Electronic Arts 2008 Annual Report Download - page 151

Download and view the complete annual report

Please find page 151 of the 2008 Electronic Arts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

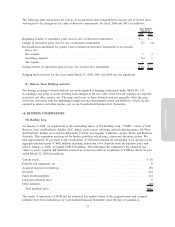

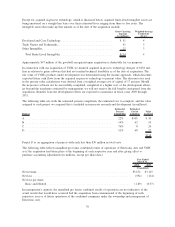

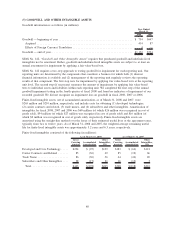

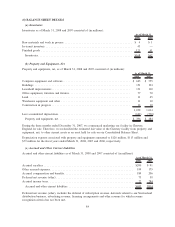

The following table summarizes the activity in accumulated other comprehensive income, net of related taxes,

with regard to the changes in fair value of derivative instruments, for fiscal 2008 and 2007 (in millions):

2008 2007

Year Ended

March 31,

Beginning balance of unrealized gains (losses), net, on derivative instruments .............. $— $—

Change in unrealized gains (losses), net, on derivative instruments ....................... (5) (4)

Reclassification adjustment for (gains) losses, realized on derivative instruments to net income

(loss), net:

Net revenue ............................................................. 3 3

Operating expenses ........................................................ (2) 1

Tax expense ............................................................. 1 —

Ending balance of unrealized gains (losses), net, on derivative instruments ................. $ (3) $—

Hedging ineffectiveness for the years ended March 31, 2008, 2007 and 2006 was not significant.

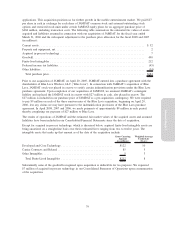

(b) Balance Sheet Hedging Activities

Our foreign exchange forward contracts are not designated as hedging instruments under SFAS No. 133.

Accordingly, any gains or losses resulting from changes in the fair value of the forward contracts are reported

in interest and other income, net. The gains and losses on these forward contracts generally offset the gains

and losses associated with the underlying foreign-currency-denominated assets and liabilities, which are also

reported in interest and other income, net, in our Consolidated Statements of Operations.

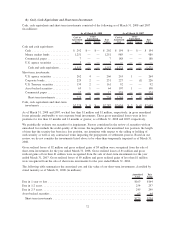

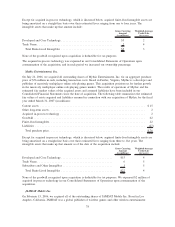

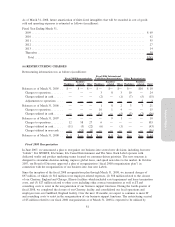

(4) BUSINESS COMBINATIONS

VG Holding Corp.

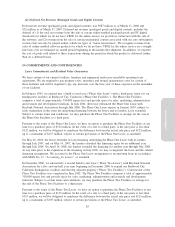

On January 4, 2008, we acquired all of the outstanding shares of VG Holding Corp. (“VGH”), owner of both

Bioware Corp. and Pandemic Studios, LLC, which create action, adventure and role-playing games. BioWare

and Pandemic Studios are located in Edmonton, Canada; Los Angeles, California; Austin, Texas; and Brisbane,

Australia. This acquisition positions us for further growth in role-playing, action and adventure genres. We

paid approximately $2 per share to the stockholders of VGH and assumed all outstanding stock options for an

aggregate purchase price of $682 million, including transaction costs. Separate from the purchase price and

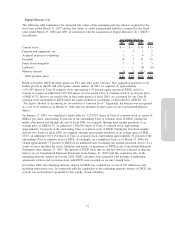

prior to January 4, 2008, we loaned VGH $30 million. The following table summarizes the estimated fair

values of assets acquired and liabilities assumed in connection with our acquisition of VGH for the fiscal year

ended March 31, 2008 (in millions):

Current assets ................................................................... $ 68

Property and equipment, net ........................................................ 8

Acquired in-process technology ...................................................... 138

Goodwill....................................................................... 414

Finite-lived intangibles ............................................................ 114

Long-term deferred taxes ........................................................... 9

Other liabilities .................................................................. (69)

Total purchase price............................................................. $682

The results of operations of VGH and the estimated fair market values of the acquired assets and assumed

liabilities have been included in our Consolidated Financial Statements since the date of acquisition.

Annual Report

75