Dell 2002 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2002 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

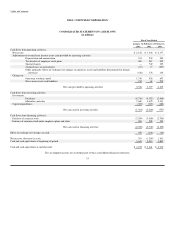

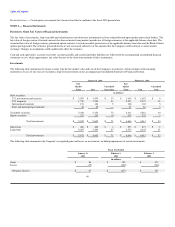

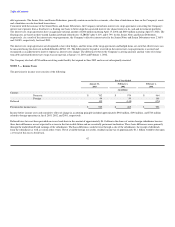

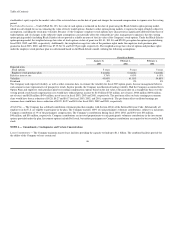

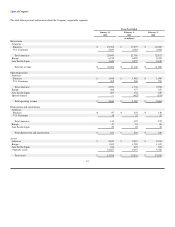

The components of the Company's net deferred tax asset are as follows:

Fiscal Year Ended

January 31, February 1,

2003 2002

(in millions)

Deferred tax assets:

Deferred income $ 186 $ 165

Inventory and warranty provisions 155 133

Investment impairments 118 126

Credit carryforwards — 115

Provisions for product returns and doubtful accounts 44 58

Other 125 135

628 732

Deferred tax liabilities:

Unrealized gains on investments — (26)

Other (145) (94)

(145) (120)

Net deferred tax asset $ 483 $ 612

Current portion (included in other current assets) $ 292 $ 196

Non-current portion (included in other non-current assets) 191 416

Net deferred tax asset $ 483 $ 612

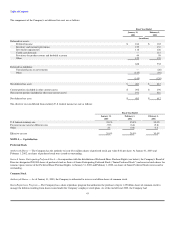

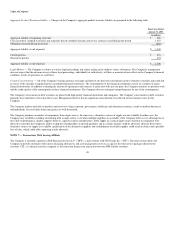

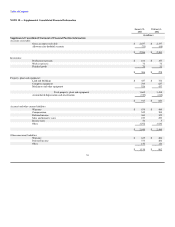

The effective tax rate differed from statutory U.S. federal income tax rate as follows:

Fiscal Year Ended

January 31, February 1, February 2,

2003 2002 2001

U.S. federal statutory rate 35.0% 35.0% 35.0%

Foreign income taxed at different rates (7.9) (6.6) (5.8)

Other 2.8 (0.4) 0.8

Effective tax rate 29.9% 28.0% 30.0%

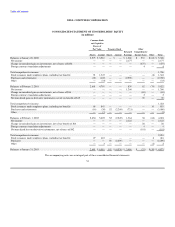

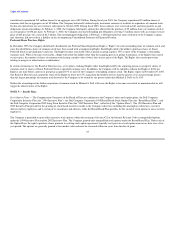

NOTE 4 — Capitalization

Preferred Stock

Authorized Shares — The Company has the authority to issue five million shares of preferred stock, par value $.01 per share. At January 31, 2003 and

February 1, 2002, no shares of preferred stock were issued or outstanding.

Series A Junior Participating Preferred Stock — In conjunction with the distribution of Preferred Share Purchase Rights (see below), the Company's Board of

Directors designated 200,000 shares of preferred stock as Series A Junior Participating Preferred Stock ("Junior Preferred Stock") and reserved such shares for

issuance upon exercise of the Preferred Share Purchase Rights. At January 31, 2003 and February 1, 2002, no shares of Junior Preferred Stock were issued or

outstanding.

Common Stock

Authorized Shares — As of January 31, 2003, the Company is authorized to issue seven billion shares of common stock.

Share Repurchase Program — The Company has a share repurchase program that authorizes the purchase of up to 1.25 billion shares of common stock to

manage the dilution resulting from shares issued under the Company's employee stock plans. As of the end of fiscal 2003, the Company had

43