

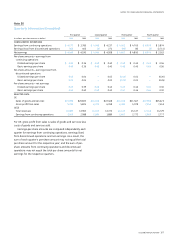

STOCK OPTION ACTIVITY

Weighted

average

Weighted remaining Aggregate

average contractual intrinsic

Shares exercise term value

(in thousands) price (in years) (in millions)

Outstanding at

January 1, 2006(a) 259,116 $33.07

Granted 20,464 34.00

Exercised (35,335) 17.52

Forfeited (4,453) 32.46

Expired (7,372) 41.84

Outstanding at

December 31, 2006 232,420 $35.25 4.7 $1,040

Exercisable at

December 31, 2006 183,217 $35.93 3.8 $ 818

Options expected to vest 43,994 $32.61 8.1 $ 202

(a) Included 1.2 million options with a weighted average exercise price of $21.81

related to various acquisitions.

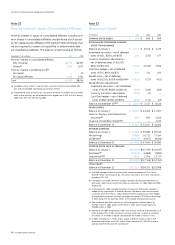

We measure the fair value of each stock option grant at the date

of grant using a Black-Scholes option pricing model. The weighted

average grant-date fair value of options granted during 2006,

2005 and 2004 amounted to $7.99, $8.87 and $8.33, respectively.

The following assumptions were used in arriving at the fair value

of options granted during 2006, 2005 and 2004, respectively:

risk-free interest rates of 4.8%, 4.1% and 4.0%; dividend yields of

2.9%, 2.5% and 2.5%; expected volatility of 24%, 28% and 28%;

and expected lives of six years and two months, six years and

six years. Risk free interest rates reflect the yield on zero-coupon

U.S. Treasury securities. Expected dividend yields presume a

set dividend rate. Expected volatilities are based on implied

volatilities from traded options and historical volatility of our stock.

The expected option lives are based on our historical experience

of employee exercise behavior.

The total intrinsic value of options exercised during 2006,

2005 and 2004 amounted to $1,312 million, $731 million and

$958 million, respectively. As of December 31, 2006, there was

$200 million of total unrecognized compensation cost related to

nonvested options. That cost is expected to be recognized over

a weighted average period of three years and 11 months.

Cash received from option exercises during 2006, 2005 and

2004 was $622 million, $403 million and $459 million, respectively.

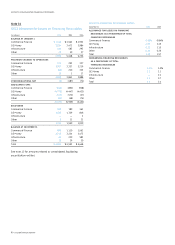

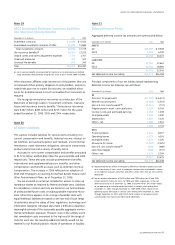

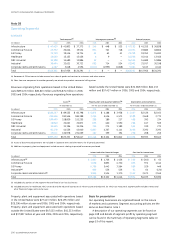

RSU ACTIVITY

Weighted

average

remaining Aggregate

contractual intrinsic

Shares term value

(in thousands) (in years) (in millions)

Outstanding at January 1, 2006

Granted

Vested

Forfeited

33,078

9,167

(4,879)

(3,039)

Outstanding at December 31, 2006 34,327 5.6 $1,277

RSUs expected to vest 30,972 4.9 $1,152

The fair value of each restricted stock unit is the market price of

our stock on the date of grant. The weighted average grant-

date fair value of RSUs granted during 2006, 2005 and 2004

amounted to $33.95, $34.72 and $32.47, respectively. The total

intrinsic value of RSUs vested during 2006, 2005 and 2004

amounted to $132 million, $90 million and $85 million, respec-

tively. As of December 31, 2006, there was $535 million of total

unrecognized compensation cost related to nonvested RSUs.

That cost is expected to be recognized over a weighted average

period of four years and 11 months.

PSU activity

As of December 31, 2006, 1.4 million PSUs with a weighted

average remaining contractual term of two years, an aggregate

intrinsic value of $51 million and $18 million of unrecognized

compensation cost were outstanding.

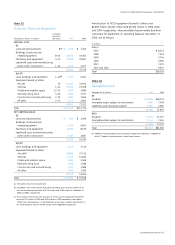

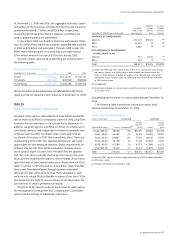

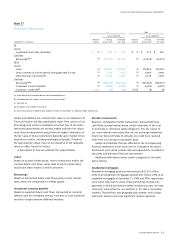

Note 25

Supplemental Cash Flows Information

Changes in operating assets and liabilities are net of acquisitions

and dispositions of principal businesses.

Amounts reported in the “Payments for principal businesses

purchased” line in the Statement of Cash Flows is net of cash

acquired and included debt assumed and immediately repaid in

acquisitions.

Amounts reported in the “All other operating activities” line

in the Statement of Cash Flows consists primarily of adjustments

to current and noncurrent accruals and deferrals of costs and

expenses, adjustments for gains and losses on assets, increases

and decreases in assets held for sale and adjustments to assets.

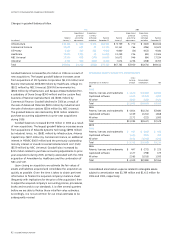

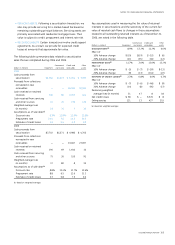

Significant non-cash transactions include the following: In 2006,

in connection with our sale of GE Insurance Solutions, Swiss Re

assumed $1,700 million of debt, and GE received $2,238 million

of newly issued Swiss Re common stock. See note 2. In 2005,

NBC Universal acquired IAC/InterActiveCorp’s 5.44% common

interest in VUE for a total purchase price that included $115 million

of non-cash consideration, representing the fair value of future

services to be performed by NBC Universal; and in 2004, the

issuance of GE common stock valued at $10,674 million in

connection with the acquisition of Amersham and the issuance

of NBC Universal common stock valued at $5,845 million in

connection with the combination of NBC and VUE.

98 ge 2006 annual report