Dell 2002 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2002 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

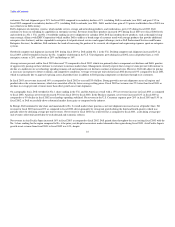

customers. Net unit shipments grew 21% for fiscal 2003 compared to an industry decline of 1% (excluding Dell) in calendar year 2002, and grew 15% in

fiscal 2002 compared to an industry decline of 7% (excluding Dell) in calendar year 2001. Dell's market share gain of 2.3 points worldwide in fiscal 2003 was

one of the best in Dell's history.

Dell's shipments of enterprise systems, which include servers, storage and networking products, and workstations, grew 21% during fiscal 2003. Dell

continues to focus on extending its capabilities in enterprise systems. Revenues from these products increased 19% during fiscal 2003 over fiscal 2002 levels

and resulted in a No. 1 U.S. and No. 2 worldwide ranking in server shipments for calendar 2002. Dell has introduced new products, such as through its long-

term strategic alliance with EMC Corporation (which enables Dell to address a broad range of customer needs with storage products that provide additional

enterprise-class features), and has expanded its enterprise-level professional services and support offerings (such as Dell Professional Services and Premier

Enterprise Services). In addition, Dell continues the trend of increasing the portion of its research, development and engineering expenses spent on enterprise

systems.

Notebook computer unit shipments increased 20% during fiscal 2003 as Dell ranked No. 1 in the U.S. Desktop computer unit shipments increased 22% in

fiscal 2003 as Dell extended its lead as the No. 1 supplier of desktops in the U.S. Unit shipments grew during fiscal 2002 across all product lines as well:

enterprise systems at 26%, notebooks at 20% and desktops at 14%.

Average revenue per-unit sold in fiscal 2003 decreased 7% compared to fiscal 2002, which was primarily due to component cost declines and Dell's practice

of aggressively passing on these declines to customers to increase market share. Management currently expects that average revenue per unit will continue to

decline at a moderate rate as technology spending remains soft and component cost declines continue at historical rates. However, Dell will adjust its pricing

as necessary in response to future economic and competitive conditions. Average revenue per unit sold in fiscal 2002 decreased 15% compared to fiscal 2001,

which was primarily due to aggressive pricing across all product lines in addition to Dell passing component cost declines through to its customers.

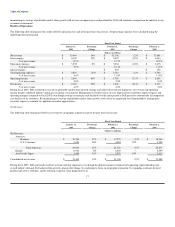

In fiscal 2003, net revenue increased 14% as compared to fiscal 2002 to a record $35.4 billion. Strong growth in net unit shipments across all regions and

products drove the revenue increase, which was somewhat offset by lower average selling prices. Fiscal 2002 net revenue was 2% lower than fiscal 2001 as

declines in average per-unit revenues more than offset growth in net unit shipments.

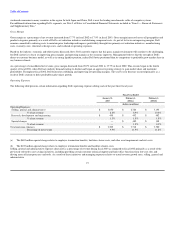

On a geographic basis, Dell extended its No. 1 share ranking in the U.S. and the Americas overall with a 15% net revenue increase in fiscal 2003 as compared

to fiscal 2002. Americas net revenue decreased 5% from fiscal 2001 to fiscal 2002. In the Business segment, net revenue increased 12% in fiscal 2003 as

compared to a 9% decline in fiscal 2002 as technology spending stabilized. Net revenue in the U.S. Consumer segment grew 26% in fiscal 2003 and 15% in

fiscal 2002, as Dell successfully drove substantial market share gains as compared to the industry.

In Europe, Dell continued to take share and maintained its No. 2 overall market share position as net unit shipments increased across all product lines. Net

revenue for fiscal 2003 increased 8% as compared to fiscal 2002, driven primarily by strong unit growth during the third and fourth quarters which was

partially offset by declining average per-unit revenues. Net revenue for fiscal 2002 was relatively flat as compared to fiscal 2001, as declining average per-

unit revenues offset unit growth due to weak demand and economic softness.

Net revenue in Asia Pacific-Japan increased 16% in fiscal 2003 as compared to fiscal 2002. Dell gained share throughout the year (exiting fiscal 2003 with the

No. 3 share ranking for the region compared to No. 6 the prior year) despite inconsistent market demand in the region during fiscal 2003. Asia Pacific-Japan's

growth in net revenue from fiscal 2001 to fiscal 2002 was 14%, despite

18