Dell 2002 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2002 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

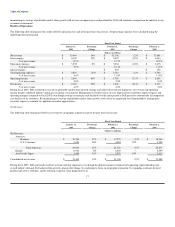

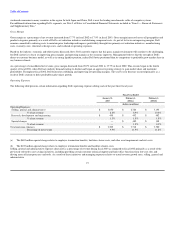

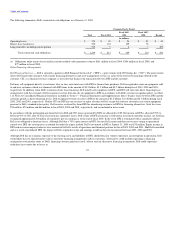

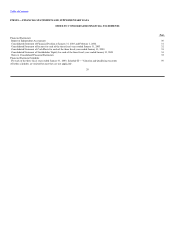

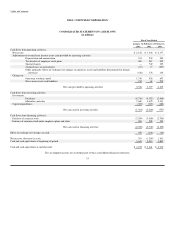

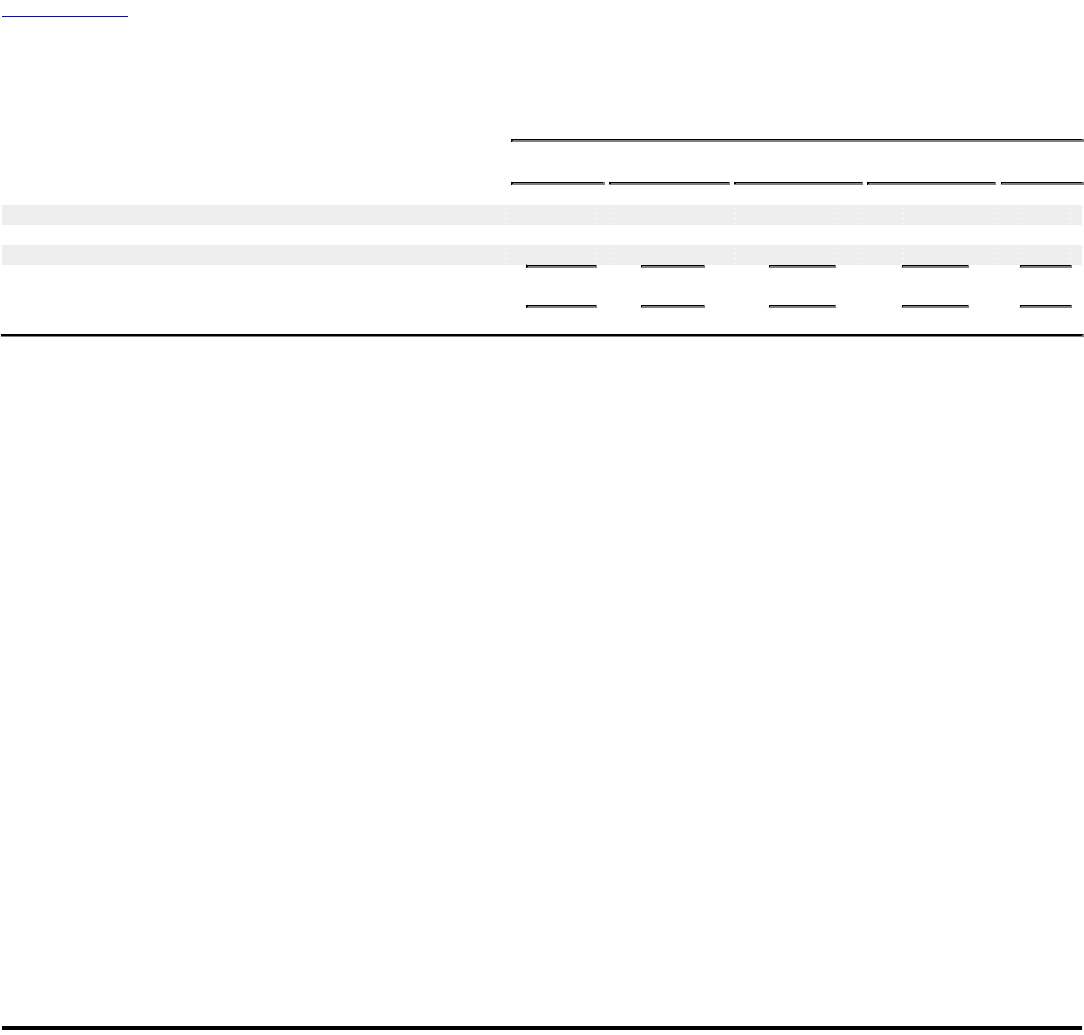

The following summarizes Dell's contractual cash obligations as of January 31, 2003.

