Emerson 2009 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2009 Emerson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Emerson 200918

markets; while the temperature sensors and ow controls

businesses declined. The growth in refrigeration was

driven by the transport container market. The under-

lying sales increase reects a 2 percent increase in the

United States and 4 percent growth internationally, with

Asia growing 9 percent and Europe declining 6 percent.

Earnings increased 2 percent to $551 million in 2008

compared with $538 million in 2007. The margin was

diluted as higher sales prices were more than offset by

material ination and higher restructuring costs of

$13 million.

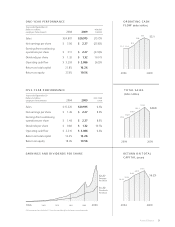

C h A n G e c h a n g e

(d o l l A R s in m i l l i o n s ) 2007 2008 2009 ‘07-‘08 ‘08 - ‘09

Sales $4,006 3,861 (4)%

Earnings $ 564 527 (7)%

Margin 14.1% 13.6%

Sales for the Appliance and Tools

segment were $3.0 billion in 2009, a 22 percent decrease

from 2008. Declines in the storage, tools and appli-

ance businesses were due to the continued downturn

in the U.S. residential and nonresidential markets, while

declines in the motors and appliance and solutions busi-

nesses reect major customers reducing inventory and

production levels due to the difcult economic condi-

tions. The sales decrease reects a 21 percent decline in

underlying sales and an unfavorable impact from foreign

currency translation of 1 percent ($41 million). Underlying

sales in the United States were down 21 percent while

underlying international sales decreased 17 percent.

The underlying sales decrease reects an estimated

23 percent decline in volume and an approximate

2 percent positive impact from pricing. Earnings for 2009

were $365 million, a 31 percent decrease from 2008,

reecting deleverage on lower sales volume and higher

rationalization costs of $16 million, which were partially

offset by savings from cost reductions, higher selling

prices and a 2008 impairment charge of $31 million in the

appliance control business (see Note 4).

Sales in the Appliance and Tools

segment were $3.9 billion in 2008, a 4 percent decrease

from 2007. Results for 2008 were mixed, reecting

the different sectors served by these businesses. The

professional tools, commercial storage and hermetic

motor businesses showed increases, while the residen-

tial storage, appliance components, and appliance and

commercial motors businesses declined. The growth in

the professional tools business was driven by U.S. and

Latin American markets. The declines in the residential

storage and appliance-related businesses primarily reect

the downturn in the U.S. consumer appliance and resi-

dential end-markets, as the U.S. markets represented

more than 80 percent of sales for this segment. Under-

lying sales in the United States were down 6 percent

from the prior year, while international underlying sales

increased 13 percent in total. The decrease in total sales

reects a 3 percent decline in underlying sales, an

unfavorable impact from divestitures of 2 percent

($65 million) and a favorable impact from foreign

currency translation of 1 percent ($40 million). The

underlying sales decrease reects an estimated 7 percent

decline in volume and an approximate 4 percent posi-

tive impact from higher pricing. Earnings for 2008 were

$527 million, a 7 percent decrease from 2007. Earnings

decreased because of deleverage on lower sales volume

and the $31 million impairment charge in the appliance

control business (see Note 4), which was partially offset

by savings from cost reduction actions. The increase in

sales prices was substantially offset by higher material

(copper and other commodities) and wage costs. The

2007 sale of the consumer hand tools product line favor-

ably impacted the margin.

The Company continues to generate substantial cash

from operations, is in a strong nancial position with

total assets of $20 billion and stockholders’ equity of

$9 billion and has the resources available for reinvest-

ment in existing businesses, strategic acquisitions and

managing its capital structure on a short- and

long-term basis.

Annual dividends increased to a record $1.32 per share in

2009, representing the 53rd consecutive year of increases.

2004 2009

$0.80

$1.32

$0.83 $0.89

$1.05

$1.20