Food Lion 2009 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2009 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

96 - Delhaize Group - Annual Report 2009

CONSOLIDATED STATEMENT

OF CHANGES IN EQUITY

CONSOLIDATED STATEMENT

OF CASH FLOWS

NOTES TO THE FINANCIAL

STATEMENTS

CONSOLIDATED STATEMENT

OF COMPREHENSIVE INCOME

CONSOLIDATED INCOME

STATEMENT

CONSOLIDATED BALANCE SHEET

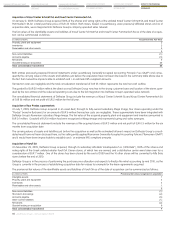

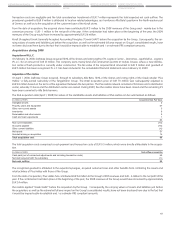

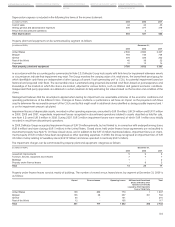

Acquisition of Knauf Center Schmëtt SA and Knauf Center Pommerlach SA

On January 2, 2009, Delhaize Group acquired 100% of the shares and voting rights of the unlisted Knauf Center Schmëtt SA and Knauf Center

Pommerlach SA for a total purchase price of EUR 25 million. Both stores, based in Luxembourg, were previously affiliated stores and as of

acquisition date, were integrated into Delhaize Group’s company operated sales network.

The fair values of the identifiable assets and liabilities of Knauf Center Schmëtt SA and Knauff Center Pommerlach SA as of the date of acquisi-

tion can be summarized as follows:

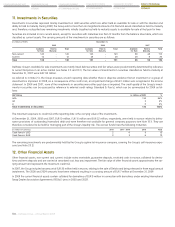

(in millions of EUR) Acquisition Date Fair Value

Property, plant and equipment 2

Inventories 2

Receivables and other assets 5

9

Non-current liabilities (1)

Accounts payable (3)

Net assets 5

Goodwill arising on acquisition 20

Total consideration transferred 25

Both entities previously prepared financial statements under Luxembourg Generally Accepted Accounting Principle (“Lux GAAP”) and conse-

quently the carrying values of the assets and liabilities just before the acquisition have not been disclosed in the summary table above due to

the fact that it would be impracticable to establish and / or estimate IFRS compliant amounts.

Transaction costs are negligible and the total consideration transferred of EUR 25 million represents the total net cash outflow.

The goodwill of EUR 20 million reflects the direct access Delhaize Group now has to the strong customer base and location of the stores oper-

ated by the two entities and the reduced operating costs due to the full integration into Delhaize Group’s operated sales network.

The consolidated financial statements of Delhaize Group include the revenues of Knauf Center Schmëtt SA and Knauf Center Pommerlach SA

of EUR 56 million and net profit of EUR 2 million for the full year.

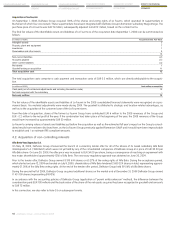

Acquisition of four Prodas supermarkets

On July 7, 2009, Delhaize Group acquired in an asset deal, through its fully-owned subsidiary Mega Image, four stores operating under the

“Prodas” brand in Bucharest, for an amount of EUR 6 million (transaction costs are negligible). These supermarkets have been integrated with

Delhaize Group’s Romanian subsidiary Mega Image. The fair value of the acquired property, plant and equipment and inventory amounted to

EUR 0.1 million. Goodwill of EUR 6 million has been recognized at Mega Image and represents buying and sales synergies.

The consolidated financial statements include the revenues of the acquired stores of EUR 3 million and net profit of EUR 0.5 million for the six

months from acquisition date.

The carrying values of assets and liabilities just before the acquisition as well as the estimated full year’s impact on Delhaize Group’s consoli-

dated result have not been disclosed here, as the selling entity applied Romanian Generally Accepted Accounting Policies (“Romanian GAAP”)

and it would have been impracticable to establish and / or estimate IFRS compliant amounts.

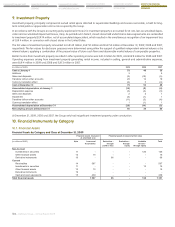

Acquisition of Koryfi SA

On November 23, 2009, Delhaize Group acquired, through its subsidiary Alfa Beta Vassilopoulos S.A. (“Alfa Beta”), 100% of the shares and

voting rights of the Greek unlisted retailer Koryfi SA. Eleven stores, of which two are owned, and a distribution center were taken over for a

consideration of EUR 7 million. One of the stores has been closed by the end of 2009 and the 10 other stores will be converted to Alfa Beta

stores before the end of 2010.

Delhaize Group is in the process of performing the purchase price allocation and expects to finalize the initial accounting by mid 2010, as the

Group is currently in the process of establishing acquisition date fair values for example for the lease agreements acquired.

The provisional fair values of the identifiable assets and liabilities of Koryfi SA as of the date of acquisition can be summarized as follows:

(in millions of EUR) Provisional fair values recognized on acquisition

Intangible assets 1

Property, plant and equipment 3

Inventories 3

Receivables and other assets 1

8

Non-current liabilities (1)

Short-term borrowings (2)

Accounts payable (6)

Other current liabilities (1)

Net assets (2)

Goodwill arising on acquisition 9

Total consideration transferred 7