Costco 2006 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2006 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

fiscal 2006 resulted primarily from the repayment of the 7

1

⁄

8

% Senior Notes in June 2005. In addition,

interest expense decreased on the 3

1

⁄

2

% Zero Coupon Notes as note holders converted approximately

$190.9 million in principal amount of the Notes into common stock. The amount of interest capitalized

increased in fiscal 2006, contributing to the decrease in interest expense, as both interest rates and the

dollar amount of projects under construction increased. The overall decrease in interest expense in

fiscal 2006 was partially offset by the increase in interest rates on the 5

1

⁄

2

% Senior Notes, which were

swapped into variable rate debt in March 2002.

2005 vs. 2004

Interest expense totaled $34.4 million in fiscal 2005, compared to $36.7 million in fiscal 2004. Interest

expense in both fiscal 2005 and 2004 included interest on the 3

1

⁄

2

% Zero Coupon Notes, the 7

1

⁄

8

%

and 5

1

⁄

2

% Senior Notes, and on balances outstanding under our bank credit facilities and promissory

notes. The decrease was primarily a result of a decrease in interest on our 3

1

⁄

2

% Zero Coupon Notes

as note holders converted approximately $280.8 million in principle amount of the Notes into common

stock during fiscal 2005. Additionally, capitalized interest increased year-over-year as interest rates

and construction costs increased in fiscal 2005 over fiscal 2004. These decreases were partially offset

by increases in interest on the Senior Notes as these fixed rate instruments were swapped into

variable rate debt in November 2001 and March 2002, which was mitigated by the fact that the 7

1

⁄

8

%

Senior Notes matured and were repaid on June 15, 2005.

Interest Income and Other

Fiscal 2006 Fiscal 2005 Fiscal 2004

Interest income and other .............. $138,355 $109,096 $51,627

2006 vs. 2005

Interest income and other totaled $138.4 million in fiscal 2006, compared to $109.1 million in fiscal

2005. This increase primarily reflects increased interest income resulting from higher interest rates

earned, as well as an extra week in fiscal 2006 as compared to fiscal 2005.

2005 vs. 2004

Interest income and other totaled $109.1 million in fiscal 2005, compared to $51.6 million in fiscal 2004.

The increase primarily reflects increased interest income resulting from higher cash and cash

equivalents balances and short-term investments on hand throughout fiscal 2005, as well as higher

interest rates earned on the balances as compared to fiscal 2004.

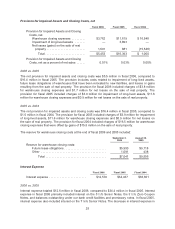

Provision for Income Taxes

Fiscal 2006 Fiscal 2005 Fiscal 2004

Income tax expense ...................... $648,202 $485,870 $518,231

Effective tax rate ........................ 37.01% 31.37% 37.00%

The effective income tax rate on earnings in fiscal 2006, 2005 and 2004 was 37.01%, 31.37% and

37.00%, respectively. The low rate in fiscal 2005 was primarily attributable to a non-recurring $54.2

million income tax benefit resulting primarily from the settlement of a transfer pricing dispute between

the United States and Canada (covering the years 1996-2003) and a net tax benefit on excess foreign

tax credits on unremitted foreign earnings of $20.6 million. Excluding these benefits the effective

income tax rate on earnings in fiscal 2005 would have been 36.2%.

26