Dick's Sporting Goods 2010 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2010 Dick's Sporting Goods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Pre-opening Expenses —Pre-opening expenses, which consist primarily of rent, marketing, payroll and recruiting costs, are

expensed as incurred.

Merger and Integration Costs — The Company recorded $10.1 million of merger and integration costs during 2009. These costs

relate to the integration of Chick’s operations and include duplicative administrative costs and management, advertising and

severance expenses associated with the conversions from Chick’s stores to Dick’s stores. The Company recorded $15.9 million of

merger and integration costs during 2008. These costs related to the integration of Golf Galaxy and Chick’s and included

duplicative administrative costs, severance and system conversion costs related to the operational consolidation of Golf Galaxy

and Chick’s with Dick’s pre-existing business. In addition, during 2008, the Company recorded $2.5 million in the provision for

income taxes reflecting the tax impact of non-deductible executive separation costs resulting from the departure of certain

executive officers of Golf Galaxy during July 2008.

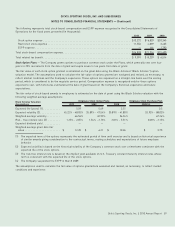

Earnings Per Share — Basic earnings per share is computed based on the weighted average number of shares of common stock

outstanding during the period. Diluted earnings per share is computed based on the weighted average number of shares of

common stock, plus the effect of dilutive potential common shares outstanding during the period, using the treasury stock

method. Dilutive potential common shares include outstanding stock options, restricted stock and warrants.

Stock-Based Compensation — The Company has the ability to grant restricted shares of common stock and stock options to

purchase common stock under the Dick’s Sporting Goods, Inc. Amended and Restated 2002 Stock and Incentive Plan and the Golf

Galaxy, Inc. 2004 Incentive Plan (the “Plans”). The Company also has an employee stock purchase plan (“ESPP”) that provides for

eligible employees to purchase shares of the Company’s common stock (see Note 9).

Income Taxes — The Company utilizes the asset and liability method of accounting for income taxes and provides deferred income

taxes for temporary differences between the amounts reported for assets and liabilities for financial statement purposes and for

income tax reporting purposes, using enacted tax rates in effect in the years in which the differences are expected to reverse.

Revenue Recognition — Revenue from retail sales is recognized at the point of sale, net of sales tax. Revenue from e-commerce

sales is recognized upon shipment of merchandise and any service related revenue is recognized primarily as the services are

performed. A provision for anticipated merchandise returns is provided through a reduction of sales and cost of goods sold in the

period that the related sales are recorded. Revenue from gift cards and returned merchandise credits (collectively the “cards”) are

deferred and recognized upon the redemption of the cards. These cards have no expiration date. Income from unredeemed cards

is recognized in the Consolidated Statements of Operations in selling, general and administrative expenses at the point at which

redemption becomes remote. The Company performs an evaluation of the aging of the unredeemed cards, based on the elapsed

time from the date of original issuance, to determine when redemption is remote.

Cost of Goods Sold — Cost of goods sold includes the cost of merchandise, inventory shrinkage and obsolescence, freight,

distribution and store occupancy costs. Occupancy costs include rent, common area maintenance charges, real estate and other

asset based taxes, general maintenance, utilities, depreciation, fixture lease expenses and certain insurance expenses.

Selling, General and Administrative Expenses — Selling, general and administrative expenses include store and field support

payroll and fringe benefits, advertising, bank card charges, information systems, marketing, legal, accounting, other store

expenses and all expenses associated with operating the Company’s corporate headquarters.

Advertising Costs — Production costs of advertising and the costs to run the advertisements are expensed the first time the

advertisement takes place. Advertising expense, net of cooperative advertising, was $185.2 million, $160.1 million and $154.3 million

for fiscal 2010, 2009 and 2008, respectively.

Vendor Allowances — Vendor allowances include allowances, rebates and cooperative advertising funds received from vendors.

These funds are determined for each fiscal year and the majority are based on various quantitative contract terms. Amounts

expected to be received from vendors relating to the purchase of merchandise inventories are recognized as a reduction of cost of

goods sold as the merchandise is sold. Amounts that represent a reimbursement of costs incurred, such as advertising, are

recorded as a reduction to the related expense in the period that the related expense is incurred. The Company records an

estimate of earned allowances based on the latest projected purchase volumes and advertising forecasts. On an annual basis at

the end of the fiscal year, the Company confirms earned allowances with vendors to determine that the amounts are recorded in

accordance with the terms of the contract.

52 Dick’s Sporting Goods, Inc. ¬2010 Annual Report

DICK’S SPORTING GOODS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS —(Continued)