Dish Network 2008 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2008 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.DISH NETWORK CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - Continued

F-16

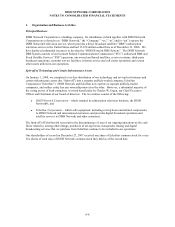

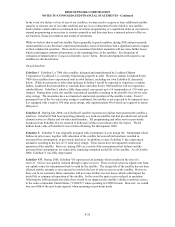

Research and Development Costs

Research and development costs are expensed as incurred. For the year ended December 31, 2008, we did not

incur any research and development costs. For the years ended December 31, 2007 and 2006, research and

development costs were $79 million and $57 million, respectively. The research and development costs

incurred in prior years related to the set-top box business and acquisition of Sling Media which were

distributed to EchoStar in connection with the Spin-off.

New Accounting Pronouncements

Revised Business Combinations

In December 2007, the Financial Accounting Standards Board (“FASB”) issued Statement of Financial

Accounting Standards No. 141R (revised 2007), “Business Combinations” (“SFAS 141R”). SFAS 141R

replaces SFAS 141 and establishes principles and requirements for how an acquirer recognizes and

measures in its financial statements the identifiable assets acquired, including goodwill, the liabilities

assumed and any non-controlling interest in the acquiree. SFAS 141R also establishes disclosure

requirements to enable users of the financial statements to evaluate the nature and financial effects of the

business combination. We expect SFAS 141R will have an impact on our consolidated financial

statements, but the character and magnitude of the specific effects will depend upon the type, terms and

size of the acquisitions we consummate after the effective date of January 1, 2009.

Noncontrolling Interests in Consolidated Financial Statements

In December 2007, the FASB issued Statement of Financial Accounting Standards No. 160,

“Noncontrolling Interests in Consolidated Financial Statements” (“SFAS 160”). SFAS 160 establishes

accounting and reporting standards for ownership interests in subsidiaries held by parties other than the

parent, the amount of consolidated net income attributable to the parent and to the noncontrolling interest,

changes in a parent’s ownership interest and the valuation of retained noncontrolling equity investments

when a subsidiary is deconsolidated. SFAS 160 also establishes reporting requirements for providing

sufficient disclosures that clearly identify and distinguish between the interests of the parent and the

interests of the noncontrolling owners. This standard is effective for fiscal years beginning after December

15, 2008. We do not expect the adoption of SFAS 160 to have a material impact on our financial position

or results of operations.

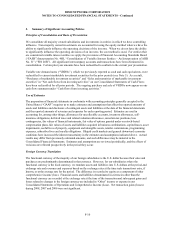

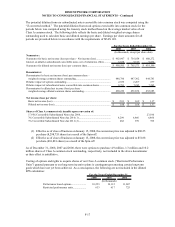

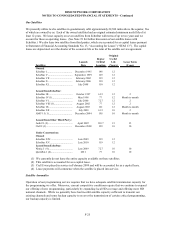

3. Basic and Diluted Net Income (Loss) Per Share

Statement of Financial Accounting Standards No. 128, “Earnings Per Share” (“SFAS 128”) requires

entities to present both basic earnings per share (“EPS”) and diluted EPS. Basic EPS excludes dilution and

is computed by dividing net income (loss) by the weighted-average number of common shares outstanding

for the period. Diluted EPS reflects the potential dilution that could occur if stock options were exercised

and convertible securities were converted to common stock.