Payments Due by Period

Fiscal 2005- Fiscal 2007-

Total Fiscal 2004 2006 2008 Beyond

(in millions)

Operating leases $ 174 $ 45 $ 56 $ 29 $ 44

Master lease facilities(a) 550 163 309 78 —

Long-term debt, including current portion 515 9 4 3 499

Total contractual cash obligations $ 1,239 $ 217 $ 369 $ 110 $ 543

(a) Obligations under master lease facilities include residual value guarantees of up to $161 million in fiscal 2004, $306 million in fiscal 2006, and

$77 million in fiscal 2008.

Other Financing Arrangements

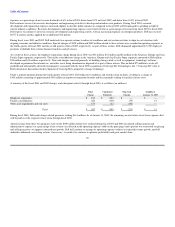

Dell Financial Services — Dell is currently a partner in Dell Financial Services L.P. ("DFS"), a joint venture with CIT Group, Inc. ("CIT"). The joint venture

allows Dell to provide customers with various financing alternatives and asset management services as a part of the total service package offered to the

customer. CIT, as a financial services company, is the entity that finances the transaction between DFS and the customer.

Dell may sell equipment directly to customers who, in turn, enter into loans with DFS to finance their purchases. Dell recognized revenue on equipment sold

to end-user customers which was financed with DFS loans in the amount of $2.3 billion, $1.3 billion and $0.7 billion during fiscal 2003, 2002 and 2001,

respectively. In addition, when Dell's customers desire lease financing, Dell usually sells equipment to DFS, and DFS will enter into direct financing lease

arrangements with the customers. Dell recognizes revenue from the sale of equipment to DFS in accordance with Dell's revenue recognition policy (see Note

1 of Notes to Consolidated Financial Statements included in "Item 8 — Financial Statements and Supplementary Data") because leases between DFS and the

customer qualify as direct financing leases. Dell recognized revenue on sales to DFS in the amount of $1.2 billion, $1.4 billion and $1.8 billion during fiscal

2003, 2002 and 2001, respectively. Neither CIT nor DFS has any recourse or rights of return to Dell, except that end-user customers may return equipment

pursuant to Dell's standard return policy. Dell receives a referral fee from DFS for introducing customers to DFS for financing alternatives. Such fees were

$70 million, $70 million and $66 million in fiscal 2003, 2002 and 2001, respectively, and are included in net revenue.

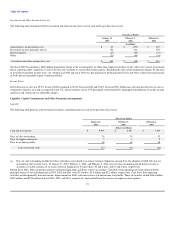

In accordance with the partnership agreement between Dell and CIT, losses generated by DFS are allocated to CIT. Net income in DFS is allocated 70% to

Dell and 30% to CIT, after CIT has recovered any cumulative losses. Dell's share of DFS net income is reflected in investment and other income, net. Dell has

recognized approximately $4 million of cumulative pre-tax earnings as of the end of fiscal 2003. In the event DFS is terminated with a cumulative deficit,

Dell is not obligated to fund any losses. Although Dell has a 70% equity interest in DFS, because Dell cannot and does not exercise voting or operational

control over DFS, the investment is accounted for under the equity method. Dell's investment in DFS at January 31, 2003 was $35 million. Equity income in

DFS and any intercompany balances were immaterial to Dell's results of operations and financial position for fiscal 2003, 2002 and 2001. Had Dell controlled

and as a result consolidated DFS, the impact to Dell's reported revenue and earnings would not have been material for fiscal 2003, 2002 and 2001.

Although Dell has no economic exposure to the existing assets and liabilities of DFS, should the joint venture experience an interruption in operations, Dell

would likely have to find alternative sources for future financing arrangements with its customers. Alternatives could include negotiating a financing

arrangement with another entity or Dell's financing customer purchases itself. Absent such an alternative financing arrangement, Dell could experience

reductions in revenues due to losses in

24