Dish Network 2008 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2008 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.DISH NETWORK CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - Continued

F-14

Accounting for Uncertainty in Income Taxes

We adopted the provisions of FASB Interpretation No. 48, “Accounting for Uncertainty in Income Taxes –

an Interpretation of FASB Statement No. 109” (“FIN 48”), on January 1, 2007. FIN 48 clarifies the

accounting for uncertainty in income taxes recognized in an enterprise’s financial statements in accordance

with SFAS 109 and prescribes a recognition threshold and measurement process for financial statement

recognition and measurement of a tax position taken or expected to be taken in a tax return. FIN 48 also

provides guidance on derecognition, classification, interest and penalties, accounting in interim periods,

disclosure and transition.

Fair Value of Financial Instruments

Fair values for our publicly traded debt securities are based on quoted market prices. The fair values of our

private debt is estimated based on an analysis in which we evaluate market conditions, related securities,

various public and private offerings, and other publicly available information. In performing this analysis,

we make various assumptions, among other things, regarding credit spreads, and the impact of these factors

on the value of the notes.

Deferred Debt Issuance Costs

Costs of issuing debt are generally deferred and amortized to interest expense over the terms of the respective

notes (Note 9).

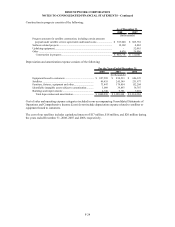

Revenue Recognition

We recognize revenue when an arrangement exists, prices are determinable, collectibility is reasonably

assured and the goods or services have been delivered. Revenue from our subscription television services

is recognized when programming is broadcast to subscribers. Programming payments received from

subscribers in advance of the broadcast or service period are recorded as “Deferred revenue and other” in

the Consolidated Balance Sheets until earned. For certain of our promotions relating to our receiver systems,

subscribers are charged an upfront fee. A portion of this fee may be deferred and recognized over 48 to 60

months, depending on whether the fee is received from existing or new subscribers. Revenue from

advertising sales is recognized when the related services are performed.

Subscriber fees for equipment rental, additional outlets and fees for receivers with multiple tuners, high

definition (“HD”) receivers, digital video recorders (“DVRs”), and HD DVRs, our DishHOME Protection

Plan and other services are recognized as revenue, monthly as earned. Revenue from equipment sales and

equipment upgrades are recognized upon shipment to customers.

Revenue from equipment sales to AT&T, Inc. (“AT&T”) pursuant to our original agreement with AT&T is

deferred and recognized over the estimated average co-branded subscriber life. Revenue from installation

and certain other services performed at the request of AT&T is recognized upon completion of the

services. Further, development and implementation fees received from AT&T will continue to be

recognized over the estimated average subscriber life of all subscribers acquired under both the original

and revised agreements with AT&T.

Accounting for certain of our existing and new subscriber promotions which include programming discounts

and subscriber rebates falls under the scope of EITF Issue No. 01-9, “Accounting for Consideration Given by

a Vendor to a Customer (Including a Reseller of the Vendor’s Capital Products)” (“EITF 01-9”). In

accordance with EITF 01-9, programming revenues under these promotions are recorded as earned at the

discounted monthly rate charged to the subscriber. See “Subscriber Acquisition Promotions” below for

discussion regarding the accounting for costs under these promotions.