Food Lion 2009 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2009 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

64 - Delhaize Group - Annual Report 2009

securities when his/her voting rights reach

five percent, 10 percent, and so on by blocks

of five percent, or when the voting rights fall

below one of these thresholds.

The same disclosure requirement applies if a

person transfers the direct or indirect control

of a corporation or other legal entity which

owns itself three percent at least of the voting

rights of the Company. Similarly, if as a result

of events changing the breakdown of voting

rights, the percentage of the voting rights

reaches, exceeds or falls below any of the

above thresholds, a disclosure is required

even when no acquisition or disposal of

securities has occurred (e.g., as a result of

a capital increase or a capital decrease).

Finally, a disclosure is also required when

persons acting in concert enter into, modify

or terminate their agreement which results

in their voting rights reaching, exceeding or

falling below any of the above thresholds.

The disclosure statements must be

addressed to the BFIC and to the Company at

the latest the fourth trading day following the

day on which the circumstance giving rise to

the disclosure occurred. Unless otherwise

provided by law, a shareholder shall be

allowed to vote at a shareholders’ meeting of

the Company only the number of securities

he/she validly disclosed 20 days, at the

latest, before such meeting.

Delhaize Group is not aware of the existence

of any shareholders’ agreement with respect

to the voting rights pertaining to the securities

of the Company.

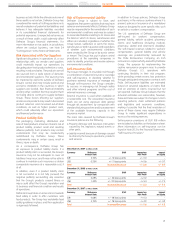

With the exception of the shareholders

identified in the table below, no shareholder

or group of shareholders had declared as of

March 1, 2010 holdings of at least 3% of the

outstanding voting rights of Delhaize Group.

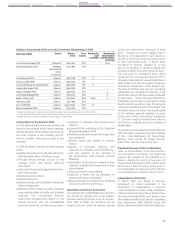

Date Name of Shareholder Number of

Shares Held Percentage of

Total Voting

Rights on

Date of

Notification

October 24, 2008

(1)

Rebelco SA (subsidiary of Sofina SA)

Rue de l’industrie 31, 1040 Brussels Belgium

4 050 000 4.04%

February 18, 2009

Citibank N.A.(2)

388

Greenwich Street - 14th Floor, New York, NY 10013

10 682 499 10.62%

February 18, 2010

BlackRock Asset Management Japan Co. Ltd

Marunouchi Trust Tower Main, 1-8-3 Marunouchi, Chiyoda-ku, Tokyo 100-8217

434 157 0.43%

BlackRock Advisors (UK) Limited

Murray House, 1 Royal Mint Court, London, EC3N 4HH

1 315 353 1.30%

BlackRock Institutional Trust Company, N.A.

400 Howard Street, San Francisco, CA, 94105-2618

2 288 516 2.27%

BlackRock Fund Advisors

Murray House, 1 Royal Mint Court, London, EC3N 4HH

544 747 0.54%

BlackRock Asset Management Canada Ltd

161 Bay Street, Suite 2500, Toronto, Ontario M5J 2S1

52 143 0.05%

BlackRock Financial Management, Inc.

40 East 52nd Street, New York, 10022 USA

1 278 0.00%

BlackRock Investment Management, LLC

40 East 52nd Street, New York, 10022 USA

129 693 0.13%

BlackRock Investment Management (Australia) Ltd

Level 18, 120 Colins Street, Melbourne VIC 3000, Australia

2 274 0.00%

BlackRock Investment Management (Dublin) Ltd

33 King William St, London EC4R 9AS UK

8 498 0.01%

BlackRock Fund Managers Ltd

33 King William St, London EC4R 9AS UK

19 197 0.02%

BlackRock International Ltd

40 Torphichen Street, Edinburgh, EH3 8JB, UK

39 345 0.04%

BlackRock Investment Management UK Ltd

33 King William St, London EC4R 9AS UK

21 094 0.02%

BlackRock Advisors, LLC

40 East 52nd Street, New York, 10022 USA

78 200 0.08%

BlackRock (Luxembourg) SA

6 D rte de Treves, L-2633 Sennengebierg, Luxembourg

20 800 0.02%

BlackRock Asset Management Australia Limited

Level 18, 120 Colins Street, Melbourne VIC 3000, Australia

96 612 0.10%

Total BlackRock 5 051 907 5.01%

(1)

Situation as of September 1, 2008.

(2)

Citibank, N.A. has succeeded The Bank of New York Mellon as Depositary for the American Depositary Receipts program of Delhaize Group as

of February 18, 2009. Citibank, N.A. exercises the voting rights attached to such shares in compliance with the Deposit Agreement that provides

among others that Citibank, N.A. may vote such shares only in accordance with the voting instructions it receives from the holders of American

Depositary Shares.

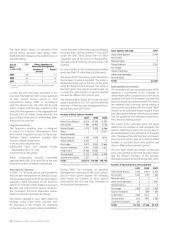

On December 31, 2009, the directors and the

Company’s Executive Management owned

as a group 417 648 ordinary shares and

ADRs of Delhaize Group SA combined, which

represented approximately 0.41% of the total

number of outstanding shares of the Company

as of that date. On December 31, 2009, the

Company’s Executive Management owned as

a group 720 560 stock options, warrants and

restricted stock units representing an equal

number of existing or new ordinary shares or

ADRs of the Company.