Emerson 2009 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2009 Emerson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report 15

There were no discontinued operations in scal 2009. The

$42 million loss from discontinued operations ($0.05 per

share) in scal 2008 included the $42 million gain on the

divestiture of Brooks, the $92 million loss related to the

divestiture of the European appliance motor and pump

business, and $8 million of combined earnings related to

these divestitures. Fiscal 2007 income from discontinued

operations related to the European appliance motor and

pump business was $7 million, or $0.01 per share. See

previous discussion under Acquisitions and Divestitures

and Note 3 for additional information regarding prior year

discontinued operations.

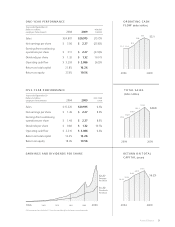

Net earnings were $1.7 billion and earnings per share

were $2.27 for 2009, decreases of 29 percent and

26 percent, respectively, compared with 2008, due to

the same factors discussed previously. Net earnings as

a percent of net sales were 8.2 percent and 9.7 percent

in 2009 and 2008. Return on stockholders’ equity (net

earnings divided by average stockholders’ equity) was

19.5 percent in 2009 compared with 27.0 percent in

2008. Return on total capital was 16.2 percent in 2009

compared with 21.8 percent in 2008, and is computed

as net earnings excluding after-tax net interest expense,

divided by average stockholders’ equity plus short- and

long-term debt less cash and short-term investments.

Net earnings were $2.4 billion and earnings per share

were $3.06 for 2008, increases of 13 percent and

15 percent, respectively, compared with net earnings

and earnings per share of $2.1 billion and $2.66,

respectively, in 2007. Net earnings as a percent of net

sales were 9.7 percent in 2008 and 2007. Net earnings

in 2008 included the net loss from discontinued opera-

tions discussed previously. Return on stockholders’

equity reached 27.0 percent in 2008 compared with

25.2 percent in 2007, and the Company realized a 2008

return on total capital of 21.8 percent compared with

20.1 percent in 2007.

Following is a summary of segment results for scal 2009

compared with scal 2008, and also 2008 compared with

scal 2007. The Company denes segment earnings as

earnings before interest and taxes.

n Process Management n Climate Technologies

n Industrial Automation n Appliance and Tools

n Network Power

C h A n G e c h a n g e

(d o l l A R s in m i l l i o n s ) 2007 2008 2009 ‘07-‘08 ‘08 - ‘09

Sales $5,699 6,652 17%

Earnings $1,066 1,306 23%

Margin 18.7% 19.6%

Process Management segment sales

were $6.2 billion in 2009, a decrease of $419 million, or

6 percent, from 2008. Nearly all of the Process businesses

reported lower sales and earnings, particularly for the

measurement and ow business resulting primarily from

weakness in the chemical, rening and marine markets.

Sales were down slightly for the valves business while

the power and water business had a small sales increase.

The segment sales decrease reects a 2 percent decline

in underlying sales on lower volume, a 6 percent

($373 million) unfavorable impact from foreign currency

translation and a 2 percent ($94 million) favorable impact

primarily from the Roxar acquisition. Regionally, sales

declined 6 percent in the United States while interna-

tional sales were at, as growth in Asia (7 percent) offset

decreases in Europe (4 percent), Middle East/Africa

(3 percent), Canada (6 percent) and Latin America

(2 percent). Earnings decreased 18 percent to

$1,068 million from $1,306 million in the prior year,

reecting the lower sales volume, negative product mix,

higher rationalization costs of $43 million and a

$12 million negative impact from foreign currency

transactions related to the strengthening of the U.S. dollar

in 2009 versus weakening in the prior year, partially

offset by savings from cost reduction actions. The

margin decrease primarily reects unfavorable product

mix (approximately 2 points) and deleverage on lower

volume, which were partially offset by productivity

13%

21%

45%

21%

14%

29%

15%

17%

25%