Dish Network 2008 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2008 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS - Continued

58

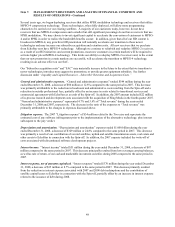

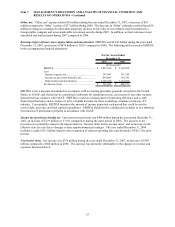

Interest on Long-Term Debt

We have semi-annual cash interest requirements for our outstanding long-term debt securities (see Note 9 in the Notes

to the Consolidated Financial Statements in Item 15 of this Annual Report on Form 10-K for details), as follows:

Annual

Semi-Annual Debt Service

Payment Dates Requirements

6 3/8% Senior Notes due 2011........................................... April 1 and October 1 63,750,000$

3 % Convertible Subordinated Notes due 2011................. June 30 and December 31 750,000$

6 5/8% Senior Notes due 2014........................................... April 1 and October 1 66,250,000$

7 1/8% Senior Notes due 2016........................................... February 1 and August 1 106,875,000$

7% Senior Notes due 2013................................................. April 1 and October 1 35,000,000$

7 3/4% Senior Notes due 2015........................................... May 31 and November 30 58,125,000$

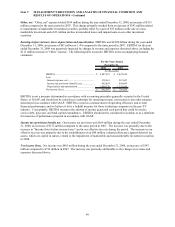

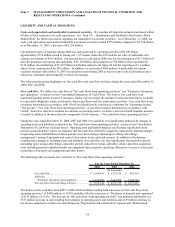

We also have periodic cash interest requirements for our outstanding capital lease obligations, mortgages and other

notes payable. Future cash interest requirements for all of our outstanding long-term debt as of December 31, 2008

are summarized as follows:

Total 2009 2010 2011 2012 2013 Thereafter

Long-term debt........................................ 1,943,786$ 330,500$ 330,000$ 330,000$ 266,250$ 266,250$ 420,786$

Capital lease obligations, mortgages

and other notes payable........................ 126,541 16,436 15,454 14,516 13,512 12,436 54,187

Total ....................................................... 2,070,327$ 346,936$ 345,454$ 344,516$ 279,762$ 278,686$ 474,973$

Payments due by period

(In thousands)

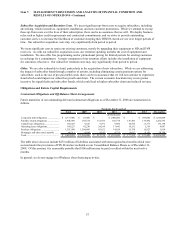

Satellite-Related Obligations

Satellites under Construction. As of December 31, 2008, we had entered into the following contracts to construct

new satellites which are contractually scheduled to be completed within the next two years. Future commitments

related to these satellites are included in the table above under “Satellite-related obligations” except where noted

below.

x EchoStar XIV. During 2007, we entered into a contract for the construction of EchoStar XIV, a DBS

satellite, which is expected to be completed during 2009.

x EchoStar XV. In April 2008, we entered into a contract for the construction of EchoStar XV, a DBS

satellite, which is expected to be completed during 2010.

Although the table above includes future commitments related to both the EchoStar XIV and EchoStar XV satellites

discussed above, it only includes the cost associated with one launch contract. These amounts will increase when

we contract for the launch of the second satellite.

In addition, we have agreed to lease capacity on two satellites from EchoStar which are currently under construction.

Future commitments related to these satellites are included in the table above under “Satellite-related obligations.”

x Nimiq 5. In March 2008, we entered into a transponder service agreement with EchoStar to lease capacity

on Nimiq 5, a DBS satellite, which is expected to be completed during 2009.

x QuetzSat-1. In November 2008, we entered into a transponder service agreement with EchoStar to lease

capacity on QuetzSat-1, a DBS satellite, which is expected to be completed during 2011.

In certain circumstances the dates on which we are obligated to make these payments could be delayed. These

amounts will increase to the extent we procure insurance for our satellites or contract for the construction, launch or

lease of additional satellites.