Electronic Arts 2008 Annual Report Download - page 175

Download and view the complete annual report

Please find page 175 of the 2008 Electronic Arts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

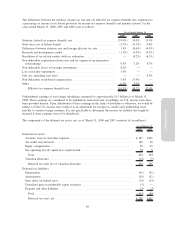

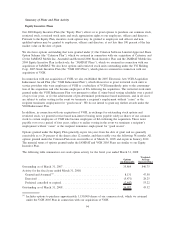

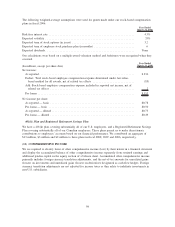

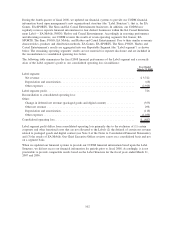

The change in the components of accumulated other comprehensive income is summarized as follows (in

millions):

Foreign

Currency

Translation

Adjustment

Unrealized

Gains

(Losses) on

Investments,

net

Unrealized

Gains

(Losses) on

Derivative

Instruments,

net

Accumulated

Other

Comprehensive

Income

Balances as of March 31, 2005 . . ............... $30 $ 26 $— $ 56

Other comprehensive income (loss) .............. (10) 37 — 27

Balances as of March 31, 2006 . . ............... 20 63 — 83

Other comprehensive income . . . ............... 23 188 — 211

Balances as of March 31, 2007 . . ............... 43 251 — 294

Other comprehensive income (loss) .............. 42 251 (3) 290

Balances as of March 31, 2008 . . ............... $85 $502 $ (3) $584

The change in unrealized gains (losses) on investments and derivative instruments are shown net of taxes of

$3 million in fiscal 2008, less than $1 million in fiscal 2007 and $0 in fiscal 2006.

During fiscal 2007 and 2006, we realized substantially all gains and losses outstanding from our derivative

instruments. See Note 3 of the Notes to Consolidated Financial Statements.

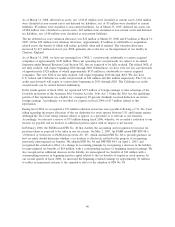

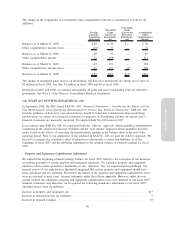

(14) STAFF ACCOUNTING BULLETIN No. 108

In September 2006, the SEC issued SAB No. 108, “Financial Statements — Considering the Effects of Prior

Year Misstatements when Quantifying Misstatements in Current Year Financial Statements”. SAB No. 108

provides guidance on how prior year misstatements should be taken into consideration when quantifying

misstatements in current year financial statements for purposes of determining whether the current year’s

financial statements are materially misstated. We adopted SAB No. 108 in fiscal 2007.

In accordance with SAB No. 108, we considered both the “rollover” approach, which quantifies misstatements

originating in the current year income statement and the “iron curtain” approach which quantifies misstate-

ments based on the effects of correcting the misstatements existing in the balance sheet at the end of the

reporting period. Prior to our application of the guidance in SAB No. 108, we used the rollover approach. We

elected to recognize the cumulative effect of adoption as adjustments to assets and liabilities as of the

beginning of fiscal 2007 and the offsetting adjustment to the opening balance of retained earnings for fiscal

2007.

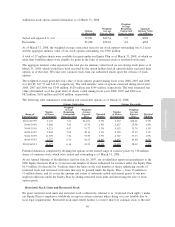

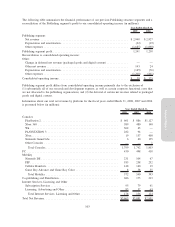

Property and Equipment Capitalization Adjustment

We adjusted the beginning retained earnings balance for fiscal 2007 related to the correction of our historical

accounting treatment of certain property and equipment purchases. We capitalize property and equipment

purchases when certain quantitative thresholds are met; otherwise, they are expensed when purchased. Our

internal review of our capitalization thresholds suggested that certain property and equipment should have

been capitalized and not expensed. We believe the impact of the property and equipment capitalization errors

were not material to prior years’ income statements under the rollover approach. However, under the iron

curtain method, the cumulative property and equipment capitalization errors were material to our fiscal 2007

financial statements and, therefore, we recognized the following cumulative adjustment to our fiscal 2007

opening balance sheet (in millions):

Increase in property and equipment, net ................................................. $13

Increase in deferred income tax liabilities ............................................... 3

Increase in retained earnings . ........................................................ 10

Annual Report

99