Dick's Sporting Goods 2010 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2010 Dick's Sporting Goods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

13. Retirement Savings Plans

The Company’s retirement savings plan, established pursuant to Section 401(k) of the Internal Revenue Code, covers regular

status full-time hourly and salaried employees as of their date of hire and part-time regular employees that have worked

1,000 hours or more in a year and attained 21 years of age. Under the terms of the retirement savings plan, the Company may

make a discretionary matching contribution equal to a percentage of each participant’s contribution, up to 10% of the participant’s

compensation. The Company’s discretionary matching contribution percentage is typically 50%. Total expense recorded under the

plan was $5.5 million, $3.6 million and $4.1 million for fiscal 2010, 2009 and 2008, respectively.

We have non-qualified deferred compensation plans for highly compensated employees whose contributions are limited under

qualified defined contribution plans. Amounts contributed and deferred under the deferred compensation plans are credited or

charged with the performance of investment options offered under the plans and elected by the participants. In the event of

bankruptcy, the assets of these plans are available to satisfy the claims of general creditors. The liability for compensation

deferred under the Company’s plans was $18.6 million and $12.1 million at January 29, 2011 and January 30, 2010, respectively,

and is included with long-term liabilities on the Consolidated Balance Sheets. Total expense recorded under these plans was

$3.8 million, $0.6 million and $0.5 million for fiscal 2010, 2009 and 2008, respectively.

14. Commitments and Contingencies

The Company enters into licensing agreements for the exclusive or preferential rights to use certain trademarks extending

through 2020. Under specific agreements, the Company is obligated to pay annual guaranteed minimum royalties. The aggregate

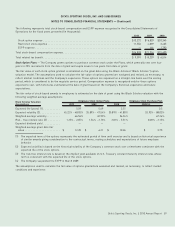

amount of required payments at January 29, 2011 is as follows (in thousands):

Fiscal Year

2011 . . . . . . . . . . . . . $12,115

2012 . . . . . . . . . . . . . 14,935

2013 . . . . . . . . . . . . . 16,658

2014 . . . . . . . . . . . . . 18,430

2015 . . . . . . . . . . . . . 5,257

Thereafter. . . . . . . . . . . . 24,175

$91,570

Also, the Company is required to pay additional royalties when the royalties that are based on the qualified purchases or retail

sales (depending on the agreement) exceed the guaranteed minimum. The aggregate payments made under these agreements

requiring minimum guaranteed contractual amounts were $11.4 million, $12.6 million and $9.7 million during fiscal 2010, 2009

and 2008, respectively.

The Company also has certain naming rights, marketing, and other commitments extending through 2026 of $140.5 million.

Payments under these commitments were $49.7 million during fiscal 2010. Payments under these commitments are scheduled to

be made as follows: fiscal 2011, $59.3 million; fiscal 2012, $36.9 million; fiscal 2013, $3.4 million; fiscal 2014, $3.6 million; fiscal

2015, $3.7 million; and thereafter, $33.6 million.

In December 2009, the Company entered into an asset assignment agreement with a related party. The Company made deposits

totaling $8 million in fiscal 2009 under the assigned purchase agreement. All deposits are attributed to the total purchase price of

$59.5 million, which is payable in increments through 2013. If the agreement is terminated prior to the delivery date, up to

$3.5 million of the deposits are non-refundable.

On January 28, 2011, the Company and attorneys for a group of plaintiffs filed a settlement agreement in the United States

District Court for the Western District of New York to settle Tamara Barrus, et al. v. Dick’s Sporting Goods, Inc. et al. and

22 related wage and hour class action lawsuits. The settlement, which is subject to court approval, covers wage and hour claims

under the laws of 36 states. Under the settlement, the total amount to be paid will depend on the number of claims that are

submitted by class members with a maximum settlement amount not to exceed $15 million plus interest and taxes. The

settlement and related fees resulted in a pre-tax charge during the fiscal fourth quarter of 2010 of approximately $10.8 million

Dick’s Sporting Goods, Inc. ¬2010 Annual Report 65

DICK’S SPORTING GOODS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)