Food Lion 2009 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2009 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

82 - Delhaize Group - Annual Report 2009

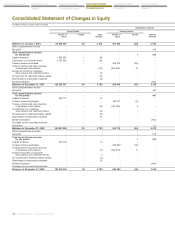

CONSOLIDATED STATEMENT

OF CHANGES IN EQUITY

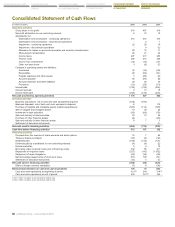

CONSOLIDATED STATEMENT

OF CASH FLOWS

NOTES TO THE FINANCIAL

STATEMENTS

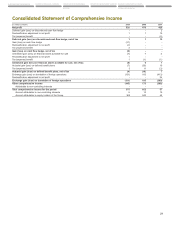

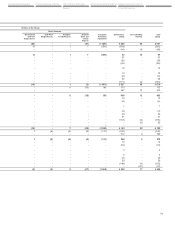

CONSOLIDATED STATEMENT

OF COMPREHENSIVE INCOME

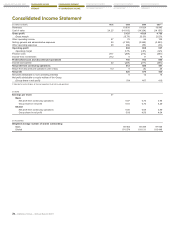

CONSOLIDATED INCOME

STATEMENT

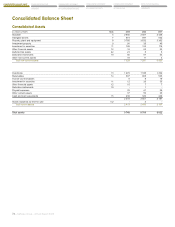

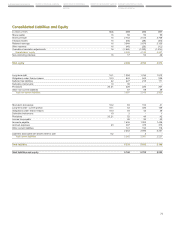

CONSOLIDATED BALANCE SHEET

t*'3*$Agreements for the Construction of Real Estate

t*'3*$Hedges of a Net Investment in a Foreign Operation

t*'3*$Transfers of Assets from Customers

Where the adoption of a new, amended or revised pronouncement is deemed to have an impact on the presentation of the financial state-

ments or performance of the Group, its impact is described below:

tImprovements to IFRS

In May 2008, the IASB issued its first omnibus of amendments to its standards, primarily with the aim of removing inconsistencies and

clarifying wording. Most of the 34 amendments to various standards are effective as of January 1, 2009 and had no impact on the Group.

However, as part of this publication the IASB amended IAS 40 Investment Property in order to include investment property under construc-

tion within the scope of IAS 40 and allow such property under construction to be measured at fair value. While Delhaize Group measures its

investment property at amortized cost, the amendment requires a separate disclosure of investment property under construction from other

items of property, plant and equipment (where they had been included before) and also the disclosure of the fair value of such property under

construction. The revised disclosures requirements have been included in Note 9.

In April 2009, the IASB issued its second omnibus of amendments containing 15 changes to 12 IASB pronouncements, of which most of them

are effective January 1, 2010 (see further Note 2.5). However, the IASB included in this omnibus amendment an addition to IAS 18 Revenue, by

inserting to the appendix of IAS 18, which accompanies but is not part of the standard, guidance to determine whether the Group is acting

as a principal or as an agent. The amendment to the appendix of IAS 18 has no effective date and was therefore effective as of publication

date. As it is an addition to the appendix to IAS 18, which does not form part of the endorsed accounting literature, this amendment does not

require endorsement. The Group has assessed its existing revenue agreements against the new guidance and concluded that its previous

accounting policies were in line with the revised guidance issued.

t"NFOENFOUTUP*'34 Financial Instruments Disclosures

In March 2009, the IASB issued an amendment to IFRS 7, with an effective date for these amendments for annual periods beginning on or

after January 1, 2009, however not requiring comparative information in the first year of application.

The amendment requires additional disclosures about fair value measurement and liquidity risk. Financial instruments measured at fair value

are to be disclosed by source of inputs using a three level fair value hierarchy, by class of financial instruments. In addition, a reconciliation

between the beginning and the ending balance for level 3 fair value measurements is now required, as well as significant transfers between

levels in the fair value hierarchy. The amendment also clarifies the requirements for liquidity risk disclosure with respect to derivative transac-

tions and assets used for liquidity management.

The fair value measurement disclosures are presented in Note 10. The revised liquidity risk disclosure requirements had no significant impact

on Delhaize Group and are reflected in the section “Risk Factors” in this annual report and the various notes dealing with financial instru-

ments.

As the changes only result in revised and additional disclosures, there is no impact on earnings per share.

t*'34Operating Segments

The standard replaces IAS 14 Segment Reporting and introduces the so-called “management approach” to segment reporting into the IFRS

literature. IFRS 8 requires the Group to report financial and descriptive information about its reportable segments. Such reportable segments

are operating segments or aggregations of operating segments that meet specified criteria. Operating segments are components of an

entity, which engage in business activities from which they may earn revenues and incur expenses, including revenues and expenses that

relate to transactions with any of the Group’s other components, about which discrete financial information is available that is evaluated

regularly by the chief operating decision maker (CODM) in deciding how to allocate resources and in assessing performance. The Group is

required to report separate information about each operating segment that:

(a) has been identified as described above or results from aggregating two or more of those segments if they exhibit similar long-term

financial performance and have similar economic characteristics; and

(b) exceeds certain quantitative thresholds.

Delhaize Group identified the Executive Committee as its CODM and defined operating segments based on the information provided to the

Executive Committee, which mainly represent the various operating entities run by the Group. Delhaize Group subsequently established

reportable segments, which aggregate:

(a) its US operating segments, as they are considered to have similar economic characteristics and exhibit similar long-term financial per-

formance; and

(b) its operating segments that do not exceed the quantitative threshold defined by IFRS 8.

Although the operating segment “Greece” does not meet the quantitative thresholds set in IFRS 8, management concluded that this operating

segment should be disclosed separately to enhance the understanding of the nature and financial effects of its business activities and the

economic environment in which Delhaize Group operates.