Costco 2006 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2006 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

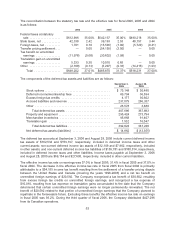

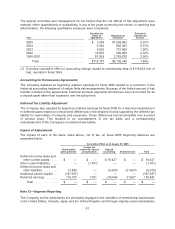

The Company has not provided for U.S. deferred taxes on cumulative undistributed earnings of

non-U.S. affiliates aggregating $907,090 and $865,579 at September 3, 2006, and August 28, 2005,

respectively, as such earnings are deemed permanently reinvested. Because of the availability of U.S.

foreign tax credits and complexity of the computation, it is not practicable to determine the U.S. federal

income tax liability or benefit associated with such earnings if such earnings were not deemed to be

permanently reinvested.

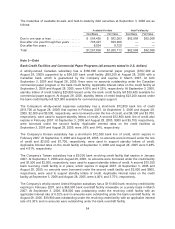

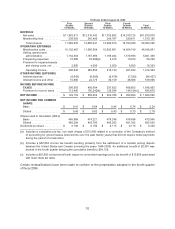

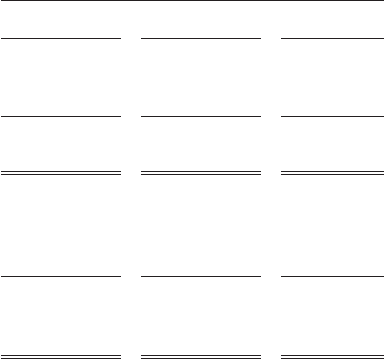

Note 9—Net Income Per Common and Common Equivalent Share

The following data show the amounts used in computing net income per share and the effect on

income and the weighted average number of shares of dilutive potential common stock.

Fiscal Year Ended

September 3,

2006 August 28, 2005 August 29,

2004

Net income available to common stockholders used in

basic net income per share ....................... $1,103,215 $1,063,092 $882,393

Interest on convertible notes, net of tax ............... 3,040 7,672 11,607

Net income available to common stockholders after

assumed conversions of dilutive securities .......... $1,106,255 $1,070,764 $894,000

Weighted average number of common shares used in

basic net income per share (000’s) ................. 469,718 473,945 459,223

Stock options and restricted stock units (000’s) ........ 5,944 6,000 3,892

Conversion of convertible notes (000’s) ............... 4,679 12,090 19,344

Weighted number of common shares and dilutive

potential common stock used in diluted net income

(000’s) per share ............................... 480,341 492,035 482,459

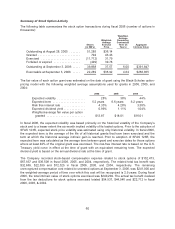

The diluted share base calculation for fiscal years ended September 3, 2006, August 28, 2005 and

August 29, 2004, excludes 11,142,000, 12,575,000 and 24,748,000 stock options and restricted stock

units outstanding, respectively. These equity instruments are excluded due to their anti-dilutive effect.

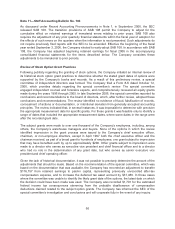

Note 10—Commitments and Contingencies

Legal Proceedings

The Company is involved from time to time in claims, proceedings and litigation arising from its

business and property ownership. The Company is a defendant in the following matters, among others:

Two actions purportedly brought as class actions on behalf of certain present and former Costco

managers in California, in which plaintiffs principally allege that they have not been properly

compensated for overtime work. Scott M. Williams v. Costco Wholesale Corp., United States District

Court (San Diego), Case No. 02-CV-2003 NAJ (JFS); Superior Court for the County of San Diego,

Case No. GIC-792559; Greg Randall v. Costco Wholesale Corp., Superior Court for the County of Los

Angeles, Case No. BC-296369.

An overtime compensation case brought as a class action on behalf of present and former hourly

employees in California, in which plaintiffs principally allege that Costco’s semi-annual bonus formula is

improper with regard to retroactive overtime pay. Anthony Marin v. Costco Wholesale Corp., Superior

Court for the County of Alameda, Case No. RG-04150447.

An action purportedly brought as a class action on behalf of present and former hourly employees in

California, in which plaintiffs principally allege that Costco did not properly compensate and record hours

64