Electronic Arts 2008 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2008 Electronic Arts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.(6)

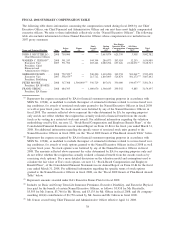

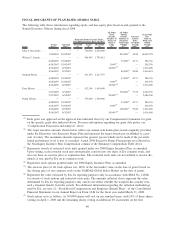

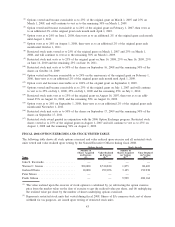

Includes (a) $2,000,000 forgiveness of a loan to Mr. Jenson; (b) $43,630 in imputed interest income on

the loan; (c) $26,648 paid on behalf of Mr. Jenson for relocation-related costs, including storage and ship-

ping of household goods; (d) $41,495 for the tax gross-up related to relocation costs incurred during and

prior to fiscal 2007; (e) $1,098 of term life insurance and disability premiums in fiscal 2007; and (f) com-

pany-matching 401(k) contributions of $13,200 earned by Mr. Jenson for fiscal 2007.

(7)

During fiscal 2008, Dr. Florin was on payroll in Geneva, Switzerland and paid in Swiss francs. The

amounts reflected in the Summary Compensation Table above (other than equity awards and Dr. Florin’s

fiscal 2008 bonus) were converted into U.S. dollars based on the exchange rates in effect on March 31,

2008.

(8)

Includes (a) $234,398 in company-paid relocation and international assignment expenses, of which

$191,626 was paid in the form of a housing allowance, $8,132 was related to language training, $25,640

related to dependent education, and $9,000 related to tax preparation assistance; (b) $135,556 in company-

matching defined contribution plan contributions; (c) $25,138 in automobile and fuel allowance received

by Dr. Florin for which all senior employees and members of management resident in Switzerland are

generally eligible; (d) $4,302 of company-paid medical and life insurance premiums and related benefits

and (e) tax gross-up of $101,667 for fiscal 2008.

(9)

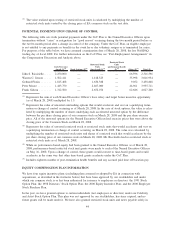

During fiscal 2007, Dr. Florin was on payroll in the United Kingdom from April 1, 2006 through

August 31, 2006, and on payroll in Geneva, Switzerland from September 1, 2006 through March 31,

2007. As such, Dr. Florin’s salary and other compensation (other than equity awards) were paid in either

British pounds or Swiss francs. The amounts reflected in the Summary Compensation Table above (other

than equity awards and Dr. Florin’s fiscal 2007 bonus) were converted into U.S. dollars based on exchange

rates in effect on March 31, 2007.

(10)

Includes (a) $383,022 in company-paid relocation and international assignment expenses, of which

$198,418 was paid in the form of a housing allowance, $49,118 paid as a one-time cash relocation allow-

ance, $45,997 related to storage and shipping of household goods, $25,693 related to temporary living

expenses, $24,846 related to dependent education, $12,260 related to tax preparation assistance, and the

remainder related to various other relocation-related expenses; (b) $80,865 in company-matching defined

contribution plan contributions; (c) $23,309 in automobile and fuel allowance received by Dr. Florin for

which all senior employees and members of management resident in the UK and Switzerland are generally

eligible; and (d) $13,976 of company-paid medical and life insurance premiums and related benefits for

fiscal 2007.

(11)

Represents hiring bonus of $1,500,000.

(12)

Includes (a) $139,390 for relocation-related costs, including costs of a househunting trip, temporary hous-

ing, home sale costs and storage and shipping of household goods; and (b) $46,917 for the tax gross-up

related to the relocation costs incurred during fiscal 2008. For more information regarding Mr. Moore’s

compensation, see “Compensation Discussion and Analysis” above.

39