Emerson 2009 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2009 Emerson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Emerson 20092

From left: Edward L. Monser, Chief Operating Ofcer; Charles A. Peters, Senior Executive Vice President; David N. Farr,

Chairman, Chief Executive Ofcer, and President; Craig W. Ashmore, Executive Vice President Planning and

Development; Walter J. Galvin, Vice Chairman and Chief Financial Ofcer; Charles A. Peters, David N. Farr.

we responded quickly, rapidly falling customer demand and signicant inventory reductions

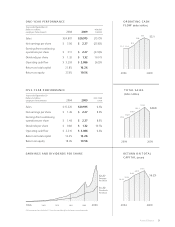

negatively impacted prot margins. As a result, scal 2009 net earnings per share declined

26 percent to $2.27 on a 16 percent decline in net sales.

Underlying sales (excluding the impact of acquisitions and foreign currency translation)

declined 13 percent, impacted heavily by the global recession. This compares with a decline

in global G7 gross xed investment (GFI) of 12 percent during the same time period. GFI is

an economic indicator reecting demand for many of our products and services, and while it is

showing encouraging signs of stabilization, we expect continued challenging end-market

demand – and lower sales – in the rst half of scal 2010.

Because the sales decline and our aggressive inventory reduction created underutilized capacity,

our operating prot margin declined to 15.1 percent, down from 16.5 percent in 2008, which

was our highest level in more than 30 years. Our after-tax return on total capital was 16.2 percent,

down from 21.8 percent in scal 2008.

Cash ow from operations was strong at $3.1 billion. Strong cash ow remains a high priority,

enabling us to pursue acquisitions, develop new technologies, and return cash to shareholders

through stock repurchases and dividends. I am pleased to note that 2009 marked Emerson’s 53rd

consecutive annual dividend increase, and the board of directors has acted to increase the dividend

again by 1.5 percent, to an annual rate of $1.34.