Dish Network 2008 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2008 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DISH NETWORK CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - Continued

F-40

14. Stock-Based Compensation

We account for our stock-based compensation in accordance with Statement of Financial Accounting

Standards No. 123R (As Amended), “Share-Based Payment” (“SFAS 123R”), which (i) revises Statement

of Financial Accounting Standards No. 123, “Accounting and Disclosure of Stock-Based Compensation,”

(“SFAS 123”) to eliminate both the disclosure only provisions of that statement and the alternative to

follow the intrinsic value method of accounting under Accounting Principles Board Opinion No. 25,

“Accounting for Stock Issued to Employees” (“APB 25”) and related interpretations, and (ii) requires the

cost resulting from all share-based payment transactions with employees be recognized in the results of

operations over the period during which an employee provides the requisite service in exchange for the

award and establishes fair value as the measurement basis of the cost of such transactions.

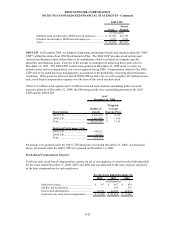

Stock Incentive Plans

In connection with the Spin-off, as provided in our existing stock incentive plans and consistent with the

Spin-off exchange ratio, each DISH Network stock option was converted into two stock options as follows:

x an adjusted DISH Network stock option for the same number of shares that were

exercisable under the original DISH Network stock option, with an exercise price equal

to the exercise price of the original DISH Network stock option multiplied by 0.831219.

x a new EchoStar stock option for one-fifth of the number of shares that were exercisable

under the original DISH Network stock option, with an exercise price equal to the

exercise price of the original DISH Network stock option multiplied by 0.843907.

Similarly, each holder of DISH Network restricted stock units retained his or her DISH Network restricted

stock units and received one EchoStar restricted stock unit for every five DISH Network restricted stock

units that they held.

Consequently, the fair value of the DISH Network stock award and the new EchoStar stock award

immediately following the Spin-off was equivalent to the fair value of such stock award immediately prior

to the Spin-off.

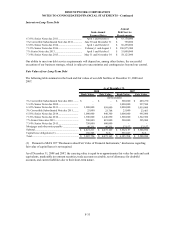

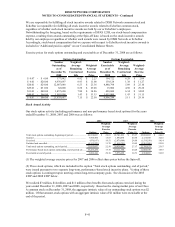

We maintain stock incentive plans to attract and retain officers, directors and key employees. Awards

under these plans include both performance and non-performance based equity incentives. As of

December 31, 2008, we had outstanding under these plans stock options to acquire 21.8 million shares of

our Class A common stock and 1.5 million restricted stock awards. Stock options granted through

December 31, 2008 were granted with exercise prices equal to or greater than the market value of our Class

A common stock at the date of grant and with a maximum term of ten years. While historically we have

issued stock options subject to vesting, typically at the rate of 20% per year, some stock options have been

granted with immediate vesting and other stock options vest only upon the achievement of certain

company-wide objectives. As of December 31, 2008, we had 57.5 million shares of our Class A common

stock available for future grant under our stock incentive plans.

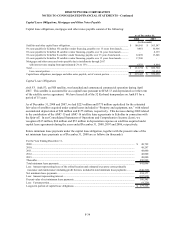

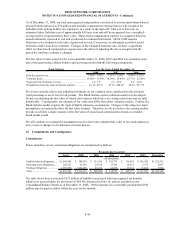

As of December 31, 2008, the following stock incentive awards were outstanding:

Stock Incentive Awards Outstanding

Stock

Options

Restricted

Stock

Units

Stock

Options

Restricted

Stock

Units

Held by DISH Network employees.......... 18,267,950 517,735 1,722,714 85,866

Held by EchoStar employees................... 3,567,737 934,999 N/A N/A

Total......................................................... 21,835,687 1,452,734 1,722,714 85,866

As of December 31, 2008

EchoStar AwardsDISH Network Awards