Emerson 2009 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2009 Emerson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Emerson 200912

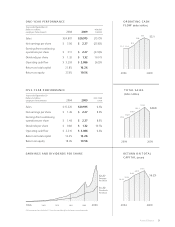

exclude acquisitions, divestitures and foreign currency

translation), a 4 percent ($933 million) unfavorable

impact from foreign currency translation and a 1 percent

($131 million) contribution from acquisitions. The under-

lying sales decrease for scal 2009 included an 18 percent

decrease in the United States and a 9 percent decrease

internationally, composed of Europe (16 percent), Latin

America (7 percent), Middle East/Africa (6 percent), Asia

(2 percent) and Canada (6 percent). The Company esti-

mates that the underlying sales decline primarily reects

an approximate 14 percent decline from volume and an

approximate 1 percent impact from higher pricing.

Net sales for scal 2008 were $24.8 billion, an increase

of approximately $2.7 billion, or 12 percent, over scal

2007, with international sales leading overall growth.

Consolidated sales results reect increases in four of the

Company’s ve business segments with an approximate

7 percent ($1,523 million) increase in underlying sales, a

4 percent ($809 million) favorable impact from foreign

currency translation and a 1 percent ($344 million) contri-

bution from acquisitions, net of divestitures. The Network

Power, Process Management and Industrial Automa-

tion businesses drove sales growth, while the Appliance

and Tools and Climate Technologies businesses were

impacted by the U.S. consumer spending slowdown. The

underlying sales increase for scal 2008 was driven by an

international sales increase of more than 10 percent plus

a 3 percent increase in the United States. The interna-

tional sales increase primarily reects growth in Asia (17

percent), Latin America (18 percent), Middle East/Africa

(17 percent) and Europe (3 percent). The Company esti-

mates that the underlying sales growth of approximately

7 percent primarily reects an approximate 6 percent

gain from volume, aided by penetration gains, and an

approximate 1 percent impact from higher selling prices.

n United States n Asia

n Europe n Other

Emerson is a global business for which international sales

have grown over the years and now constitute 55 percent

of the Company’s total sales. The Company expects this

trend to continue due to faster economic growth in emerging

markets in Asia, Latin America and Middle East/Africa.

International destination sales, including U.S. exports,

decreased approximately 14 percent, to $11.6 billion

in 2009. U.S. exports of $1,290 million were down

16 percent compared with 2008, reecting declines in

Industrial Automation, Network Power, Climate Technol-

ogies and Process Management as these businesses were

impacted by lower volume and the stronger U.S. dollar.

International subsidiary sales, including shipments to

the United States, were $10.3 billion in 2009, down

14 percent from 2008. Excluding the 7 percent net unfa-

vorable impact from acquisitions and foreign currency

translation, international subsidiary sales decreased

7 percent compared with 2008. Underlying destination

sales declined 16 percent in Europe; 2 percent overall in

Asia, including 2 percent growth in China; 7 percent in

Latin America and 6 percent in Middle East/Africa.

International destination sales, including U.S. exports,

increased approximately 20 percent, to $13.5 billion in

2008, representing 54 percent of the Company’s total

sales. U.S. exports of $1,537 million were up 20 percent

compared with 2007, reecting strong growth in the

Network Power, Process Management and Climate

Technologies businesses, aided by the weaker U.S. dollar

as well as the benet from acquisitions. Underlying

destination sales grew 17 percent in Asia during the year,

driven mainly by 21 percent growth in China, while sales

grew 18 percent in Latin America, 17 percent in Middle

East/Africa and 3 percent in Europe. International subsid-

iary sales, including shipments to the United States, were

$12.0 billion in 2008, up 19 percent over 2007. Excluding

the 8 percent net favorable impact from acquisitions,

divestitures and foreign currency translation, interna-

tional subsidiary sales increased 11 percent compared

with 2007.

The Company acquired Roxar ASA, Trident Powercraft

Private Limited, System Plast S.p.A. and several smaller

businesses during 2009. Roxar supplies measure-

ment solutions and software for reservoir production

optimization, enhanced oil and gas recovery and ow

assurance. Trident Power manufactures and supplies

power generating alternators and associated products.

System Plast manufactures engineered modular belts and

custom conveyer components for food processing and

packaging industries. Total cash paid for these businesses

13%

21%

45%

21%

14%

29%

15%

17%

25%