Food Lion 2009 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2009 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

111

SUMMARY STATUTORY ACCOUNTS

OF DELHAIZE GROUP SA

HISTORICAL FINANCIAL OVERVIEW CERTIFICATION OF RESPONSIBLE

PERSONS

REPORT OF THE STATUTORY AUDITOR

SUPPLEMENTARY INFORMATION

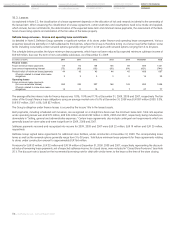

Cumulative Translation Adjustment

The cumulative translation adjustment relates to changes in the balance of assets and liabilities due to changes in the functional currency of the

Group’s subsidiaries relative to the Group’s reporting currency. The balance in cumulative translation adjustment is mainly impacted by the apprecia-

tion or depreciation of the U.S. dollar to the euro.

Capital Management

Delhaize Group’s objectives for managing capital are to safeguard the Group’s ability to continue as a going concern and to maximize share-

holder value while keeping sufficient flexibility to execute strategic projects and reduce cost of capital. The Group monitors capital by using the

same debt/equity classifications as applied in its IFRS reporting.

During 2009, the capital and share premium of Delhaize Group increased by EUR 14 million.

Non-controlling Interests

Non-controlling interests represent third-party interests in the equity of fully consolidated companies that are not wholly owned by Delhaize

Group.

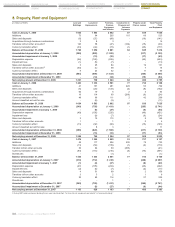

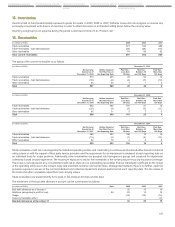

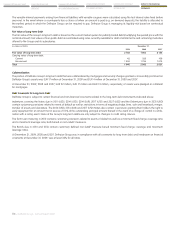

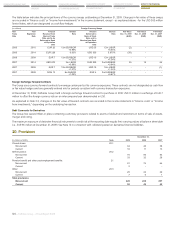

Non-controlling interests (in millions of EUR) December 31,

Note 2009 2008 2007

Belgium 1 1 1

Greece 4.2 16 51 48

Total 17 52 49

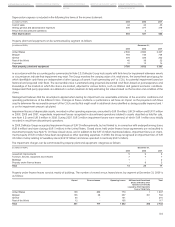

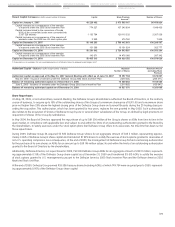

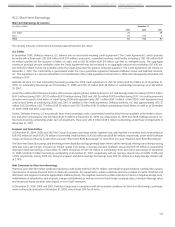

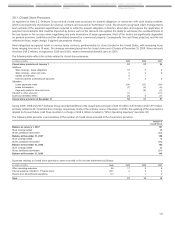

17. Dividends

On May 28, 2009, the shareholders approved the payment of a gross dividend of EUR 1.48 per share (EUR 1.11 per share after deduction of the

25% Belgian withholding tax) or a total gross dividend of EUR 149 million. On May 22, 2008, the shareholders approved the payment of a gross

dividend of EUR 1.44 per share (EUR 1.08 per share after deduction of the 25% Belgian withholding tax) or a total gross dividend of EUR 144 mil-

lion.

With respect to the current year, the Board of Directors proposes a gross dividend of EUR 1.60 per share to be paid to owners of ordinary shares

against coupon no. 48 on June 3, 2010. This dividend is subject to approval by shareholders at the Ordinary General Meeting of May 27, 2010

and has therefore not been included as a liability in Delhaize Group’s consolidated financial statements prepared under IFRS. The total estimated

dividend, based on the number of shares outstanding at March 10, 2010 is EUR 161 million. The payment of this dividend will not have income

tax consequences for the Group.

As a result of the potential exercise of warrants issued under the Delhaize Group 2002 Stock Incentive Plan, the Group may have to issue new

ordinary shares, to which payment in 2010 of the 2009 dividend is entitled, between the date of adoption of the annual accounts by the Board

of Directors and the date of their approval by the Ordinary General Meeting of May 27, 2010. The Board of Directors will communicate at the

Ordinary General Meeting of May 27, 2010 the aggregate number of shares entitled to the 2009 dividend and will submit at this meeting the

aggregate final amount of the dividend for approval. The annual statutory accounts of Delhaize Group SA for 2009 will be modified accordingly.

The maximum number of shares which could be issued between March 10, 2010, and May 27, 2010, assuming that all vested warrants were

to be exercised, is 2 801 734. This would result in an increase in the total amount to be distributed as dividends to a total of EUR 4 million. Total

outstanding non-vested warrants at March 10, 2010 amounted to 1 059 973, representing a maximum additional dividend to be distributed of

EUR 2 million.