Emerson 2009 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2009 Emerson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Annual Report 13

was approximately $776 million (net of cash acquired of

approximately $31 million and debt assumed of approxi-

mately $230 million). Annualized sales for acquired

businesses were approximately $530 million in 2009.

During the rst quarter of scal 2010, the Company

entered into a denitive agreement and commenced

a tender offer to acquire Avocent Corporation for

approximately $1.2 billion in cash. Avocent is a leader in

delivering information technology operations manage-

ment solutions that reduce operating costs, simplify

management and increase availability of critical informa-

tion technology environments via integrated, centralized

software. Avocent products complement the Network

Power segment’s power systems, energy manage-

ment and precision cooling solutions. The transaction

is expected to be completed in December 2009 and is

subject to acceptance of the tender offer by a majority of

Avocent shareholders, customary closing conditions and

regulatory approvals.

The Company acquired Motorola Inc.’s Embedded

Computing business and several smaller businesses

during 2008. Embedded Computing provides commu-

nication platforms and enabling software used by

manufacturers of equipment for telecommunications,

medical imaging, defense and aerospace and industrial

automation markets. Total cash paid for these businesses

(net of cash and equivalents acquired of approximately

$2 million) was approximately $561 million.

In the rst quarter of scal 2008, the Company divested

its Brooks Instrument ow meters and ow controls unit,

which had sales for the rst quarter of 2008 of $21 million

and net earnings of $1 million. Proceeds from the sale of

Brooks were $100 million, resulting in a pretax gain of

$63 million ($42 million after-tax). The net gain on dives-

titure and Brooks’ results of operations for scal 2008 are

classied as discontinued operations; prior year results of

operations were inconsequential. Also in scal 2008, the

Company received approximately $101 million from the

divestiture of the European appliance motor and pump

business, resulting in a loss of $92 million. The European

appliance motor and pump business had total annual

sales of $453 million and $441 million in 2008 and 2007,

respectively and net earnings, excluding the divestiture loss,

of $7 million in both years. The divestiture loss and results

of operations are classied as discontinued operations.

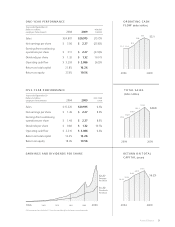

Costs of sales for scal 2009 and 2008 were $13.2 billion

and $15.7 billion, respectively, while gross prot was

$7.7 billion in 2009 compared with $9.1 billion for 2008.

The decrease in gross prot primarily reects lower sales

volume and unfavorable foreign currency translation. As

a percent of net sales, cost of sales was 63.2 percent for

both 2009 and 2008, resulting in consistent gross margin

of 36.8 percent for both years. The level gross margin

compared with 2008 reects benets realized from ratio-

nalization actions and other productivity improvements,

materials cost containment and selective price increases,

which were offset by deleverage on lower sales volume,

inventory liquidation and unfavorable product mix. In

addition, due to the economic slowdown the Company’s

inventory obsolescence allowance increased approxi-

mately $40 million in 2009.

Costs of sales for scal 2007 were $14.1 billion and cost

of sales as a percent of net sales was 63.6 percent. Gross

prot was $8.1 billion for 2007, resulting in a gross prot

margin of 36.4 percent. The increase in the gross prot

margin in 2008 primarily reects leverage on higher sales

volume and benets realized from productivity improve-

ments, which were partially offset by negative product

mix. Higher sales prices, together with the benets

received from commodity hedging of approximately

$42 million, were more than offset by higher raw material

and wage costs. The increase in the gross prot amount

in 2008 primarily reects higher sales volume and foreign

currency translation, as well as acquisitions.

Selling, general and administrative (SG&A) expenses

for 2009 were $4.5 billion, or 21.7 percent of net sales,

compared with $5.1 billion, or 20.3 percent of net sales

for 2008. The $0.6 billion decrease in SG&A was primarily

due to lower sales volume, benets from rationalization,

favorable foreign currency translation and a $28 million

decrease in incentive stock compensation expense (see

Note 14). The increase in SG&A as a percent of sales was

primarily the result of deleverage on lower sales volume,

partially offset by cost reduction actions and the lower

incentive stock compensation expense.

SG&A expenses for 2008 were $5.1 billion, or

20.3 percent of net sales, compared with $4.6 billion,

or 20.6 percent of net sales for 2007. The increase of

approximately $0.5 billion in 2008 was primarily due to an

increase in variable costs on higher sales volume, acquisi-

tions and foreign currency translation, partially offset by

a $103 million decrease in incentive stock compensation

(see Note 14). The reduction in SG&A as a percent of sales

was primarily the result of lower incentive stock compen-

sation, leverage on higher sales and benets realized from

cost reduction actions, particularly in the Process Manage-

ment and Network Power businesses.