Dell 2002 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2002 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

stockholders' equity equal to the market value of the restricted shares on the date of grant and charges the unearned compensation to expense over the vesting

period.

Fair Value Disclosures — Under SFAS No. 123, the value of each option is estimated on the date of grant using the Black-Scholes option pricing model,

which was developed for use in estimating the value of freely traded options. Similar to other option pricing models, it requires the input of highly subjective

assumptions, including the stock price volatility. Because (1) the Company's employee stock options have characteristics significantly different from those of

traded options and (2) changes in the subjective input assumptions can materially affect the estimated fair value, management's opinion is that the existing

option pricing models (including Black-Scholes) do not provide a reliable measure of the fair value of the Company's stock options. Under the Black-Scholes

option pricing model, the weighted average fair value of stock options at date of grant was $11.41, $13.04, and $20.98, per option for options granted during

fiscal 2003, 2002, and 2001, respectively. Additionally, the weighted-average fair value of the purchase rights under the employee stock purchase plan

granted in fiscal 2003, 2002, and 2001 was $7.39, $6.74, and $13.95 per right, respectively. The weighted-average fair value of options and purchase rights

under the employee stock purchase plan was determined based on the Black-Scholes model, utilizing the following assumptions:

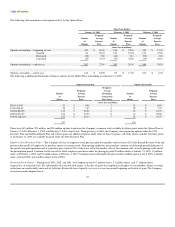

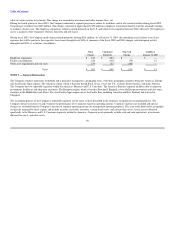

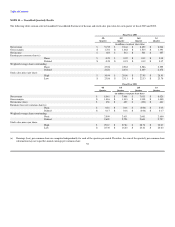

Fiscal Year Ended

January 31, February 1, February 2,

2003 2002 2001

Expected term:

Stock options 5 years 5 years 5 years

Employee stock purchase plan 6 months 6 months 6 months

Risk-free interest rate 3.76% 4.63% 6.15%

Volatility 43.00% 61.18% 54.85%

Dividends 0% 0% 0%

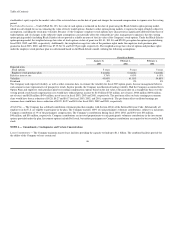

The Company used expected volatility, as well as other economic data, to estimate the volatility for fiscal 2003 option grants, because management believes

such amount is more representative of prospective trends. In prior periods, the Company used historical trailing volatility. Had the Company accounted for its

Option Plans and employee stock purchase plan by recording compensation expense based on the fair value at the grant date on a straight-line basis over the

vesting period, stock-based compensation costs would have reduced pretax income by $1.0 billion ($723 million, net of taxes), $964 million ($694 million,

net of taxes) and $620 million ($434 million, net of taxes) in fiscal 2003, 2003 and 2001, respectively. The pro forma effect on basic earnings per common

share would have been a reduction of $0.28, $0.27 and $0.17 for fiscal 2003, 2002, and 2001, respectively. The pro forma effect on diluted earnings per

common share would have been a reduction of $0.29, $0.27 and $0.16 for fiscal 2003, 2002 and 2001, respectively.

401(k) Plan — The Company has a defined contribution retirement plan that complies with Section 401(k) of the Internal Revenue Code. Substantially all

employees in the U.S. are eligible to participate in the plan. The Company matches 100% of each participant's voluntary contributions, subject to a maximum

Company contribution of 3% of the participant's compensation. The Company's contributions during fiscal 2003, 2002, and 2001 were $38 million,

$40 million, and $36 million, respectively. Company contributions are invested proportionate to each participant's voluntary contributions in the investment

options provided under the plan. Investment options include Dell stock, but neither participant nor Company contributions are required to be invested in Dell

stock.

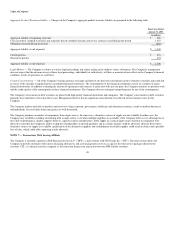

NOTE 6 — Commitments, Contingencies and Certain Concentrations

Lease Commitments — The Company maintains master lease facilities providing the capacity to fund up to $1.1 billion. The combined facilities provide for

the ability of the Company to lease certain real

46