Electronic Arts 2008 Annual Report Download - page 180

Download and view the complete annual report

Please find page 180 of the 2008 Electronic Arts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

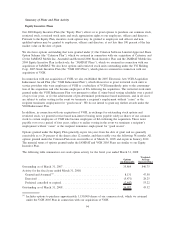

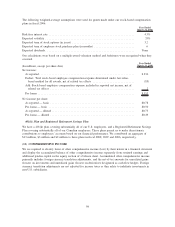

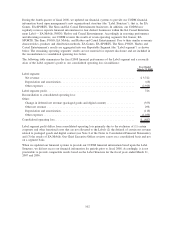

Information about our operations in North America, Europe and Asia as of and for the fiscal years ended

March 31, 2008, 2007 and 2006 is presented below (in millions): North

America Europe Asia Total

Year ended March 31, 2008

Net revenue from unaffiliated customers ........................ $1,942 $1,541 $182 $3,665

Long-lived assets ......................................... 1,630 173 10 1,813

Year ended March 31, 2007

Net revenue from unaffiliated customers ........................ $1,666 $1,261 $164 $3,091

Long-lived assets ......................................... 1,150 267 11 1,428

Year ended March 31, 2006

Net revenue from unaffiliated customers ........................ $1,584 $1,174 $193 $2,951

Long-lived assets ......................................... 1,061 203 7 1,271

Substantially all of our North America net revenue is generated in the United States.

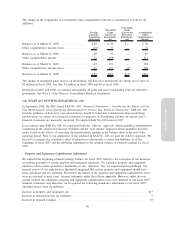

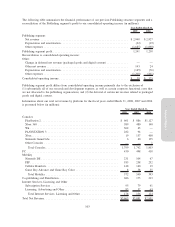

Our direct sales to GameStop Corp. represented approximately 13 percent and 12 percent of total net revenue

in fiscal 2008 and 2007, respectively. Our direct sales to Wal-Mart Stores, Inc. represented approximately

12 percent of total net revenue in fiscal 2008 and 13 percent of total revenue in both fiscal 2007 and 2006.

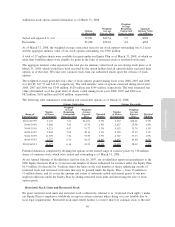

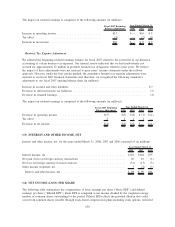

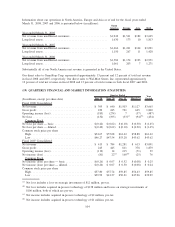

(19) QUARTERLY FINANCIAL AND MARKET INFORMATION (UNAUDITED)

(In millions, except per share data) June 30 Sept. 30 Dec. 31 March 31

Year

Ended

Quarter Ended

Fiscal 2008 Consolidated

Net revenue ................................... $ 395 $ 640 $1,503 $1,127 $3,665

Gross profit ................................... 229 245 721 665 1,860

Operating income (loss) .......................... (183) (274) 7 (37) (487)

Netloss...................................... (132) (195) (33)

(a)

(94)

(b)

(454)

Common Stock

Net loss per share — basic ........................ $(0.42) $(0.62) $(0.10) $(0.30) $(1.45)

Net loss per share — diluted ....................... $(0.42) $(0.62) $(0.10) $(0.30) $(1.45)

Common stock price per share

High....................................... $54.67 $57.08 $61.62 $58.88 $61.62

Low....................................... $46.27 $47.54 $53.28 $43.62 $43.62

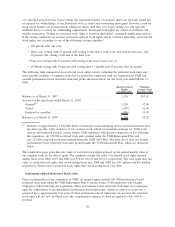

Fiscal 2007 Consolidated

Net revenue ................................... $ 413 $ 784 $1,281 $ 613 $3,091

Gross profit ................................... 245 445 811 378 1,879

Operating income (loss) .......................... (119) 14 215 (71) 39

Net income (loss) ............................... (81) 22

(c)

160

(d)

(25) 76

Common Stock

Net income (loss) per share — basic ................. $(0.26) $ 0.07 $ 0.52 $(0.08) $ 0.25

Net income (loss) per share — diluted ................ $(0.26) $ 0.07 $ 0.50 $(0.08) $ 0.24

Common stock price per share

High....................................... $57.80 $57.74 $59.85 $54.43 $59.85

Low....................................... $39.99 $41.37 $50.21 $47.96 $39.99

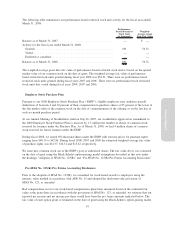

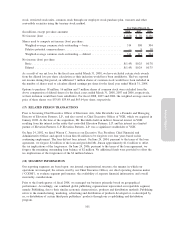

(a)

Net loss includes a loss on strategic investment of $12 million, pre-tax.

(b)

Net loss includes acquired in-process technology of $138 million and losses on strategic investments of

$106 million, both of which are pre-tax.

(c)

Net income includes acquired in-process technology of $2 million, pre-tax.

(d)

Net income includes acquired in-process technology of $1 million, pre-tax.

104