Dell 2002 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2002 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

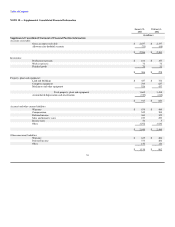

property, buildings and equipment (collectively referred to as the "Properties") to be constructed or acquired. Rent obligations for the Properties commence on

various dates. At January 31, 2003, approximately $640 million of the combined facilities had been utilized. In January 2003, the FASB issued FIN 46 that

will impact Dell's accounting for these lease facilities (see Note 1 — Description of Business and Summary of Significant Accounting Policies for additional

discussion).

The leases have initial terms of five and seven years. Those with an initial term of five years contain an option to renew for two successive years, subject to

certain conditions. The leases expire between fiscal 2004 and 2008. The Company may, at its option, purchase the Properties during or at the end of the lease

term for 100% of the then outstanding amounts expended by the lessor to build, construct or acquire the Properties (approximately $640 million at January 31,

2003). Pursuant to the terms of the agreements associated with such leases, the Company guarantees a residual value for the properties (of up to

approximately $544 million at January 31, 2003), which must be paid to the lessor if the Company does not exercise its purchase option or renew the lease.

The Company periodically records an expense that over the lease term approximates the difference between the estimated fair value of the Properties at lease

expiration and the residual value guarantee. As of January 31, 2003 and February 1, 2002, the Company had accrued approximately $110 million and $78

million of such expenses, respectively. The leases are classified as operating leases, and therefore, the leased assets and obligations (other than the

aforementioned $110 million and $78 million) are not reflected on the accompanying Consolidated Statement of Financial Position.

Future minimum lease payments under these leases (excluding residual value guarantees) as of January 31, 2003 are as follows: $2 million in fiscal 2004; $2

million in fiscal 2005; $1 million in fiscal 2006; and $1 million thereafter. Residual value guarantees of up to $161 million, $306 million and $77 million are

due in fiscal 2004, 2006 and 2008, respectively.

As part of the above lease transactions, the Company restricted $94 million and $90 million of its investment securities as collateral for specified lessor

obligations under the leases as of January 31, 2003 and February 1, 2002. These investment securities are restricted as to withdrawal and are managed by third

parties subject to certain limitations under the Company's investment policy. In addition, the Company must meet certain financial covenant requirements

related to interest coverage, net debt to capitalization, and consolidated tangible net worth as defined by the underlying agreements. The tangible net worth

financial covenant requires that the Company's Tangible Net Worth, as defined, not be less than $1 billion. The Company was in compliance with all financial

covenants in fiscal 2003, 2002, and 2001.

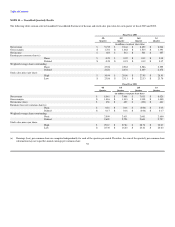

The Company leases other property and equipment, manufacturing facilities and office space under non-cancelable leases. Certain leases obligate the

Company to pay taxes, maintenance and repair costs. Future minimum lease payments under all non-cancelable leases (excluding the master lease facilities

described above) as of January 31, 2003 are as follows: $45 million in fiscal 2004; $35 million in fiscal 2005; $21 million in fiscal 2006; $15 million in fiscal

2007; $14 million in fiscal 2008; and $44 million thereafter. Rent expense under all leases totaled $96 million, $93 million, and $95 million for fiscal 2003,

2002 and 2001, respectively.

47