Costco 2006 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2006 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

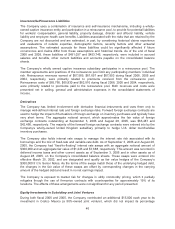

employees will retain their vested stock options before exercising them (“expected term”), the

estimated volatility of the Company’s common stock price over the expected term (“volatility”), the risk-

free interest rate and the dividend yield. Changes in the subjective assumptions can materially affect

the estimate of fair value of stock-based compensation.

The Company adopted SFAS 123R using the modified prospective method, which requires the

Company to recognize stock options granted prior to its adoption of SFAS 123 under the fair value

method and expense these amounts over the remaining vesting period of the stock options. This

resulted in the Company expensing $13,192 in fiscal 2006 for stock options granted in fiscal 2001 and

fiscal 2002. Prior to the adoption of SFAS 123R, the Company presented all tax benefits resulting from

the exercise of stock options as operating cash inflows in the consolidated statement of cash flows, in

accordance with the provision of the Emerging Issues Task Force (EITF) Issue No. 00-15,

“Classification in the Statement of Cash Flows of the Income Tax Benefit Received by a Company

upon Exercise of a Nonqualified Employee Stock Option.” SFAS 123R requires, on a prospective

basis, the benefits of tax deductions in excess of the compensation cost recognized for those options

to be classified as financing cash inflows rather than operating cash inflows. This amount is shown as

excess tax benefit from exercise of stock options on the consolidated statements of cash flows.

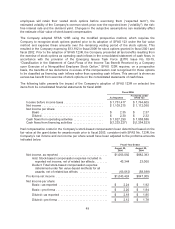

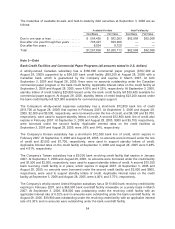

The following table presents the impact of the Company’s adoption of SFAS 123R on selected line

items from its consolidated financial statements for fiscal 2006:

Fiscal 2006

As Reported Pro-forma under

SFAS 123

Income before income taxes ......................... $1,751,417 $ 1,764,609

Net income ....................................... $1,103,215 $ 1,112,050

Net income per share:

Basic ........................................ $ 2.35 $ 2.37

Diluted ....................................... $ 2.30 $ 2.32

Cash flows from operating activities ................... $1,827,290 $ 1,858,586

Cash flows from financing activities ................... $(1,233,227) $(1,264,523)

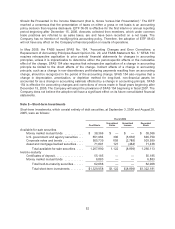

Had compensation costs for the Company’s stock-based compensation been determined based on the

fair value at the grant dates for awards made prior to fiscal 2003, consistent with SFAS No. 123R, the

Company’s net income and net income per share would have been adjusted to the proforma amounts

indicated below:

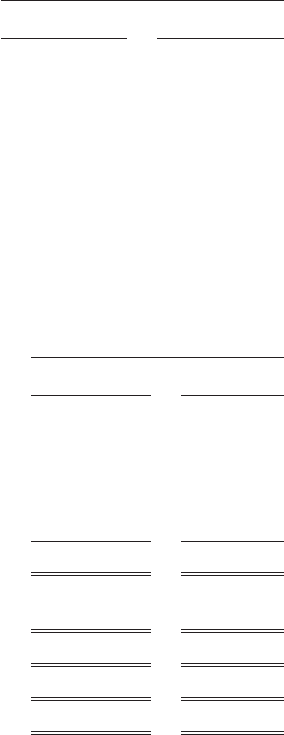

Fiscal Year Ended

August 28,

2005 August 29,

2004

Net income, as reported ............................... $1,063,092 $882,393

Add: Stock-based compensation expense included in

reported net income, net of related tax effects ........ 43,344 23,000

Deduct: Total stock-based compensation expense

determined under fair value-based methods for all

awards, net of related tax effects .................. (63,012) (58,388)

Pro-forma net income ................................. $1,043,424 $847,005

Net Income per share:

Basic—as reported ............................... $ 2.24 $ 1.92

Basic—pro-forma ................................. $ 2.20 $ 1.84

Diluted—as reported .............................. $ 2.18 $ 1.85

Diluted—pro-forma ................................ $ 2.12 $ 1.78

49