Dell 2002 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2002 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

with these in-transit customer shipments in other current assets in the accompanying Consolidated Statement of Financial Position until they are delivered and

revenue is recognized.

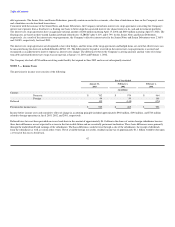

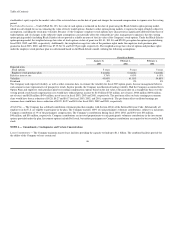

Warranty — The Company records warranty liabilities for the estimated costs that may be incurred under its basic limited warranty as well as under

separately priced extended warranty and service contracts for which the Company is obligated to perform. These liabilities are accrued at the time product

revenue is recognized. These costs primarily include technical support, as well as parts and labor associated with service dispatches. Factors that affect the

Company's warranty liability include the number of installed units, historical and anticipated rate of warranty claims on those units and cost per claim to

satisfy the Company's warranty obligation. As these factors are impacted by actual experience and future expectations, the Company assesses the adequacy of

its recorded warranty liabilities and adjusts the amounts as necessary.

Shipping Costs — The Company's shipping and handling costs are included in cost of sales for all periods presented.

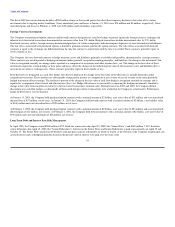

Advertising Costs — Advertising costs are charged to expense as incurred. Advertising expenses for fiscal years 2003, 2002, and 2001, were $426 million,

$361 million, and $431 million, respectively.

Website Development Costs — The Company expenses the costs of maintenance and minor enhancements to the features and functionality of its websites.

Income Taxes — Deferred tax assets and liabilities are recorded based on the difference between the financial statement and tax basis of assets and liabilities

using enacted tax rates in effect for the year in which the differences are expected to reverse.

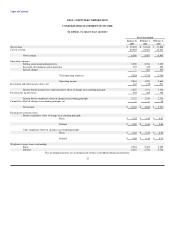

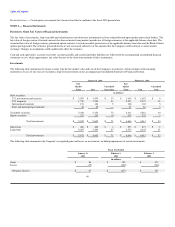

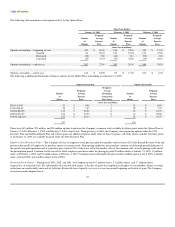

Earnings Per Common Share, Including Pro Forma Effects of Stock-Based Compensation — Basic earnings per share is based on the weighted effect of all

common shares issued and outstanding, and is calculated by dividing net income by the weighted average shares outstanding during the period. Diluted

earnings per share is calculated by dividing net income by the weighted average number of common shares used in the basic earnings per share calculation

plus the number of common shares that would be issued assuming exercise or conversion of all potentially dilutive common shares outstanding.

At January 31, 2003, the Company has three stock-based employee compensation plans, which are described more fully in Note 5. The Company applies the

recognition and measurement principles of APB Opinion No. 25, Accounting for Stock Issued to Employees, and related Interpretations in accounting for

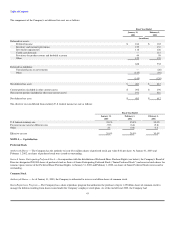

those plans. The following table sets forth the computation of basic and diluted earnings per share for each of the past three fiscal years and illustrates the

effect on net income and earnings per share if the Company had applied the fair value recognition provisions of SFAS No. 123, Accounting for Stock-Based

Compensation, to stock-based employee compensation.

37