Food Lion 2009 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2009 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

86 - Delhaize Group - Annual Report 2009

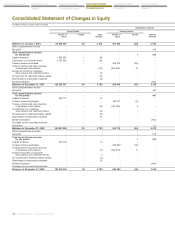

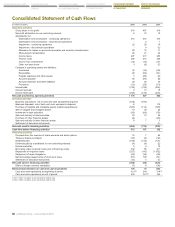

CONSOLIDATED STATEMENT

OF CHANGES IN EQUITY

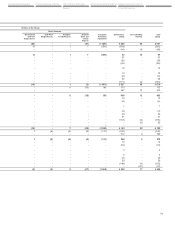

CONSOLIDATED STATEMENT

OF CASH FLOWS

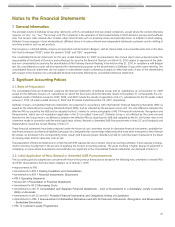

NOTES TO THE FINANCIAL

STATEMENTS

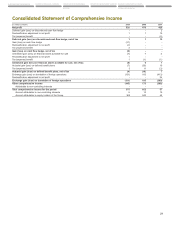

CONSOLIDATED STATEMENT

OF COMPREHENSIVE INCOME

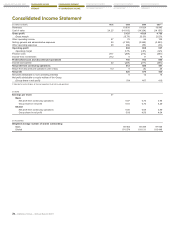

CONSOLIDATED INCOME

STATEMENT

CONSOLIDATED BALANCE SHEET

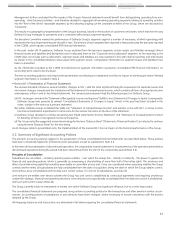

Intangible assets with finite lives are amortized on a straight-line basis over their estimated useful lives. The useful lives of intangible assets

with finite lives are reviewed annually and are as follows:

t1SFTDSJQUJPOGJMFT ZFBST

t'BWPSBCMFMFBTFSJHIUT 3FNBJOJOHMFBTFUFSN

t$PNQVUFSTPGUXBSF UPZFBST

t0UIFSJOUBOHJCMFBTTFUT UPZFBST

Intangible assets with indefinite useful lives are not amortized, but are annually tested for impairment and when there is an indication that

the asset may be impaired. The Group believes that acquired and used trade names have indefinite lives because they contribute directly

to the Group’s cash flows as a result of recognition by the customer of each banner’s characteristics in the marketplace. There are no legal,

regulatory, contractual, competitive, economic or other factors that limit the useful life of the trade names. The assessment of indefinite life is

reviewed annually to determine whether the indefinite life assumption continues to be supportable. Changes, if any, would result in prospec-

tive amortization.

Property, Plant and Equipment

Property, plant and equipment is stated at cost less accumulated depreciation and impairment, if any. Acquisition costs include expenditures

that are directly attributable to the acquisition of the asset. Such costs include the cost of replacing part of the asset and dismantling and restor-

ing the site of an asset if there is a legal or constructive obligation and borrowing costs for long-term construction projects if the recognition

criteria are met. Subsequent costs are included in the asset’s carrying amount or recognized as a separate asset, as appropriate, only when

it is probable that future economic benefits associated with the item will flow to the Group and the cost of the item can be measured reliably.

Costs of day-to-day servicing of property, plant and equipment are recognized in the income statement as incurred.

Depreciation is calculated using the straight-line method based on the estimated useful lives of the related assets and starts when the asset is avail-

able for use as intended by management. When parts of an item of property, plant and equipment have different useful lives, they are accounted

for as separate components of property, plant and equipment. Land is not depreciated. The useful lives of tangible fixed assets are as follows:

t#VJMEJOHT UPZFBST

t1FSNBOFOUJOTUBMMBUJPOT UPZFBST

t.BDIJOFSZBOEFRVJQNFOU UPZFBST

t'VSOJUVSFTGJYUVSFTFRVJQNFOUBOEWFIJDMFT UPZFBST

Gains and losses on disposals are determined by comparing the proceeds with the carrying amount and are recognized within “Other operat-

ing income” (Note 27) or “Other operating expenses” (Note 28) in the income statement.

Residual values, useful lives and methods of depreciation are reviewed at each financial year-end, and adjusted prospectively, if appropri-

ate.

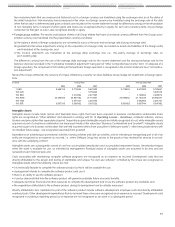

Investment Property

Investment property is defined as property (land or building - or part of a building - or both) held by Delhaize Group to earn rentals or for capital

appreciation or both, but not for sale in the ordinary course of business or for use in supply of goods or services or for administrative purposes

and includes investment property under construction. Delhaize Group recognizes the part of an owned (or leased under a finance lease) prop-

erty that is leased to third-party retailers as investment property, unless it represents an insignificant portion of the property.

Investment property is measured initially at cost including transaction costs. Subsequent to initial recognition, Delhaize Group elected to meas-

ure investment property at cost, less accumulated depreciation and accumulated impairment losses, if any (i.e., applying the same accounting

policies as for property, plant and equipment). The fair values, which reflect the market conditions at the balance sheet date, are disclosed in

Note 9.

Leases

The determination of whether an agreement is, or contains a lease, is based on the substance of the agreement at inception date. Leases are

classified as finance leases when the terms of the lease agreement transfer substantially all the risks and rewards incidental to ownership to

the Group. All other leases are classified as operating leases.

Assets held under finance leases are recognized as assets at the lower of fair value or present value of the minimum lease payments at the

inception of the lease. The corresponding liability to the lessor is included in the balance sheet as a finance lease obligation. Lease payments

are allocated between finance costs and a reduction of the lease obligation to achieve a constant rate of interest over the lease term. Finance

lease assets and leasehold improvements are depreciated over the shorter of the expected useful life of similar owned assets or the relevant

lease term.

Rents paid on operating leases are charged to income on a straight-line basis over the lease term. Benefits received and receivable as an

incentive to enter into an operating lease are spread over the relevant lease term on a straight-line basis as a reduction of rent expense.

In connection with investment property, where the Group is the lessor, leases where the Group does not transfer substantially all the risk and

rewards incident to the ownership of the investment property are classified as operating leases and are generating rental income. Contingent

rents are recognized as other operating income (Note 27) in the period in which they are earned.