Emerson 2009 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2009 Emerson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Emerson 200914

Other deductions, net were $530 million in 2009, a

$227 million increase from 2008 that primarily reects

$203 million of incremental rationalization expense.

The Company continuously makes investments in its

operations to improve efciency and remain competitive

on a global basis, and in 2009 incurred costs of

$295 million for actions to rationalize its businesses to

the level appropriate for current economic conditions

and improve its cost structure in preparation for the ulti-

mate economic recovery. The 2009 increase also includes

higher intangible asset amortization of $27 million due

to acquisitions, lower nonrecurring gains of $25 million

and other items. Gains in 2009 included the sale of an

asset for which the Company received $41 million and

recognized a gain of $25 million ($17 million after-tax).

See Notes 4 and 5 for further details regarding other

deductions, net and rationalization costs.

Other deductions, net of $303 million in 2008 represented

a $128 million increase from $175 million in 2007. The

increase in 2008 versus 2007 includes a $31 million

impairment charge related to the North American

appliance control business, higher intangible asset

amortization of $18 million due to acquisitions,

incremental rationalization expense of $17 million, a

$12 million charge for in-process research and develop-

ment in connection with the Embedded Computing

acquisition, $12 million of incremental foreign currency

transaction losses, lower one-time gains of $10 million

and other items. In 2008, the Company received

$54 million and recognized a gain of $39 million

($20 million after-tax) on the sale of its equity investment

in Industrial Motion Control Holdings, a manufacturer of

motion control components for automation equipment,

and also recorded a gain of $18 million related to the sale

of a facility.

Interest expense, net was $220 million, $188 million and

$228 million in 2009, 2008 and 2007, respectively. The

increase of $32 million in 2009 was due to lower interest

income, driven by lower worldwide interest rates, and

higher average long-term borrowings reecting a change

in debt mix. The $40 million decrease in interest expense

in 2008 was primarily due to lower interest rates and

lower average borrowings.

Income taxes were $693 million, $1,137 million and

$964 million for 2009, 2008 and 2007, respectively,

resulting in effective tax rates of 29 percent, 32 percent

and 31 percent. The lower effective tax rate in 2009

reects the Company recognizing a benet from a net

operating loss carryforward at a foreign subsidiary, a

credit related to the repatriation of certain non-U.S. earn-

ings, and a change in the mix of regional pretax income

as operating results declined signicantly in the United

States and Europe while declining only slightly in Asia.

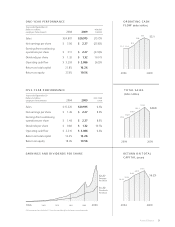

Earnings from continuing operations were $1.7 billion

for 2009, while earnings from continuing operations

per share were $2.27, decreases of 30 percent and

27 percent, respectively, compared with $2.5 billion and

$3.11 for 2008. The earnings decline is due to decreases

in all of the Company’s business segments and reects

lower sales volume, increased rationalization expense and

unfavorable product mix, partially offset by savings from

cost reduction actions and materials cost containment.

Earnings declined $373 million in Industrial Automation,

$238 million in Process Management, $227 million in

Network Power, $162 million in Appliance and Tools and

$154 million in Climate Technologies. Earnings per share

results reect the benet of share repurchases. See

the Business Segments discussion that follows for

additional information.

Earnings from continuing operations and earnings from

continuing operations per share for 2008 increased

15 percent and 17 percent, respectively, compared with

$2.1 billion and $2.65 for 2007, reecting increases in

four of the ve business segments, including $240 million

in Process Management, $149 million in Network Power

and $62 million in Industrial Automation. The increased

earnings reect leverage from higher sales, benets

realized from cost containment and higher selling prices,

partially offset by higher raw material and wage costs.

(dollars in billions)

Earnings from continuing operations were $1.7 billion in

2009, a 7 percent compound annual growth rate since 2004.

2004 2009

$1.2

$1.4

$1.8

$2.1

$2.5

$1.7