Electronic Arts 2008 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2008 Electronic Arts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.facility, plus accrued interest, on the earlier of (a) 364 days from the date on which we initially borrow the

funds and (b) August 9, 2009. On May 19, 2008, we extended the expiration date of the tender offer until

June 16, 2008. We intend to pay for the Take-Two shares and related transaction fees and expenses with

internally available cash and borrowings under the term loan facility or other financing sources, which may be

available to us in the future.

The loan financing arrangements supporting our Redwood City headquarters leases with Keybank National

Association, described in the “Off-Balance Sheet Commitments” section below, are scheduled to expire in July

2009. At any time prior to the expiration of the financing in July 2009, we may re-negotiate the lease and the

related financing arrangement. Upon expiration of the leases, we may purchase the facilities for $247 million,

or arrange for a sale of the facilities to a third party. In the event of a sale to a third party, if the sale price is

less than $247 million, we will be obligated to reimburse the difference between the actual sale price and

$247 million, up to maximum of $222 million, subject to certain provisions of the leases.

As of March 31, 2008, approximately $1,357 million of our cash, cash equivalents, short-term investments and

marketable equity securities that was generated from operations was domiciled in foreign tax jurisdictions.

While we have no plans to repatriate these funds to the United States in the short term, if we choose to do so,

we would accrue and pay additional taxes on any portion of the repatriation where no United States income

tax had been previously provided.

We have a “shelf” registration statement on Form S-3 on file with the SEC. This shelf registration statement,

which includes a base prospectus, allows us at any time to offer any combination of securities described in the

prospectus in one or more offerings up to a total amount of $2 billion. Unless otherwise specified in a

prospectus supplement accompanying the base prospectus, we would use the net proceeds from the sale of any

securities offered pursuant to the shelf registration statement for general corporate purposes, including for

working capital, financing capital expenditures, research and development, marketing and distribution efforts

and, if opportunities arise, for acquisitions or strategic alliances. Pending such uses, we may invest the net

proceeds in interest-bearing securities. In addition, we may conduct concurrent or other financings at any time.

Our ability to maintain sufficient liquidity could be affected by various risks and uncertainties including, but

not limited to, those related to customer demand and acceptance of our products on new platforms and new

versions of our products on existing platforms, our ability to collect our accounts receivable as they become

due, successfully achieving our product release schedules and attaining our forecasted sales objectives, the

impact of acquisitions and other strategic transactions in which we may engage, the impact of competition,

economic conditions in the United States and abroad, the seasonal and cyclical nature of our business and

operating results, risks of product returns and the other risks described in the “Risk Factors” section, included

in Part I, Item 1A of this report.

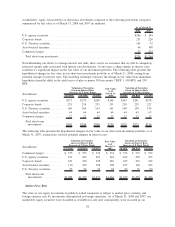

Contractual Obligations and Commercial Commitments

Development, Celebrity, League and Content Licenses: Payments and Commitments

The products we produce in our studios are designed and created by our employee designers, artists, software

programmers and by non-employee software developers (“independent artists” or “third-party developers”). We

typically advance development funds to the independent artists and third-party developers during development

of our games, usually in installment payments made upon the completion of specified development milestones.

Contractually, these payments are generally considered advances against subsequent royalties on the sales of

the products. These terms are set forth in written agreements entered into with the independent artists and

third-party developers.

In addition, we have certain celebrity, league and content license contracts that contain minimum guarantee

payments and marketing commitments that may not be dependent on any deliverables. Celebrities and

organizations with whom we have contracts include: FIFA, FIFPRO Foundation, UEFA and FAPL (Football

Association Premier League Limited) (professional soccer); NASCAR (stock car racing); National Basketball

Association (professional basketball); PGA TOUR and Tiger Woods (professional golf); National Hockey

League and NHL Players’ Association (professional hockey); Warner Bros. (Harry Potter and Batman); New

52