Emerson 2009 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2009 Emerson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report 11

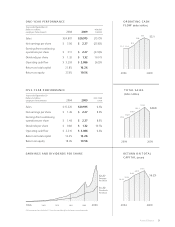

Years ended September 30 | Dollars in millions, except per share amounts

C h A n G e c h a n g e

2007 2008 2009 2007-2008 2008 - 2009

Net sales $22,131 24,807 12%

Gross profit $ 8,065 9,139 13%

Percent of sales 36.4% 36.8% 36.8%

SG&A $ 4,569 5,057

Percent of sales 20.6% 20.3% 21.7%

Other deductions, net $ 175 303

Interest expense, net $ 228 188

Earnings from continuing operations

before income taxes $ 3,093 3,591 16%

Percent of sales 14.0% 14.5% 11.6%

Earnings from continuing operations $ 2,129 2,454 15%

Net earnings $ 2,136 2,412 13%

Percent of sales 9.7% 9.7% 8.2%

Diluted EPS – Earnings from continuing operations $ 2.65 3.11 17%

Diluted EPS – Net earnings $ 2.66 3.06 15%

Return on equity 25.2% 27.0%

Return on total capital 20.1% 21.8%

Fiscal 2009 was a very challenging year as a signicant

decline in gross xed investment worldwide, particu-

larly for capital goods and nonresidential construction,

as well as housing and consumer spending, adversely

impacted sales and earnings for all of the Company’s

business segments. These declines began in the third

quarter of scal 2008, continued throughout 2009, and

the Company anticipates continued weakness stem-

ming from these factors for much of scal 2010. Given

the difcult economic environment, the Company took

aggressive actions and incurred signicant costs to

rationalize its businesses to the level appropriate for the

conditions and to improve its cost structure in prepara-

tion for the ultimate recovery. Fiscal 2009 net sales were

$20.9 billion, a decrease of 16 percent; earnings from

continuing operations and earnings from continuing

operations per share were $1.7 billion and $2.27,

decreases of 30 percent and 27 percent, respectively;

net earnings and net earnings per share were $1.7 billion

and $2.27, decreases of 29 percent and 26 percent,

respectively, from scal 2008. Underlying sales declined

across all major geographic regions, particularly in the

United States and Europe. Sales in Asia were down slightly

but included a 2 percent increase in China. Unfavorable

foreign currency translation also negatively impacted

results for the year due to the strength of the U.S. dollar

as compared with 2008. Sales and earnings for scal 2009

decreased versus prior year in all segments, reecting

lower spending and investment by both businesses and

consumers as condence declined and remained low.

Although operating in a challenging environment, the

Company was able to achieve gross margin consistent

with prior year due to the benets of rationalization

actions and other productivity improvements, as well

as higher pricing in certain markets and materials cost

containment. Earnings margins decreased primarily

because of deleverage on lower sales volume and higher

rationalization expense. Despite the economic environ-

ment, Emerson’s nancial position remains strong and in

2009 the Company generated cash near the same level as

the prior year with operating cash ow of $3.1 billion and

free cash ow (operating cash ow less capital expendi-

tures) of $2.6 billion. Emerson maintains a conservative

nancial structure to provide the strength and exibility

necessary to achieve its strategic objectives.

Net sales for scal 2009 were $20.9 billion, a decrease

of approximately $3.9 billion, or 16 percent, from scal

2008. Sales declined across all segments as the Compa-

ny’s businesses continued to be impacted by the broad

slowdown in consumer and capital goods businesses.

Consolidated results reect an approximate 13 percent

($3,090 million) decrease in underlying sales (which