Dick's Sporting Goods 2010 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2010 Dick's Sporting Goods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

On March 16, 2010, the Company granted 672,336 shares of restricted stock as a special one-time award in support of the

Company’s long-term strategic initiatives. These grants vest, in whole or in part, at the end of a three year period upon the

successful achievement of pre-established performance criteria.

Employee Stock Purchase Plan — The Company has an employee stock purchase plan, which provides that eligible employees may

purchase shares of the Company’s common stock. There are two offering periods in a fiscal year, one ending on June 30 and the

other on December 31, or as otherwise determined by the Company’s compensation committee. The employee’s purchase price is

85% of the lesser of the fair market value of the stock on the first business day or the last business day of the semi-annual

offering period. Employees may purchase shares having a fair market value of up to $25,000 for all purchases ending within the

same calendar year. The total number of shares issuable under the plan is 4,620,000. The Company issued 99,999 shares under

the plan during fiscal 2009. The Company suspended the ESPP in March 2009, such that its employees were not permitted to

purchase shares under the plan subsequent to the period ended June 30, 2009. The fiscal 2009 shares were issued at an average

price of $11.99.

Common Stock, Class B Common Stock and Preferred Stock — During fiscal 2004, the Company filed an amendment to its

Amended and Restated Certificate of Incorporation to increase the number of authorized shares of our common stock, par value

$0.01 per share, from 100,000,000 to 200,000,000 and Class B common stock, par value $0.01 per share, from 20,000,000 to

40,000,000. In addition, the Company’s Amended and Restated Certificate of Incorporation authorizes the issuance of up to

5,000,000 shares of preferred stock.

Holders of common stock generally have rights identical to holders of Class B common stock, except that holders of common

stock are entitled to one vote per share and holders of Class B common stock are entitled to ten votes per share. A related party

and relatives of the related party hold all of the Class B common stock. These shares can only be held by members of this group

and are not publicly tradable. Each share of Class B common stock can be converted into one share of common stock at the

holder’s option at any time.

10. Income Taxes

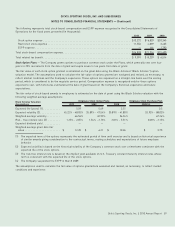

The components of the provision for income taxes are as follows (in thousands):

2010 2009 2008

Current:

Federal . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 79,931 $65,424 $ 86,091

State . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17,498 13,242 13,501

97,429 78,666 99,592

Deferred:

Federal . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18,910 8,202 (42,105)

State . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (905) 949 (3,801)

18,005 9,151 (45,906)

Total provision . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $115,434 $87,817 $ 53,686

The provision for income taxes differs from the amounts computed by applying the federal statutory rate as follows for the

following periods:

2010 2009 2008

Federal statutory rate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 35.0% 35.0% 35.0%

State tax, net of federal benefit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3.8% 4.7% 3.7%

Non-deductible compensation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — — 20.2%

Goodwill impairment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — — 328.2%

Other permanent items . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — (0.4)% 1.3%

Effective income tax rate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 38.8% 39.3% 388.4%

62 Dick’s Sporting Goods, Inc. ¬2010 Annual Report

DICK’S SPORTING GOODS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)