Dick's Sporting Goods 2010 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2010 Dick's Sporting Goods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

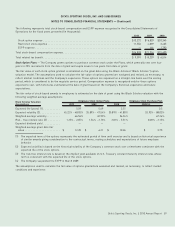

The following represents total stock-based compensation and ESPP expense recognized in the Consolidated Statements of

Operations for the fiscal years presented (in thousands):

2010 2009 2008

Stock option expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $13,272 $16,829 $20,345

Restricted stock expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11,556 4,039 3,465

ESPP expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — 446 1,790

Total stock-based compensation expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $24,828 $21,314 $25,600

Total related tax benefit. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 9,591 $ 8,239 $ 6,514

Stock Option Plans — The Company grants options to purchase common stock under the Plans, which generally vest over four

years in 25% increments from the date of grant and expire seven to ten years from date of grant.

The fair value of each stock option granted is estimated on the grant date using the Black-Scholes (“Black Scholes”) option

valuation model. The assumptions used to calculate the fair value of options granted are evaluated and revised, as necessary, to

reflect market conditions and the Company’s experience. These options are expensed on a straight-line basis over the vesting

period, which is considered to be the requisite service period. Compensation expense is recognized only for those options

expected to vest, with forfeitures estimated at the date of grant based on the Company’s historical experience and future

expectations.

The fair value of stock-based awards to employees is estimated on the date of grant using the Black Scholes valuation with the

following weighted average assumptions:

Black Scholes Valuation

Assumptions 2010 2009 2008 2008 (4)

Employee Stock Option Plans Employee Stock Purchase Plan

Expected life (years) (1) . . . . . . . . . . . 5.59 5.69 5.51 0.5

Expected volatility (2) . . . . . . . . . . . . . 45.22% - 48.03% 35.89% - 47.54% 35.89% - 41.80% 53.93% - 88.03%

Weighted average volatility . . . . . . . . . 46.56% 45.93% 36.34% 67.26%

Risk - free interest rate (3) . . . . . . . . 1.23% - 2.87% 1.54% - 2.73% 2.01% - 3.51% 0.28% - 2.13%

Expected dividend yield . . . . . . . . . . . — — — —

Weighted average grant date fair

value . . . . . . . . . . . . . . . . . . . . . . . $ 12.20 $ 6.21 $ 10.26 $ 3.75

(1) The expected term of the options represents the estimated period of time until exercise and is based on historical experience

of similar awards giving consideration to the contractual terms, vesting schedules and expectations of future employee

behavior.

(2) Expected volatility is based on the historical volatility of the Company’s common stock over a timeframe consistent with the

expected life of the stock options.

(3) The risk-free interest rate is based on the implied yield available on U.S. Treasury constant maturity interest rates whose

term is consistent with the expected life of the stock options.

(4) The Company suspended the ESPP in March 2009.

The assumptions used to calculate the fair value of options granted are evaluated and revised, as necessary, to reflect market

conditions and experience.

Dick’s Sporting Goods, Inc. ¬2010 Annual Report 59

DICK’S SPORTING GOODS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)