Dell 2002 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2002 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

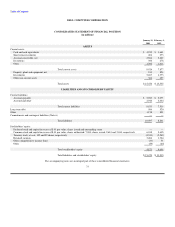

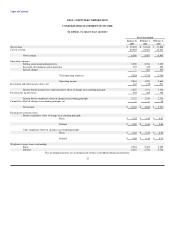

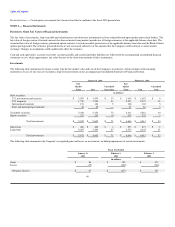

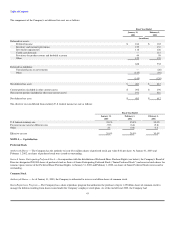

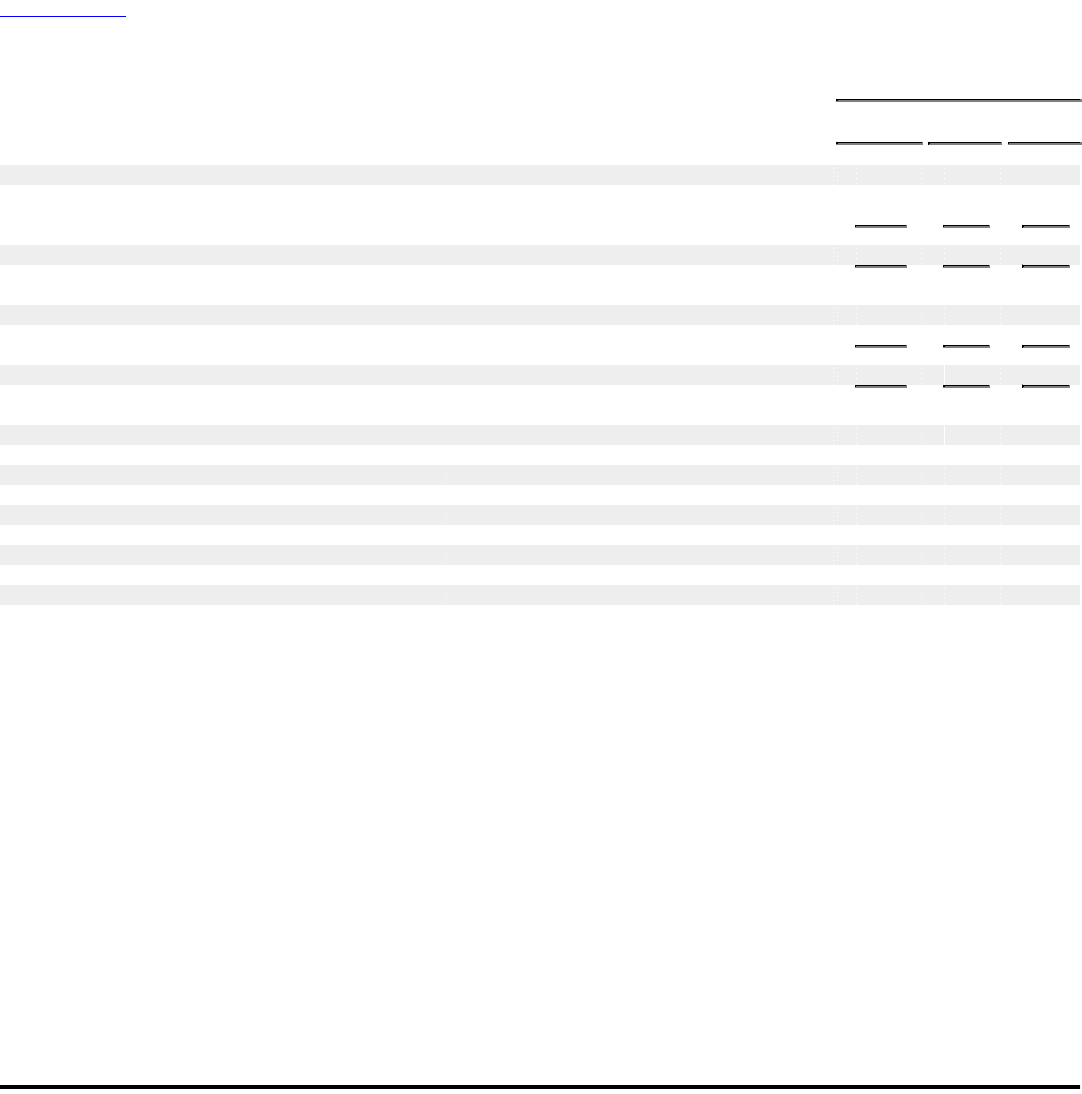

Fiscal Year Ended

January 31, February 1, February 2,

2003 2002 2001

(in millions, except per share amounts)

Net income — as reported $ 2,122 $ 1,246 $ 2,177

Deduct: Total stock-based employee compensation determined under fair value method for all awards, net of related tax

effects (723) (694) (434)

Net income — pro forma $ 1,399 $ 552 $ 1,743

Weighted average shares outstanding:

Basic 2,584 2,602 2,582

Employee stock options and other 60 124 164

Diluted 2,644 2,726 2,746

Earnings per common share:

Before cumulative effect of change in accounting principle

Basic — as reported $ 0.82 $ 0.48 $ 0.87

Basic — pro forma $ 0.54 $ 0.21 $ 0.70

Diluted — as reported $ 0.80 $ 0.46 $ 0.81

Diluted — pro forma $ 0.51 $ 0.19 $ 0.65

After cumulative effect of change in accounting principle

Basic — as reported $ 0.82 $ 0.48 $ 0.84

Basic — pro forma $ 0.54 $ 0.21 $ 0.67

Diluted — as reported $ 0.80 $ 0.46 $ 0.79

Diluted — pro forma $ 0.51 $ 0.19 $ 0.63

The pro forma earnings per share information is estimated using the Black-Scholes option pricing model (see Note 5 for additional information on fair value

disclosures) which in management's opinion does not provide a reliable measure of fair value of the Company's employee stock options. For example, in fiscal

2001 the Company granted 154 million stock options at an average exercise price of $37.78 that had an average Black-Scholes estimated fair value of $20.98.

While the disclosures above reflect a current period after-tax impact to pro forma net income of approximately $300 million related to the fiscal 2001 grants,

remaining outstanding options from fiscal 2001 are roughly $10.00 out of the money (implying little or no current fair value) at current market prices.

Equity instruments for 192 million, 232 million and 145 million shares in fiscal 2003, 2002 and 2001, respectively, were not included in the computation of

diluted weighted average shares outstanding because the effect of such instruments was antidilutive.

Comprehensive Income — The Company's comprehensive income is comprised of net income, foreign currency translation adjustments, and unrealized gains

(losses) on derivative financial instruments related to foreign currency hedging, and unrealized gains (losses) on marketable securities classified as available-

for-sale.

Recently Issued Accounting Pronouncements — In June 2002, the Financial Accounting Standards Board issued Statement of Financial Accounting Standard

("SFAS") No. 146, Accounting for Costs Associated with Exit or Disposal Activities. SFAS No. 146 provides guidance on the accounting for recognizing,

measuring and reporting of costs associated with exit and disposal activities, including restructuring activities. SFAS No. 146 adjusts the timing of when a

liability for termination benefits is to be recognized based on whether the employee is required to render future service. A liability for costs to terminate an

operating lease or other contract before the end of its term is to be recognized when the entity terminates the contract or ceases using the rights conveyed by

the contract. All

38