Fujitsu 2012 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2012 Fujitsu annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

016 FUJITSU LIMITED ANNUAL REPORT 2012

900

1,200

1,500

1,079.7

1,106.2

986.0

1Q 3Q2Q 4Q

1,295.5

–40

0

40

120

80

–17.1

24.1

3.1

1Q 3Q2Q 4Q

95.0

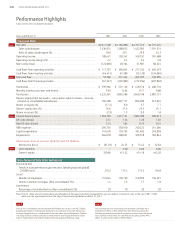

[Billions of yen] [Billions of yen]

Net Sales Operating Income (Loss)

[Quarter] [Quarter]

Fiscal 2010

Fiscal 2011

Fiscal 2012

Fiscal 2010

Fiscal 2011

Fiscal 2012

A review of fiscal 2011

Looking back, what was the year ended March 31, 2012 like for Fujitsu?

How would you rate Fujitsu’s business performance?

Operating income fell short of initial projections, amounting to ¥105.3 billion in

an extremely challenging business climate. During the fourth quarter, however,

operating income and the operating income margin were both comparable to

levels seen prior to the 2008 global financial crisis.

Q.1

A.1

In fiscal 2011, we emphasized our shift from defense to going on the offense. The global economic situation as a

whole, however, continued to face substantial uncertainty. Europe’s economic prospects receded as its sovereign debt

problem worsened, which in turn triggered an economic slowdown in emerging markets. The US economy, mean-

while, has yet to mount a full-fledged recovery. In Japan, while the supply chain rebounded from the impact of the

Great East Japan Earthquake more quickly than anticipated, the economy nonetheless stalled as the strong yen under-

mined exports and businesses reeled from the catastrophic flooding in Thailand. Regrettably, under the circumstances,

we were only able to achieve operating income of ¥105.3 billion, falling short of our initial target of ¥135.0 billion.

Looking at performance by quarter, we posted a net loss in the first quarter as a result of the Great East Japan

Earthquake. Although the economic impact from the earthquake had largely subsided by the second quarter,

revenue declined as a result of the strong yen, centered on the Device Solutions segment. In the third quarter, the

economic slump triggered by the flooding in Thailand and the European debt crisis led to postponement or other

disruptions in certain transactions. This included delays in completing contracts, even for services. But by the fourth

quarter, signs of a turnaround in the business climate began to appear, as the impact from the earthquake more or

less dissipated, and the market for devices began to recover in certain sectors. In addition, we gradually started to

see results from our shift to a leaner management structure by going on offense with structural reforms. We

achieved fourth-quarter operating income of ¥95 billion, with an operating income margin of 7.3%, on a par with

levels prior to the 2008 global financial crisis.

Structural reforms in fiscal 2011 allowed us to further solidify Fujitsu’s foundations as an ICT ? vendor. Our confi-

dence was particularly bolstered by the strength of recovery in the Technology Solutions segment. To solidify it

further, we will tackle a range of issues on the way to capturing new growth, and are determined to tie these steps

to even greater improvement in future business performance.

* See pp. 022–023 for a

more detailed account of

fiscal 2011 performance.

Financial Highlights

(Billions of yen)

(Years ended March 31) 2010 2011 2012

Net sales 4,679.5 4,528.4 4,467.5

Operating income 94.3 132.5 105.3

Net income 93.0 55.0 42.7

Interest-bearing loans 577.4 470.8 381.1

Net D/E ratio (times) 0.20 0.14 0.14

?

ICT

Information and communication technology, a term

derived from IT (information technology) and commu-

nication, which includes the sharing of knowledge and

information via communication networks. Used as a

general term for information processing and communi-

cations processing technology and applied technology.

Glossary

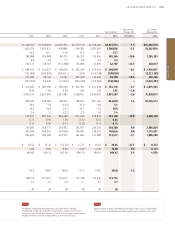

Quarterly Data by Segment (incl. intersegment transactions)