Electronic Arts 2008 Annual Report Download - page 166

Download and view the complete annual report

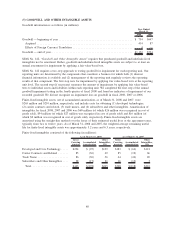

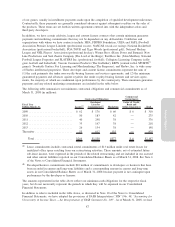

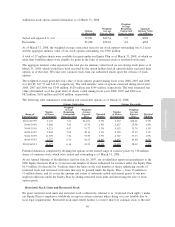

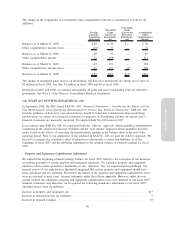

Please find page 166 of the 2008 Electronic Arts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.As of March 31, 2008, deferred tax assets, net, of $145 million were classified as current assets, $164 million

were classified as non-current assets and deferred tax liabilities, net, of $5 million were classified as current

liabilities, $5 million were classified as non-current liabilities. As of March 31, 2007, deferred tax assets, net,

of $84 million were classified as current assets, $25 million were classified as non-current assets and deferred

tax liabilities, net, of $8 million were classified as non-current liabilities.

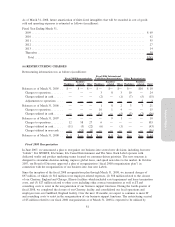

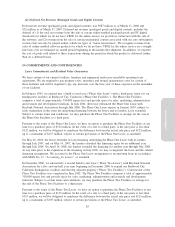

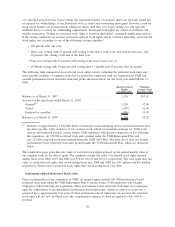

The net deferred tax asset valuation allowance was $22 million at March 29, 2008 and $5 million at March 31,

2007. Of the $22 million total valuation allowance, approximately $3 million is attributable to acquisition-

related assets, the benefit of which will reduce goodwill when and if realized. The valuation allowance

increased by $17 million in fiscal year 2008, primarily due to the loss on the impairment of our facility in

Chertsey, England.

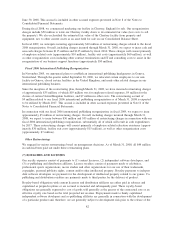

As of March 31, 2008, we have net operating loss (“NOL”) carryforwards attributable to various acquired

companies of approximately $149 million. These net operating loss carryforwards are subject to an annual

limitation under Internal Revenue Code Section 382, but are expected to be fully realized. The federal NOL if

not fully realized, will expire beginning 2026 through 2028. Furthermore, we have state net loss carryforwards

of approximately $328 million of which approximately $135 million is attributable to various acquired

companies. The state NOL if not fully realized, will expire beginning 2016 through 2018. We also have

U.S. federal and California tax credit carryforwards of $43 million and $66 million respectively. The U.S. tax

credit carryforwards will expire at various dates beginning in 2015 through 2028. The California tax credit

carryforwards can be carried forward indefinitely.

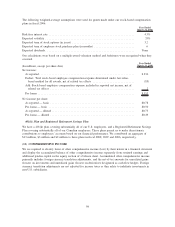

In the fourth quarter of fiscal 2006, we repatriated $375 million of foreign earnings to take advantage of the

favorable provisions of the American Jobs Creation Act (the “Jobs Act”). Under the Jobs Act, the qualifying

portion of this repatriation was eligible for a temporary 85 percent dividends received deduction on certain

foreign earnings. Accordingly, we recorded tax expense in fiscal 2006 of $17 million related to this

repatriation.

During fiscal 2006 we recognized a $73 million reduction in income taxes payable following a U.S. Tax Court

ruling regarding the proper allocation of the tax deduction for stock options between U.S. and foreign entities.

Although the Tax Court ruling remains subject to appeal, as a precedent, it is relevant to our situation.

Accordingly, we released a reserve of $73 million during fiscal 2006, whereby, we recorded a reduction to our

income tax payable and an increase to additional paid-in capital with no impact to net income.

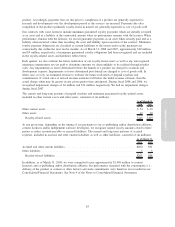

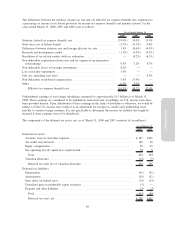

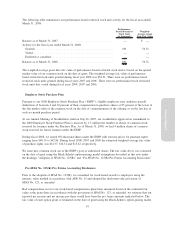

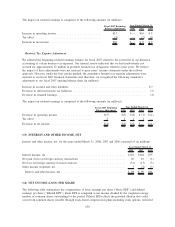

In February 2006, the FASB issued FIN No. 48 that clarifies the accounting and recognition for income tax

positions taken or expected to be taken in our tax returns. On May 2, 2007, the FASB issued FSP FIN 48-1,

“Definition of Settlement in FASB Interpretation No. 48”, which amended FIN No. 48 to provide guidance on

how an entity should determine whether a tax position is effectively settled for the purpose of recognizing

previously unrecognized tax benefits. We adopted FIN No. 48 and FSP FIN 48-1 on April 1, 2007, and

recognized the cumulative effect of a change in accounting principle by recognizing a decrease in the liability

for unrecognized tax benefits of $18 million, with a corresponding increase to beginning retained earnings. We

also recognized an additional decrease in the liability for unrecognized tax benefits of $14 million with a

corresponding increase in beginning paid-in capital related to the tax benefits of employee stock options. In

our second quarter of fiscal 2008, we increased the beginning retained earnings by approximately $1 million

to reflect an immaterial revision to the cumulative effect of the adoption of FIN No. 48.

90